When Salem Abraham would show up at his grandfather’s 10,000-acre ranch in Canadian, Texas, it was often bad news for the Hereford bulls: dehorning, branding, castration.

These days, he has an equally uncomfortable message for the tassel-loafered endowment managers at Harvard, Princeton, and MIT: “Hope is a bad strategy.”

It’s a warning Abraham — hedge fund manager, commodities trader, and Texas rancher — has been delivering for years to investors who figure they will be lucky enough to dodge the next stock-market calamity.

Endowments, foundations, and their ilk today are wildly over-reliant on the stock market, Abraham says. Their managers are ignorant that bonds and other key asset classes are increasingly correlated to equities. And they naively believe that the pricey hedge funds they shovel their money into will provide safe haven in a selloff.

They won’t. Such funds invest in stocks or other economically sensitive asset classes that move in lockstep with company shares.

“That’s watered-down equity,” scoffs Abraham from his office above the Cattle Exchange restaurant in his Panhandle hometown. “Whatever happened to not having all your eggs in one basket?”

A self-described math geek, Abraham, 54, obsesses over the frequency of black-swan crashes and their severity. “In the Great Depression, shares were down 79 percent,” he says. “If stocks were down 79 percent today — there’s no one ready for that storm.”

Abraham says he has a fix.

The Fortress Fund he runs is a one-stop fund of funds for midsize endowments that want to secure their futures. The fund has just about two-thirds the exposure to stocks as the typical portfolio. But Abraham figures it can generate returns that are nearly as good, even in bull stock markets.

The key: A third or so of assets are allocated to a carefully curated lineup of ten hedge funds with little or no correlation to stocks. “The real magic of the Fortress Fund is we understand hedge funds,” he says. “That’s our secret sauce.”

Because he uses futures for stock exposure and highly liquid U.S. Treasuries for bond allocations, and the hedge funds he selects are themselves largely unconstrained, Abraham estimates the Fortress Fund could conceivably grow to $100 billion.

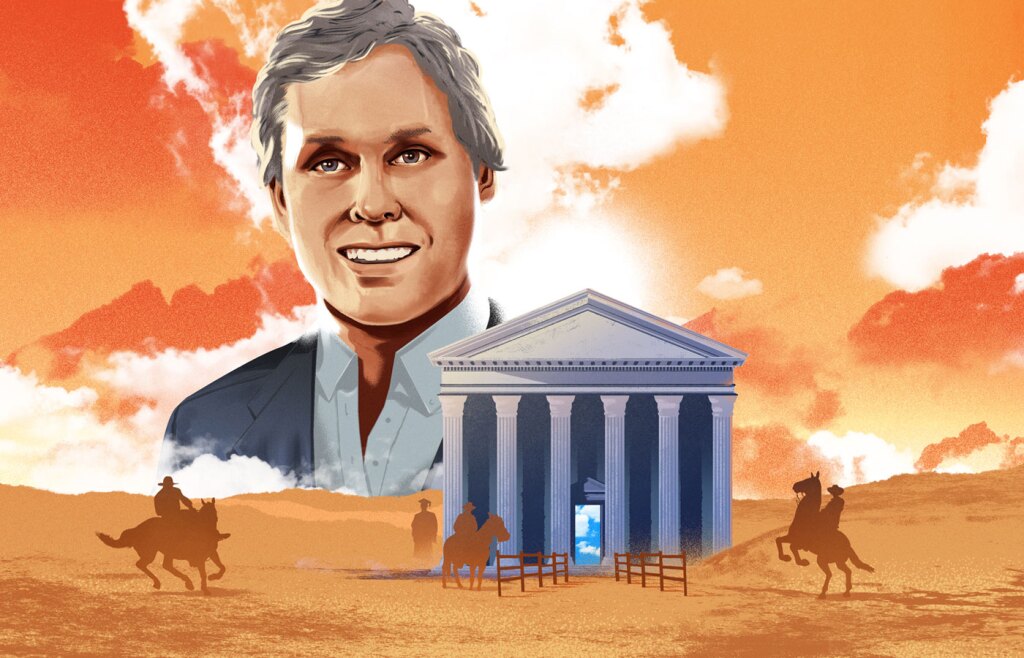

If all this smacks of Texas-style braggadocio, well, it isn’t bragging if you can back it up. And Abraham, who is 5 feet 10 inches tall with salt and pepper hair, has serious Wall Street cred.

He notched a 30-year hedge-fund career trading futures, starting at the groundbreaking Commodities Corp., launching pad for the likes of Paul Tudor Jones, Louis Moore Bacon, and Caxton Associates’ Bruce Kovner. By 2000, relying on a couple of dozen homegrown trading futures algorithms, he was generating some 5 percent of the Chicago Mercantile Exchange’s electronic trading volume.

His hedge fund, Abraham Trading Co., racked up a 21.8 percent annualized return from 1988 through 2008. At the start of that year, he co-founded the Pickens-Abraham Foundation with fellow Texan T. Boone Pickens, the late oilman and corporate raider, and began managing half of the portfolio, dubbed Fortress, with a conservative, risk-sensitive approach.

The two ranchers, though age-wise separated by nearly four decades, were close, tightly bound by their fascination with markets and their Texas Panhandle histories.

Still, Abraham and Pickens competed fiercely over whose half of the foundation’s portfolio would outperform each year, the loser picking up the dinner tab at a Dallas restaurant. “They both appreciated the power of markets,” says Jay Rosser, former longtime chief of staff for Pickens.

The result: Abraham’s Fortress portfolio lost just 17.6 percent peak to trough during the 2008-09 financial crisis, versus a 39.1 percent drop for a theoretical portfolio composed of 70 percent invested in the MSCI ACWI global stock index and 30 percent in the Bloomberg Barclays U.S. Aggregate Bond Index. The S&P 500’s decline over that stretch was 48.6 percent.

Abraham won’t comment on the record about Pickens’ performance, but a person familiar with the matter says the oilman lost some 50 percent overall in 2008.

“I’m running an endowment model; I’m hitting singles,” recalls Abraham in a Zoom interview, speaking with a light Texas drawl. “He’s swinging for the fences.” Pickens died in 2019. Abraham was a pallbearer at his funeral.

Like a lot of futures funds, Abraham Trading Co. languished during the volatility drought that began around 2010, when the fund’s assets under management peaked at $620 million. Money leached out of his flagship fund, and Abraham shuttered it in 2018, when assets bottomed out at $215 million, to focus on Fortress. He opened that fund to outsiders the next year, but it still has just $40 million in assets.

Abraham runs it from a 5,000-square-foot office in the historic, three-story Moody Building he owns. A map of Texas hangs on the wall, as does a painting of a buffalo. In the corner stands a handmade coat stand made of cedar, a gift from an old friend, now deceased, who kept a roadrunner named Charlie as a pet.

Today, Abraham is on a quest: to convince endowments and foundations, some of which must by law distribute 5 percent of their assets annually, that they face an existential risk due to stock price volatility, known as beta in Wall Street argot. They may well be permanently impaired in a selloff. “Beta bites and big beta bites big,” Abraham says.

It’s a cri de coeur that may or may not gain notice.

“I think Salem’s premise is good,” says Elaine Crocker, president of Moore Capital Management, who first tapped Abraham to manage money for Commodities Corp. straight out of college in 1988. “Whether he’s going to change the world remains to be seen.”

Wearing a Brioni shirt and blazer and Levi’s, Abraham took a seat toward the back as some 300 Stanford University parents and alumni filed in.

They were there to hear a report on the $27.7 billion endowment for the elite school, where three of Abraham’s children were enrolled at the time. Staffers made a presentation and distributed handouts.

“What do you think your stock exposure is compared to 2008?” Abraham recalls asking.

“It’s about the same,” the Stanford endowment officer responded. In 2008, the average endowment allocated roughly 60 percent to stocks and 40 percent to bonds, according to Abraham.

“I see 76 percent,” Abraham said, looking over the portfolio breakdown the endowment had furnished.

“I don’t think it’s 76,” the endowment staffer responded. “It’s lower than that.”

Abraham shook his head. “I’m just adding up your numbers,” he said, before turning and walking away.

This kind of defensiveness on the part of endowment managers is pervasive — and will come back to gut a generation of them when stocks eventually crash, according to Abraham. “They don’t want to talk about it,” he says. “It’s like drinkers’ denial.”

The Abraham Fortress Fund is simple on its face. Cherry-picking ten of the best hedge funds Abraham can find, he combines a 35 percent alternative position with 45 percent stocks and 20 percent bonds. Fortress has a $100,000 minimum and charges 0.65 percent as a fee, excluding the hedge funds’ charges.

As of year-end 2020, the Fortress Fund had returned 6 percent annualized since the strategy began in January 2008, versus 5.7 percent for the 70-30 portfolio and 5.9 percent for the MSCI ACWI Index. Abraham says he has generated those returns with just two-thirds the volatility of the 70-30 portfolio and less than half that of the global stock benchmark.

That, he argues, should be competitive with or better than Stanford’s stock-heavy fund.

A Stanford spokesperson said that the endowment’s exposures are managed in a disciplined fashion and that there may have been a miscommunication with Abraham. But it’s clear the endowment is not alone in its equity-heavy stance.

An analysis of big, elite university endowments for fiscal years 2009 through 2020 by Abraham Trading Co. shows Harvard, Yale, Stanford, MIT, and Princeton produced average annualized returns of 6.9 percent over that stretch. Abraham’s Fortress strategy returned 6 percent annualized for the period.

The real story lies in the volatility, best measured by a portfolio’s standard deviation — that is, the variation of its value around its mean over time.

The standard deviation of the five schools’ portfolios averaged 11.5 percent. That compares with just 6.3 percent for the Fortress strategy. So Abraham is delivering its returns with less than two-thirds the risk.

On average, the five endowments’ correlation to the S&P 500 index, in which a perfect match is 1.0, was 0.97. The Fortress strategy delivered its results with a correlation less than half that, 0.47.

“He’s as proud of his volatility management as his performance,” says University of Florida Investment Corp. chief investment officer William Reeser, who worked with Abraham at ALSAC, St. Jude Children’s Research Hospital’s fundraising arm.

Institutions have been shifting toward stocks for decades.

With rates plummeting, endowments piled into alternatives, like hedge funds, to generate equity-free returns.

Hedge fund dynamics kicked in. Unnoticed by many endowment managers, even those marketed as alternatives began displaying equity-like characteristics.

On a five-year rolling average, the correlation of the BarclayHedge Hedge Fund Index to the S&P 500 index was 0.73 in 2001. That dropped to 0.67 by 2004, but rose to 0.90 by the end of 2019.

“Anybody with beta in the portfolio did better,” Abraham says. “It’s a feedback loop, chasing performance. Until you go off a cliff.”

Some hedge fund classes that are traditionally viewed as uncorrelated are in fact tightly tethered to the equities markets. From December 2015 through November 2020, the Barclay Equity Long/Short Index had a correlation of 0.89 to the S&P 500, the Multi Strategy Index’s correlation was 0.86, the Event Driven Index’s was 0.84, and the Global Macro Index’s was 0.77.

Institutional investors seem to ignore such numbers. “There’s a lot of people in the investment business who don’t do the math,” Abraham says.

The same people may lack a grasp of the black-swan events that trigger stock selloffs. Since 1900, the U.S. has experienced peak-to-trough stock-market selloffs of 30 percent or more ten times, according to financial publisher Morningstar.

“You don’t get advance notice that it will happen,” says Abraham.

One place to start is his hometown of Canadian (2019 population: 3,029), where the Abraham family roots run deep, and which lies 1,610 miles from the Wall Street marketing machine.

The town, “a pretty little place,” as a recent Texas Monthly article described it, sits close by the banks of the Canadian River, so named because of a nearby trading post operated by French Canadians up from Louisiana in the 1800s, according to one theory. In 1887, the Southern Kansas Railway Co. built a bridge across the Canadian River, and the town was founded next to it.

Over the years, Canadian grew into a bustling cattle trading center and commercial hub.

Abraham’s great-grandfather, Nahim, an immigrant from what is now Lebanon, arrived in 1913 and began selling clothes and other gear to local cattle ranchers. It was the start of the Abraham business dynasty.

Nahim’s son Malouf, known as “Oofie,” who was Salem’s grandfather, had an entrepreneurial streak, expanding into land, cattle trading, and oil and gas leasing. Oofie became rich, was elected mayor of Canadian, and later won a seat in the Texas House of Representatives. Salem’s father, also named Malouf, went into medicine, working as an allergist and marrying Salem’s mother, Therese, a registered nurse who also briefly served as town mayor.

With their shared interest in business and markets, Salem was especially close to Oofie. “Without his grandfather, Salem’s not Salem,” says Mike Nelligan, a longtime friend.

A middle child, between brothers Eddie and Jason, Salem stood out as both a math prodigy and the family troublemaker. “Whatever happened, good or bad, Salem did it,” Salem chuckles.

At school, Abraham focused on his best subject, to the exclusion of most everything else. “Math, math, math, all the way down,” he says. “If you did math races on the blackboard, I won.”

One extracurricular rival for Abraham’s attention: his high school sweetheart, Ruth Ann Dennis, a year younger than him, whom he would go on to marry and with whom he would raise eight children, five girls and three boys, now ages 17 to 28. (“There’s not a lot to do out here in the country,” Abraham quips. “So you make your own entertainment.”)

From Canadian it was on to the University of Notre Dame in South Bend, Indiana, home of the Fighting Irish. With his Wrangler jeans and Western shirts, Abraham stood out from his classmates at St. Edward’s Hall, a student residence, and was less interested in intermural football and Jell-O shots than in his studies.

Abraham channeled Oofie’s entrepreneurialism. Peddling school T-shirts to classmates, he negotiated a deal to turn over half of the proceeds to St. Edward’s per school regulations.

The hall’s rector, Father Mario Pedi, declared, “Salem, you crazy Texan, you’re going to be a millionaire before you’re 30.” Abraham was silently indignant, certain he’d cross the threshold well before then.

A chance encounter with Jerry Parker, a famed commodities trader and founder of Chesapeake Capital Corp., would get him going. Parker invited him to Chesapeake headquarters in Virginia, where Abraham learned some rudimentary trend following using mathematical models.

In South Bend, Abraham hooked up a three-foot satellite dish on the roof of his off-campus apartment. He persuaded Oofie to advance him the $50,000 he had promised him upon graduation and began trading futures — first corn, then oil, other grains, and interest rates — often before the start of classes. Abraham’s skill in statistics and probabilities helped.

October 19, 1987 — Black Monday — provided a first-class lesson on the topic of risk. Abraham lost half of the $66,000 he had built up, due to a wager against eurodollars.

Chastened, Abraham closed his accounts, finished his finals, and returned to Canadian with a B.A. in finance and an engagement ring for Ruth Ann in hand.

The perspective from a Texas cow town, off the beaten path as it is, hasn’t proven much of a handicap. “As a trader, it’s hard to think of a time when I made money when the crowd was with me,” he says.

When the firm’s traders in 2005 questioned why, with prices for cattle near their highs, Abraham remained long the futures, he told them to ask the staff at the Cattle Exchange restaurant downstairs about their beef inventory.

The response: Prices were so high they were keeping their inventory to a bare minimum. So cattle futures could rally further.

“There’s a lot of commodities here,” he chuckles. And if Abraham needs to take care of business elsewhere, he can hop in his Cessna 425 twin-engine turboprop and fly there.

There’s another reason Canadian makes for a good trading hub. It’s a pretty nice place to live. Unlike a lot of Panhandle towns, the terrain can be hilly, there’s fresh water in the rivers and streams that course around it, and trees and other greenery abound — elms, cottonwood, black locust.

The downtown has benefited from efforts to spruce it up, including $1 million Abraham spent on refurbishing the local Palace movie theater, where he and Ruth Ann went on dates.

Canadian has its skeletons. On November 23, Thanksgiving Eve, 2016, local high school class president Tom Brown vanished. As a football coach, Abraham knew Brown relatively well. One of his daughters was a friend.

Over the following weeks and beyond, townspeople scoured the area for Brown, with Abraham himself joining the search on a Polaris all-terrain vehicle.

The investigation appears to have been initially botched by local law enforcement, according to reporting in an eight-part series that began last October in Texas Monthly, as well as an accompanying podcast that brought national attention to the case. Two years after he vanished, some of Brown’s remains — his skull and some bones — were found not far from one of Abraham’s properties.

Though suicide has not categorically been ruled out, Brown’s death stoked intense acrimony in the town over the investigation and suspicions as to who may have been responsible.

“It caused division,” says Laurie Brown, publisher and editor of The Canadian Record weekly, who is not related. “You watch behind your back. You’re not sure what their true character is.”

The investigation was taken over by Texas Attorney General Ken Paxton, who has for years been under indictment for alleged securities law violations, to which has pleaded not guilty. He is also accused by seven deputies of bribery and abuse of office. Paxton’s office did not respond to emails and phone calls seeking comment.

On August 21, 2019, Paxton announced there was no evidence of foul play in Brown’s death and that the investigation was being suspended. However, interviews by Paxton’s office have continued.

Says Abraham: “I want to know what the truth is no matter where the truth leads.”

The fund manager’s preoccupation with the mystery speaks to an abiding affection for the community, and his decision to build his business there so many years ago.

Prior to Abraham’s return from college, Oofie had agreed to hire the three Abraham brothers and teach them the business of trading land and oil and gas leases. But Salem continued futures trading, launching his hedge fund in 1988, backed with his own money and that of his brothers and Oofie. After an initial, dizzying plunge of over 30 percent, it rocketed back, finishing the year with a 142 percent return.

The success emboldened Abraham, who reached out to Commodities Corp.’s Crocker, at the time in charge of the firm’s Trader Evaluation Program, which either seeded or hired outright some 160 portfolio managers. She agreed to meet in Houston’s William P. Hobby Airport.

“He negotiated the death out of me,” Crocker recalls. “He was very much like a dog with a bone.”

Commodities Corp. funded the upstart with an initial $200,000. How did Abraham make the cut? “It was the focus, it was the integrity, it was the love of what he was doing,” Crocker says. “For him it was a puzzle, it was something for him to learn more and more about.”

In 1990, his first full year backed by Commodities Corp., Abraham returned 90 percent, followed by a 24 percent gain in 1991. In 1992, the fund lost 10 percent, but powered back with gains of 34 percent and 24 percent the next two years. Assets soared to $132 million by year-end 1995.

When commodity prices began lagging the technology-heavy Nasdaq in the late 1990s, investors, including Commodities Corp., pulled their money fast. Assets fell to less than $5 million by the end of the decade.

Abraham kept busy away from the futures markets. Together with six neighbors in Hemphill County, he assembled the water rights of a 72,000-acre block of land and sold them to the parched city of Amarillo for $20 million, netting himself a $9 million profit.

He didn’t neglect the family land holdings, profiting with the sale of a 12,000-acre land parcel to Pickens for around $1,000 an acre.

Abraham also spent plenty of time retooling his fund’s trading, moving beyond simple trend following. “I added other strategies, including reversionary, momentum, multiple quantitative,” Abraham says. Eventually, he had 70 to 80 models he was working with. New trading programs reduced volatility.

Following the dot-com crash of 2000-02, commodities markets percolated, and Abraham got back in the hedge fund saddle, posting returns through 2010 that averaged more than 25 percent annually. After that, annual returns were mostly flat to down, Abraham says, and customers became increasingly frustrated.

Abraham is philosophical about his transition from commodities gunslinger to fund-of-funds manager. He laid off about half of his 20-person staff, which was painful. He also realized he didn’t need to monitor markets 24 hours a day when global futures markets were open — a welcome relief.

“I can be the best catcher on the field, but you can’t be the best first baseman and pitcher,” he says. “We’ve moved from being a baseball player to being the manager of the baseball team.”

The Fortress Fund uses futures tracking the MSCI ACWI index and U.S. Treasuries for exposure to stock and bond markets, respectively. Abraham selects the ten hedge funds in the portfolio relying not only on his own experience running Abraham Trading Co., but also what he has gleaned from the various endowments and foundations whose investment committees he has worked on.

Abraham would bring an independent perspective to investment committees he served on, board members say, focusing obsessively on lurking market dangers. “We always talk about returns, but he always talks about risk-reward,” says former Federal Deposit Insurance Corp. chairman Donald E. Powell, who chaired the Amarillo Area Foundation, a Panhandle charity that disburses money to local nonprofits.

Reeser says St. Jude recruited Abraham specifically for his insights into alternative investments. “We wanted somebody who knew the industry from the inside,” says Reeser, now at the University of Florida Investment Corp. “He has a unique combination of quantitative skills and strong interpersonal skills.”

Abraham clocked overtime assessing fund metrics. “Most people didn’t have the time or inclination to manage the different volatilities,” Reeser says.

Abraham won’t divulge specifics about his hedge fund selection criteria. But he and his colleagues perform on-site visits and pay research firm Mercer to do operational due diligence.

Funds should have more than $1 billion in assets and track records of 12 years or more. “I’m not looking for the undiscovered guy,” Abraham says. “We like to see if they’ve been through ’08. You learn about people in the storm.”

Currently, the portfolio includes hedge funds focused on five strategies: global macro, managed futures, market neutral, currency, and spread trading.

For competitive purposes, neither Abraham nor research director Larry Smith reveal the funds’ closely guarded identities. Indeed, the Fortress Fund refers to its hedge-fund investments by code names, all of them after popular music stars.

The hedge-fund hit parade: Quiet Riot, according to a list provided by Abraham Trading, was down 0.11 percent on December 15, Public Enemy was down 0.03 percent, and Elton John was down 0.01 percent. Iron Maiden was up 0.05 percent, Willie Nelson was up 0.01 percent, and The Cars was up 0.06 percent. Journey was essentially flat.

(For the record, Abraham says the code name selection is Smith’s responsibility. He is not an Iron Maiden fan.)

Abraham and Smith monitor the funds on a daily basis, looking for hints of style drift, particularly into areas that generate returns corelated to the stock markets. “You can’t hide stock exposure,” Abraham says, although sometimes there will be a temporary aberration in which a hedge fund’s returns will be unexpectedly affected by equity-related developments.

Retribution at the Fortress Fund can be swift: Abraham abruptly cut one hedge fund from its roster after the spring market selloff because of a serious deviation from the execution he had expected. “We didn’t think they handled the storm properly,” says Abraham.

Fortress Fund’s performance may need juicing. Like many strategies, he can dial volatility up or down by simply increasing or decreasing the portfolio’s leverage. Recently, he increased its targeted volatility from 6 percent to 9 percent.

That ratchets up the Fortress Fund’s risk. But the increased performance may also persuade fence-sitting endowments that it’s worthwhile to consider Abraham’s approach if returns track those of stock-dependent strategies.

More assets at Fortress would translate into both lower fees and better diversification, Abraham says.

“I think we can build a product that’s good and helpful,” he muses. “Success is leaving the world a little bit better.”

A noble sentiment, for sure, but don’t think that Abraham’s new mission means his killer trading skills are wasting.

In late January 2020, in what in retrospect was a blatant case of wishful thinking, Wall Street experts downplayed the dangers of the then-novel coronavirus. Abraham instead put his faith in statistics on global databases, which soon pointed to the lethalness of Covid-19, with the number of excess deaths rising. He drove 100 miles to buy hundreds of N95 masks from the nearest Lowe’s and Home Depot, giving most away to family, friends, and colleagues.

On February 10, Abraham bought put options, which give the holder the right to sell at a set price, shares of cruise-line operator Carnival Corp., United Airlines Holdings, and Yum China Holdings, the largest restaurant operator in China.

As the pandemic accelerated, stocks plummeted. Abraham cleaned up — generating a 3,000 percent return on the options for his personal account by March 17, when he closed out his positions. “That’s the most successful trade I ever made,” he says.

Math, not hope, carried the day.