What’s in a name? Not as much as there used to be in the asset management industry.

Overall, the brands of investment firms suffered in 2023, according to the latest annual report on their marketing by Peregrine Communications. Asset managers' brand diagnostic scores in 2023 were 25 percent lower compared with 2022.

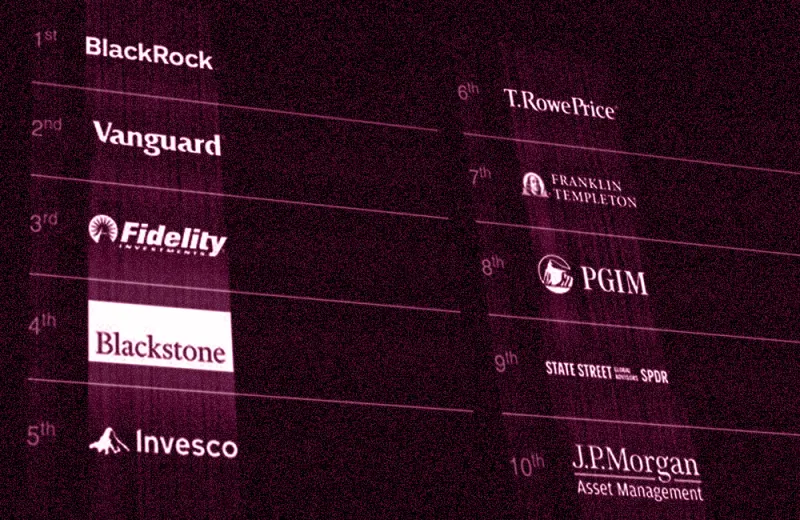

Peregrine considered 100 managers from a list of 500 independent brands surveyed by IPE. Those brands were then scored, ranked, and analyzed using more than 12,000 data points collected throughout last year. The overall scores are a composite from 10 distinct categories including brand momentum, media sentiment, social media, and others. The firms that scored the best overall were BlackRock, Vanguard, Fidelity, Blackstone, and Invesco.

Not every asset manager’s brand is worse off than it was last year. However, only 25 percent of brands had positive momentum. “A lot of managers really struggled to deliver in terms of their brand last year. I think this really plays into the industry dynamics more than anything else. It's a very tough time to be in the asset management game,” Josh Cole, co-CEO at Peregrine, told Institutional Investor.

Media sentiment is down 31 percent year-over-year — the first time the report has shown that particular trend and more evidence that asset managers “are being sucked into this vortex of negative narrative,” Cole said.

The asset management industry has been getting more competitive and, for many firms, poor performance over recent years has only made it more challenging. Revenue is down, margins are thinner and marketing budgets have shrunk. Meanwhile, they are also navigating thorny topics like ESG and politics that employees and investors want a corporate opinion on. Together, those things have, according to Cole, “created this sort of perfect storm where it's been very, very tricky for asset managers to really create the kind of brand profiles that they want.”

The Peregrine analysis shows that the biggest asset managers have fared better than others. Their brands entered 2023 with more strength and resilience, and their scale and business diversity insulated them from headwinds like poor overall investment performance and lower revenue.

Large firms also are likely to have better-organized marketing efforts. Investment firms can have dozens or hundreds of employees dedicated to their brand, creative, digital (social media and overall online presence), media (advertising), earned media (engagement with journalists). Cole says half the battle is getting all of those professionals to work in concert. The asset managers that have that brand machine humming have been slowly pulling away from the pack.

Asset managers feel like investing performance, ESG, rising geopolitical tensions, and a coming U.S. presidential are hazards to their brands. In response, some are trying harder to control their own narrative by creating content and distribution channels. Managers will always be the subject of journalism and the value of so-called earned media — having articles written about them they would consider positive — will “never go away,” Cole said. But engaging investors and others directly is also powerful, he added.

“You're seeing digital become the really key battleground… whether that's what you're doing in terms of sending out your own content, building out your social channels, video, whether it's about what people find when they Google you — your sort of Google real estate if you like. We've seen that increasingly become important,” Cole said.

Thirty-seven percent of the asset managers Peregrine analyzed have what it considers poor page-one results on Google searches. Those search results often include well-read news articles — sometimes long after they are published — and if the subject of the story or a firm like Peregrine deems those stories to be negative, that would drag down a score for search results.

That might all feel gloomy, but Cole has a positive attitude about the future for asset managers.

“The next 10 years is going to be a fabulous opportunity for firms who do have a great business, who can tell a great story about what they do, and who are willing to get creative in doing it to do some really fun stuff,” Cole said.

“I've never been more excited about working with the firms that we work with because we’re doing more and more interesting stuff in different ways than I was ever doing 15 years ago.”