Paul Wightman, CME Group

At a Glance:

- Weak oil demand has limited refinery intake of crude oil for processing into refined products.

- While oil prices have fallen sharply since July, they have been outpaced by declines in diesel prices.

While the direction of oil prices is uncertain given the concerns around supply with geopolitical tensions across the Middle East and Ukraine-Russia, weak oil demand has limited refinery intake of crude oil for processing into refined products.

The International Energy Agency (IEA) says that the downturn in China has been even more acute than expected. The IEA notes that Chinese oil demand is firmly in contraction, falling by 1.7% year-on-year in July 2024 which is in stark contrast to the 9.6% average pace of growth in 2023. The weakness in Chinese oil demand is just one instance that could accelerate the end of the so-called “platinum era of oil refining.” The platinum era of 2022 to 2023 was largely characterized by the sharp post-pandemic recovery in gasoline and diesel demand, which outpaced growth in refining capacity, and led to unusually large profit margins.

Sanctions placed on the export of refined products from Russia for its invasion of Ukraine in 2022 constrained supply, increasing competition for available crude oil. S&P Global Platts also noted that the platinum era for refiners was the result of import bans on refined products from Russia for its invasion of Ukraine in 2022. This article examines the close relationship between demand for oil products and the impact this can have on oil prices with the ensuing gyrations in refinery margins, or crack spreads.

What’s Next for Oil Prices?

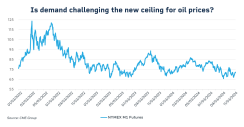

While rising geopolitical tensions in the Middle East and the ongoing Russo-Ukraine war may affect oil prices, so can the supply and demand scenario in the coming months. For example, OPEC+ has removed 3.6 million barrels of oil per day from the market which could be brought back online to try and restore market share lost to non-OPEC producers. All of these factors have led many oil analysts to cut their price forecasts to around $70 per barrel in mid-September, a sharp downward revision from the prior estimates in the middle of summer 2024. It is worth noting that the price of CME WTI futures for 2025 delivery are averaging around $69 per barrel in mid-November 2024.The persistent weak demand outlook for oil has continued to pressure oil prices and the latest decline in prices has seen prices fall by around $15 per barrel in a few short weeks (based on late mid-November 2024 prices).

Uncertain Outlook for Transport Fuels?

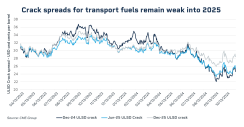

The futures market hints at continued weakness in refined product demand (or sustained end to the platinum era for refiners). While oil prices have fallen sharply since July 2024, they have been outpaced by declines in diesel prices, with the prompt crack spread falling by around $7-8 per barrel to levels not seen since 2021. CME Group data shows that the market structure for diesel cracks is in contango, where prompt prices trade at a discount to the deferred contract months. The recovery in prices reflected in the June and December 2025 values still puts diesel cracks at multi-year lows. The U.S. gasoline market is also showing similar trends in price direction, highlighting the end of the platinum era for refiners.These changes could have an impact on the likely direction for oil prices with the weakness in refined products markets extending beyond the nearby contract months.

Naphtha A Sign of Strength for Refiners

Despite the weakness in road transport fuels, there are other bright spots for refiners. Strong petrochemical demand has been supportive to the price of naphtha, with refiners searching for crude oils with higher yields for the light-end products. The chart below shows how the price of naphtha has performed compared to crude oil and other fuels such as diesel, gasoline and fuel oil. The rebound in petrochemical demand, due to improving margins, has seen naphtha outstrip gains in the other products.However, it should be considered that the naphtha yield in a barrel of crude oil is a relatively small portion of the overall barrel. Using the global average, a typical refinery produces around 8% of naphtha per barrel of oil therefore the overall impact on refinery margins is more limited.

As product demand remains sluggish, the oil markets will continue to watch trading activity in diesel and gasoline prices over the coming months as a likely indicator for future price direction and whether there will be a new platinum era on the horizon.