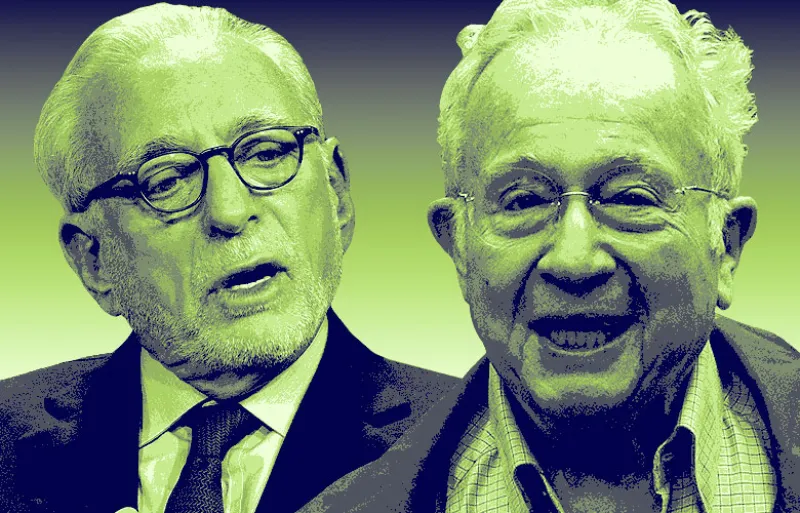

(left) Nelson Peltz of Trian Fund Management LP, (Patrick T. Fallon/Bloomberg), (right) Marty Lipton of Wachtell Lipton Rosen & Katz,

(David Paul Morris/Bloomberg)

(left) Nelson Peltz of Trian Fund Management LP, (Patrick T. Fallon/Bloomberg), (right) Marty Lipton of Wachtell Lipton Rosen & Katz,

(David Paul Morris/Bloomberg)