Illustration by II

1. You lost your patience with permabears. Doom-saying industry pundits have now been wrong for a decade, but they still command CNBC airtime — even though anyone who actually followed their dire warnings would have been rewarded with a severance package.

Permabears have made (apparently paying) jobs out of loud complaining. “Warns about dangerous bubbles,” says the Twitter bio of one notorious wolf-crier, Jesse Colombo. “Recognized by the London Times for predicting the Global Financial Crisis.” As soon as the next downturn comes, he’ll probably take credit again, without mentioning the 87 recessions he called that never happened. Dan Russo, chief market strategist for Chaikin Analytics, tidily sums up this humorless breed:

Me: Why aren’t you long stocks?

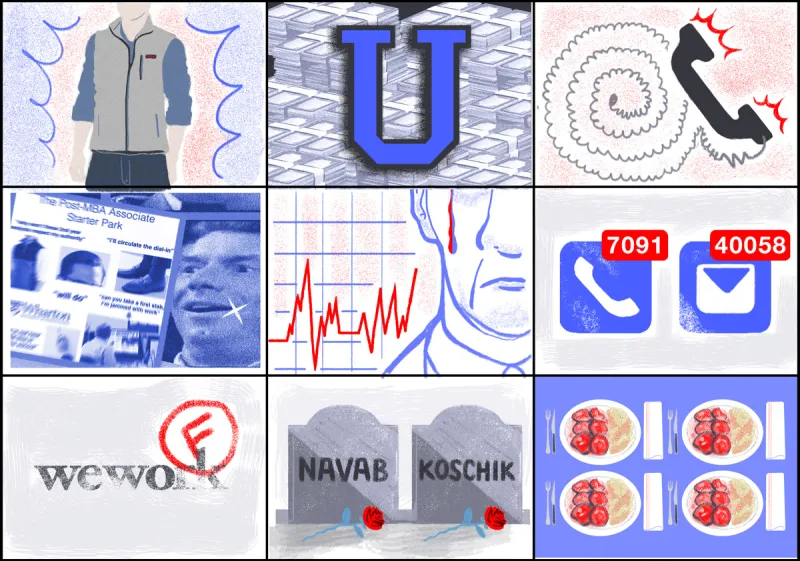

Permabear: Bc the Fed is manipulating the market

Me: Which way is it manipulating the market?

Permabear: Higher

Me: So why aren’t you long stocks?

Permabear: Because the Fed

Me: <facepalm>

2. Speaking of the Fed, zeroish interest rates plus all-time-high stock markets equaled a queasy feeling somewhere in your bowels.

3. And whenever the U.S. deficit came to mind (which was less often that it should), that queasiness level ratcheted up from “mildly hungover on a ferry” to “scraping a long-dead raccoon out of the crawl space.”

4. You cheered on public market investors’ smackdowns of WeWork, Softbank, and Adam Neumann. As an industry, you and your fellow institutions were responsible for that smacking-down: Congratulations! Founders, boards, venture capitalists, private equity shops, Fidelity, Goldman Sachs bankers . . . the WeFail fiasco showed that all of these actors can be persuaded by hype and self-interest to buy into utter BS — or at least play along. But the Greater Fool strategy of investing hits a wall when greed outpaces fool volume. Institutions proved during WeWork’s IPO roadshow that they wouldn’t be Neumann’s or Masayoshi Son’s next idiots, and $40 billion-ish of company value that never actually existed except in greedy imaginations was confirmed not to exist.

Thanks to investor rigor, Neumann has been banished to elevating his own consciousness, with only $1.2 billion and six or so mansions to show for successfully incinerating $2 billion in less than a year. Rumor has it that he’s now lighting up dank weed with $50 bills, not the Benjamins of yore. And those WeWork meanies put his Gulfstream up for sale, too. Harsh, bros.

5. You went to fabulous cities all over the world for conferences and meetings . . . only to sit in identical hotel ballrooms and eat grilled tenderloin and/or mushroom risotto.

6. If you’re an institutional allocator, you got a call from a well-mannered teenager at a London call center, wanting to know about your portfolio and manager tastes. Those who didn’t answer the first time got 50 more calls. (Hot tip: If you pick up and give them five minutes of time, said teenager will be awkwardly grateful and leave you alone for six to nine months.)

7. Regardless of who you are in the institutional universe, you dodged calls and emails from someone trying to sell you something. For us at Institutional Investor, it was mostly crypto pitches and calls from PR people “just circling back!” to see if we’d received their crypto pitches. Spoiler: We did.

8. You had to reiterate to your clients or board why an all-U.S. 60/40 portfolio isn’t a great idea over the next two decades — even though it sure looked like one for the past few years.

9. Ken Fisher sent you his book The Eight Biggest Mistakes Investors Make . . . And How to Avoid Them a while back. After this fall, you feel like Ken missed one on his list — “Big Mistake No. 9: Talking About Getting Into Girls’ Pants and What’s in Your Pants at Professional Events. How to Avoid: Just DON’T DO THAT.”

10. You were both surprised and impressed at the swift kick in the AUM that was doled out after Fisher’s comments went public in a viral video. Michigan moved first, pulling $600 million from Fisher Investments within days, followed by Los Angeles’s and Chicago’s police pension funds, among others. Fisher apologized eventually. But by Bloomberg’s tally, the total cost of that Big Mistake (i.e., sexism): about $3.9 billion. Maybe he can make it up in book sales?

11. You got into memes.

12. You wore a fleece vest with an asset management firm’s logo on it. You also realized you were living up to a finance stereotype and kept right on rocking that cozy Patagucci.

13. You pondered how a country as tiny as the U.K. could shake global markets so much, and kinda felt like they were milking the attention.

14. Endless shouty news about Brexit, Trump, trade wars, and politics wore you down. Leaping into action every time a China deal lurched ahead or fell apart ate up time and energy better spent on long-term asset allocation, portfolio risk assessments, mentoring young staff members, binge-watching Succession, and googling cat pictures.

15. You deployed a lot of money in mainland China and are ~50 percent sure that you’ll be able to get it out again.

16. You stepped in poo en route to a 7:00 a.m. breakfast meeting in San Francisco. Breakfast was microgreens and cost $19.

17. The college admissions bribery scandal made you wonder how else industry honchos swindle their kids into fancy schools. Blackmail? Hacking admissions department servers? An impossible-to-access manager magically finding $200 million in capacity for Stanford/Yale/Harvard/Duke — just after young Chadwick III scored 1100 on his SATs? Crazy thoughts, of course.

But so is the idea that PIMCO’s ex-CEO, the head of TPG’s vaunted ESG fund, and Aunt Becky from Full House would be (allegedly) doin’ crimes alongside my husband’s college roommate’s doubles partner from the Harvard tennis team in an elaborate scheme to become the Rich Grinches That Stole College from deserving kids from ethical or insufficiently wealthy families. So there’s that.

18. You spotted a client, friend, or yourself mentioned in II’s private Essential Allocator newsletter, and forwarded it to everyone you know.

19. You felt real heartache when the institutional community unexpectedly lost two of its own this year, whether you knew them personally or not. Alex Navab, the 53-year-old KKR breakout star, passed away in July on a family vacation. Mark Koschik, a pillar of Exelon’s investment team, died in September at 47 while coaching his son’s football game.

These tremendous, shocking losses reminded many how closely we hold the people we work with, and how very much they matter. The investment community proved as much in rallying around Koschik’s family to help in the one way we could: More than $100,000 has poured into a college fund for his three children, much of it from his peer investors.

May 2020 bring you happiness, alpha, good governance, and — most of all — good health.

Thank you to the industry experts who assisted with this list, including Christie Hamilton, Jim Dunn, Madsen South, Cameron McKendrick, and Ken Akoundi.