Bob Iaccino, for CME Group

At a Glance:

- The used car market is cooling off but hasn’t returned to pre-pandemic norms.

- Semiconductor production and shipping data has become a leading indicator for car supply.

The Market Shake-Up

Remember when predicting car prices was as simple as looking at seasonal trends and depreciation rates? Those days seem to be gone. This happened for a few reasons.

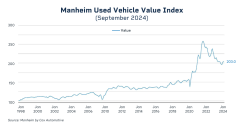

First, used car prices went through the roof. The Manheim Used Vehicle Value Index shot up 52% between April 2020 and June 2021. That kind of move makes traders sit up and take notice. We're talking about cars – usually a depreciating asset – suddenly appreciating faster than some stocks.

Finally, consumer behavior pivoted. From the urban exodus, to work-from-home, to fear of public transportation, people’s car-buying habits changed almost overnight. Suddenly, that second car wasn't just a luxury; it became a necessity for many. Government stimulus gave a significant portion of the U.S. population an extra few thousand dollars to spend. For many, that meant finally being able to afford a car upgrade or a second car. Personal vehicles became safety bubbles in uncertain times.

New Tools of the Trade

Forecasters and traders had to adjust to keep up with these changes:

Supply Chain Sleuthing: Tracking semiconductor production and shipping data has become a leading indicator for car supply. Some forecasters even monitor container ship movements and port congestion to anticipate delays.

Real-Time Consumer Insights: Credit card data, online searches and even social media can help anticipate where the car market may be heading. For example, a spike in searches for "used trucks" could signal a coming price increase in that segment.

AI and Machine Learning: These tools are crunching numbers faster than ever, spotting trends humans might miss. These algorithms can process millions of data points from various sources in seconds.

Alternative Data: Some forecasters even use dealer lots' satellite images to gauge inventory. Others are tapping into vehicle registration databases to track real-time sales trends.

These shifts have created new dynamics for traders and active investors:

Volatility: The days of car prices being a slow, steady market are gone – at least for now.

Rethinking Relationships: The historically reliable correlation between new and used car prices is no longer as trustworthy so far in 2024. In some cases, low-mileage, late-model used cars are selling for more than their new counterparts.

Ripple Effects: Related industries—parts suppliers, rental agencies and ride-sharing companies—are all part of the bigger picture now. For instance, a shortage of all-new cars could cause a rental company to buy up late-model used cars, driving the prices of used cars higher.

Regional Variations: Different areas are experiencing these trends to varying degrees. A hot market in one state might be lukewarm in another, and inflation forecasting is a big-picture discipline if you are concerned about FOMC actions.

Looking Ahead

The used car market is cooling off, but we're not back to normal yet.

The "New Normal": Whether prices settle higher or return to pre-pandemic patterns could have long-term implications for car prices and their impact on inflation and the rate-of-change volatility that the Fed watches.

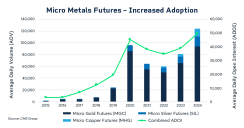

EVs: As electric vehicles gain traction, battery technology advances could lead to unexpected shifts in the market, especially in commodities like silver, copper and rare earth metals. Micro Silver futures have seen increased adoption and market activity while physical demand for the metal in industrial use continues to grow.

New regulations or incentives around climate initiatives could also impact future car values.

Changing Tastes: Online car buying and subscription services show how consumer preferences are evolving. The next big disruptor in the auto industry might not be a carmaker but a tech company.

Interest Rates: As rates rose, financing became more expensive. This likely helped cool off the market, particularly for mid-to-high-priced vehicles. As rates fall, demand may jump. As of early October, the CME FedWatch tool is showing an almost 90% chance that the FOMC will cut rates again in the November meeting.

The pandemic introduced added complexity into car price forecasting. More market participants will likely shift focus to monitoring the larger macro picture, taking the data as it comes, rather than trying to become auto analysts.