Emily Balsamo and Alison Coughlin, CME Group

AT A GLANCE

- Lumber prices skyrocketed during the pandemic, but returned to normal levels as housing demand cooled

- Construction is the primary demand input for softwood lumber in the United States, making housing starts an important indicator for lumber markets

Lumber made headlines in the fall of 2020 when Lumber futures, which had hovered around $400 per thousand board feet (mbf) for the prior two years, skyrocketed to nearly $1,000 per mbf on the back of exceptional demand from Americans tackling home repair under lockdown. The industry was also in the midst of a supply crunch that had been building for years. Though the September 2020 spike turned heads, it was only the beginning of a wild ride for lumber over the next 2.5 years, during which the front-month Lumber futures price jumped between $1,686 per mbf in May 2021 to $454 in September 2021, then exceeded $1,400 in March 2022 before falling to $344 in early 2023.

Construction is the primary demand input for softwood lumber in the United States. Housing starts, the U.S. Census count of new residential construction units issued on a monthly basis with a one-month lag, is thus an important indicator for lumber markets.

The housing deficit in the United States that the pandemic sprung to light had been building since the 2008 recession, when the subprime mortgage crisis dampened the building spree of the early 2000s that peaked in 2006 amid a series of interest rate hikes. Housing starts in 2009 fell lower than any level seen since the indicator began counting in 1959. This unprecedentedly low level of building depressed lumber prices and in the late 2010’s, led to closures of sawmills in the Pacific Northwest and Canada. At the same time, demand for housing was mounting, with the United States short an estimated 3.8 million housing units by the end of 2020. For a decade, these supply-side and demand-side factors brewed a perfect storm of high lumber demand and low supply to be unleashed during the Covid-19 Pandemic, as Americans sought more expansive accommodation under lockdown, boosted by low interest rates.

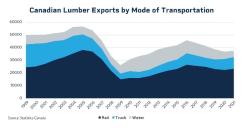

Despite extraordinary prices and demand since the onset of the pandemic, Canadian lumber exports have yet to return to pre-recession levels. The availability of lumber is a limiting factor for home building and the lumber supply chain is highly inelastic to demand given the long lifecycle of the underlying physical commodity, from planting to 2x4. Softwood lumber in North America generally requires 25-40 years to reach maturity, from planning to felling. Even if supply of forest were available today, sawmill capacity takes years to build.

The slow responsiveness of lumber supply to demand is one factor behind the explosion in housing prices during the Covid-19 Pandemic. Between March 2020 and June 2022, the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, a monthly composite of single-family home prices, marked an astounding 43% increase over 26 months. Rising interest rates have softened the price index slightly since.

As Americans were compelled to shelter in their homes throughout 2020, demand for single-family homes with greater square footage and outdoor space increased. Reflecting this tendency, new American homes are getting bigger: the average square footage of a new home exceeds 2,000 square feet in the 2020s, compared to under 1,400 in 1960 and just over 1,200 in 1940, according to housing market intelligence provider CoreLogic. The quintessential American “starter home” of modest square footage has all but disappeared from contemporary builds. At the same time, the U.S. Census reports that the average American household has shrunk from 3.3 people in 1960 to 2.6 at present. These trends converge to require increasing square footage to house each American.

New multi-family buildings provide a potential bright spot for affordability in the U.S. housing landscape, albeit with architectural criticism. According to the U.S. Census, new privately-owned housing units in multiunit (5+) buildings suffered in particular from the housing bust following the subprime mortgage crisis. Only 53,000 units in 5+ unit buildings were started in October of 2009, comprising 10% of all housing starts that month; compared to 423,000 (19% of total) in January 2006. Recent peaks, however, pale in comparison to the 1,000,000 units built in March 1973, with units in 5+ unit buildings comprising 42% of starts that month. Units in 5+ unit buildings show growth of late, and averaged 533,000 per month in 2022, or an average of 34% of all new units in the year.

Although the current style of multi-unit architecture – five residential stories above one concrete story of retail space – emanates an industrial sense, the predominant build of “5-over-1s” feature wood framing.

In 2023, lumber supply and demand has somewhat returned prices to pre-Pandemic levels. There is sufficient supply sitting with wholesalers, and housing completions have exceeded expectations recently, meaning fewer projects are demanding lumber. It is unknown how long this dynamic will last, as sawmills have announced curtailments and building season will be underway. Experts say that housing values still have room to fall, meaning those in the market may turn to renovations prior to entering the market above value and facing significant interest rates. Though lumber volatility has receded from its 2020 highs, the past several years have demonstrated the ability for lumber prices to be volatile, and those in the lumber supply chain must manage exposure to wild swings in price.