Innovations in Indexing

From modest beginnings as a method of tracking market performance to a now ubiquitous presence in investor policy statements and portfolios, index investing continues to increase in prevalence and importance. In part one of this series, we discussed the rise of passive equity investing, followed by a focus on fixed income indexing in part two. Now, in part three, we evolve the discussion to index customization. In this article, we highlight benefits, demonstrate use cases, and share best practices for institutional investors seeking bespoke index solutions.

Enhancements in technology have made it possible for indexes to help investors solve problems that previously could only be solved by other means. This dynamic has increased demand from a range of industry participants. For institutional investors, demand has been driven by several objectives, including concern with the market capitalization (equity) or debt (fixed income) weighted approaches to defining “the market,” a desire for cost-effective solutions, solving institution-specific problems, and meeting objectives such as targeting factors or sustainable investing. Delivering these solutions with indexing requires a detailed understanding of design, implementation, and the exposures generated to ensure expectations are not derailed by unintentional exposures. With that in mind, investors are wise to ask important questions, such as:

- What is the role of the asset class within the policy benchmark and is the index selected fairly and accurately representing it?

- What potential unintended factors should be considered, and is there room for improvement or fine tuning?

- If so, what else should be considered, and how should other factors be included?

Before we dive deeper into the power of custom indexing, let’s start by laying out the foundation and examining why even standard index selection is an important component in creating a passive portfolio.

Index Selection is an Active Decision in Itself

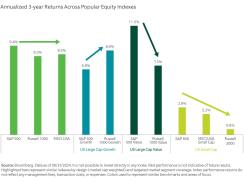

Among the decisions for passive allocations is which benchmarks to select when allocating across market segments and styles. It may be fair to assume indexes that are designed to track similar market segments – such as the S&P 600 Index and the Russell 2000 for U.S. small cap equities – will generate similar performance, but the differences between these indexes have resulted in different outcomes in recent years.

These divergences between peer indexes have led to a resurgence of client conversations regarding the decisions across benchmarks. “Benchmark selection can often be taken for granted as a result of policy decisions made long ago. However, when circumstances necessitate conversations on this topic, such as the merging of several plans into one, the differences in outcomes across similar indexes can be surprising,” says Jordan Dekhayser, Head of Equity Client Portfolio Management at Northern Trust Asset Management. Add to this concentration across market-capitalization equity indexes, uncertainty around the global macroeconomic environment, and expectations for continued heightened volatility, and many institutional investors are reconsidering how they can get the most out of index approaches. Dekhayser adds, “Indexing is a powerful tool that has evolved from simply keeping track of markets to a fairly high precision instrument. We see investors complementing off-the-shelf index designs with custom designs that are built to specification. Oftentimes, we find that working with an asset manager that knows the intricacies of index design, sources of risk and return, and can discuss results in a broader context can be beneficial for institutional investors.”

Benefits and Tradeoffs When Moving Beyond Standard Indexes

Index performance divergence has created an area of opportunity for custom indexing where institutional investors are developing passive portfolios designed to track custom indexes or models, putting investors in control of the design, and creating flexibility to meet evolving needs. “With continued improvement in available data sets and technology, indexes can be designed to fulfill several objectives. We believe a crucial consideration is to understand the portfolio impact of design choices. Institutional investors can exclude issuers, target specific sectors or sources of risk, or build thematic approaches within fixed income, for example. As always, design matters, and unintended consequences can be prevalent without thoughtful design choices,” says Ronit Walny, Head of Fixed Income Client Portfolio Management at Northern Trust Asset Management.

Index selection is still the starting point for portfolio construction. “It is the most important decision when you start your portfolio,” says Walny, “but it's not the ending point.” By selecting, tailoring, and fine-tuning an institution’s index strategy to reflect investment objectives, CIOs and their teams are in a strong position to build sound investment strategies. “There are likely to be opportunities for structural alpha captured by systematic overlays, and in some markets, active strategies still provide measurable benefits,” says Walny. Investors and managers can have the “full spectrum of conversations, but it begins with a good starting point which is at the index foundation.” Therefore, success requires an assessment of these risks and consideration during the design phase in order to ensure the strategy is successful. “Custom indexing” can take form in myriad ways, and if one is not careful, unintended risks can arise.

Considering tradeoffs and risks is important when designing a custom index solution. Once high-level objectives are decided, Dekhayser recommends a detailed analysis of the sources of risk as the next step. “We often see investors seeking multiple objectives within an index portfolio. For example, consider an investor that wants a value tilt along with a desire to control other exposures within an index fund, and wants to understand alternatives to off-the-shelf indexes. This is where more sophisticated approaches of integrating style factors and other data come into play. Running an array of outcomes to identify which exposures are creating the most active risk can help investors narrow the focus to a small range of acceptable outcomes.

Recently, institutional investor use cases have involved concentration and geopolitical risk. “Over the last 12-18 months, we’ve had more conversations with clients around equal-weighting but that has significant tradeoffs in the form of active risk relative to a cap-weighted index. Equal-weighting can be a useful tool to provide relief from concentration, but the objective of diversification can be achieved by other means that may have fewer side effects. In one example, we used the Russell 1000 Growth Index, capped the weights of the “Magnificent 7” stocks, and employed an optimizer to reduce tracking error to the standard growth index,” says Dekhayser.

Whether due to recent underperformance relative to developed markets, geopolitical risk, or perceived opportunities given market inefficiencies, investors have demonstrated an interest in managing their risk from Chinese equities. Dekhayser adds, “Interest in emerging markets that modify Chinese equity exposure remains high. Often, we start with a conversation about risk and the objectives of emerging markets exposures. Investors have been disappointed with emerging markets equity returns over the past decade despite earnings and GDP growth that would indicate better outcomes. A lot of this can be traced to share issuance that has detracted from returns. Further, the index is top heavy with global companies such that investors may not get the full benefits of diversification or exposure to local markets. In response to the hypothesis around better capturing emerging markets growth and managing risks, we worked with an institutional investor to launch a strategy that excluded companies based on governance concerns, tilted towards smaller companies whose revenues are more tied to local economies, and used a quality factor in security selection. This approach achieved their objectives and used a modified custom index as the starting point for design.” In the research, Dekhayser noted the team looked into various options to capture emerging markets growth including GDP-weighted indexes and creating a signal from forward-looking country GDP growth estimates but saw no economic rationale for using these data sets. “We didn’t propose these solutions because we can’t reliably measure the risks or understand the impacts to performance.”

Fixed income markets offer a similar yet different opportunity for alternatives to standard index funds, partially due to the challenges in fully replicating debt markets through a passive approach. Technology has played a large role in evolving indexing within fixed income. Systematic approaches to fixed income markets have emerged over the last decade due to advances in technology and enhancements in liquidity resulting from the growing fixed income ETF market, among other catalysts. The credit market is one area where a rules-based systematic strategy can add benefits. These strategies have more flexibility to be customized based on objectives to capture incremental income or isolate a maturity bucket, among other goals. Yet, most investors do not feel comfortable incorporating public debt from private or smaller companies, and lower rated portions of the credit market without some oversight to reduce impact from default, as well as more scrutiny around valuations. Incorporating factors that identify high quality companies and valuation metrics provides a valuable inclusion when navigating the credit markets and can be integrated into a systematic strategy. In addition, the fixed income markets trade very differently from the equity markets. Minimum sizes and availability are more constrained. Market impact and liquidity is an important feature in any fixed income strategy design.

Getting Started with Custom Indexes

With a seemingly unlimited set of options for customizing an index, getting started is often the biggest hurdle. Walny cautions, “Just because you can put anything into an index, does not mean that you should” and suggests that an understanding of the strategy objectives and proper risk controls should be a starting point for index design. Achieving successful outcomes often requires collaboration between institutional investors and asset managers to ensure the custom index meets the unique objectives and goals without unintentional exposures.

What’s important, from an investors’ point of view, is a manager’s “experience in developing and implementing indexes and active strategies, and the ability to sit down with clients, look at their portfolios, understand their objectives, and ultimately collaborate to develop a solution,” says Dekhayser. He stresses the importance of mastery of the index and its constituents: “You've got to understand it from soup to nuts, from index methodology to portfolio implementation to performance attribution.” By leveraging innovative solutions from the evolving indexing landscape, institutional investors stand to benefit by more precisely employing active risk budgets as opposed to just accepting an index provider’s standard methodology. Thus, the strategic utilization of indexes can transform potential vulnerabilities into opportunities for enhanced investment performance in an ever-changing market landscape.

Tap into Our Expertise

The applications for indexing continue to expand but the tools need to be applied with skill and expertise. Understanding design, implementation, and sources of risk can help investors use index approaches in new and innovative ways to solve unique portfolio challenges. Northern Trust Asset Management has more than four decades of experience managing index funds across equity and fixed income markets, including systematic equity and fixed income portfolios with various degrees of customization. Additionally, our comprehensive capabilities and deep experience extends to managing index portfolios for taxable institutions where we seek to deliver pre-tax returns similar to standard or custom indexes while providing an after-tax alpha. “We welcome the opportunity to partner with investors to solve their unique needs with indexing solutions,” said Dekhayser.

IMPORTANT INFORMATION

For Use with Institutional Investors and Financial Professionals Only. Not For Retail Use.

Northern Trust Asset Management (NTAM) is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Issued in the United Kingdom by Northern Trust Global Investments Limited, issued in the European Economic Association (“EEA”) by Northern Trust Fund Managers (Ireland) Limited, issued in Australia by Northern Trust Asset Management (Australia) Limited (ACN 648 476 019) which holds an Australian Financial Services Licence (License Number: 529895) and is regulated by the Australian Securities and Investments Commission (ASIC), and issued in Hong Kong by The Northern Trust Company of Hong Kong Limited which is regulated by the Hong Kong Securities and Futures Commission.

For Asia-Pacific (APAC) and Europe, Middle East and Africa (EMEA) markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors. This document may not be edited, altered, revised, paraphrased, or otherwise modified without the prior written permission of NTAM. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. NTAM may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTAM’s efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by NTAM. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For U.S. NTI prospects or clients, please refer to Part 2a of the Form ADV or consult an NTI representative for additional information on fees.

Forward-looking statements and assumptions are NTAM’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

© 2024 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.