When insurance company MassMutual spent $150 million to acquire OppenheimerFunds almost 30 years ago, it could not have known how stunningly successful the investment would turn out to be. Now it’s on the verge of executing another transaction — one that reflects the more difficult reality that asset managers are facing today.

Oppenheimer eventually swelled to some $230 billion in assets. In spite of that success, MassMutual put the firm on the sale block, reasoning that OppenheimerFunds would need a bigger investment than the insurer was willing to make to effectively compete in an industry facing long-term headwinds.

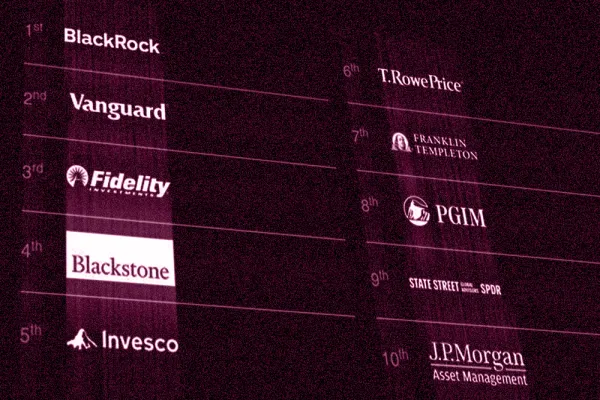

But MassMutual is not exiting entirely: Later this month, when Invesco’s purchase of OppenheimerFunds is expected to close, MassMutual will own 15.5 percent of the combined firm, a stake that could rise to 22.5 percent over time. Roger Crandall, chief executive of MassMutual, explained that the company wanted to stay invested in the asset management sector but needed to structure that investment in a way that reflected the changes in the industry.

“We knew there would be a need for scale in asset management as things like technology and branding became more important,” said Roger Crandall, CEO of MassMutual, in his first interview discussing the deal. “So what’s ideal? We didn’t want to exit [retail] asset management. We wanted to do a combination where MassMutual would be a large holder, and we wanted the combined company to have global scale and a partner that could take the great capabilities of OppenheimerFunds and bring them into different markets, particularly institutional and global.”

[II Deep Dive: Just a Quarter of Asset Managers Growing Profitably, Study Finds]

When MassMutual, a 168-year-old company, originally bought Oppenheimer, the industry was still in its infancy.

“It was bold move by MassMutual to buy it. Insurance companies weren’t in asset management at the time,” said Crandall. “But a couple of years ago, when we looked at the asset management world, we were struck by the secular changes in retail and in institutional.”

MassMutual’s first move was to restructure its institutional managers. In 2016, the organization consolidated Babson Capital Management, Cornerstone Real Estate Advisers, Wood Creek Capital Management, and Baring Asset Management into a new entity called Barings.

Once the Invesco deal is finalized, MassMutual will work with the firm on certain efforts, such as distribution. Bill Glavin, who was chair of OppenheimerFunds and CEO from 2009 to 2014, will represent MassMutual on the combined firm’s board, which will be finalized after the deal closes.

Crandall said MassMutual and Invesco will work together on numerous opportunities, including potentially managing assets for the insurance company and distributing Invesco products through MassMutual’s 8,500 financial advisors. Crandall said the insurance company’s 401(k) platform, with three million participants, is another potential opportunity for Invesco.