The last twelve months have seen more climate records fall. The world has now witnessed a year-long breach of 1.5-degree global warming. 2023 was the warmest year in modern history and Monday 22 July was the hottest day in recorded history.

Weather effects, such as the recurrence of the El Niño weather pattern in the Pacific, are contributing to the higher temperatures. But so too is the fact that we are rapidly exhausting our carbon budget. At the current rate, we have less than 10 years before the world’s emissions surpass the minimum threshold required to maintain the 1.5°C benchmark.

This climate math is now driving the investment math. Leading asset managers are stepping up with strategies that will be a key driver of the Net Zero transition.

The good news is that progress is happening very fast. Renewables are the cheapest form of electricity almost everywhere in the world. According to the International Energy Agency there is now enough manufacturing capacity for solar panels and batteries to meet the needs of its 2030 Net Zero scenario.

But the investment math continues to be a challenge in other ways.

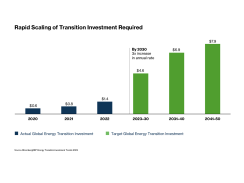

By 2030, for every dollar spent on traditional energy, we need at least four dollars deployed in clean energy and its associated infrastructure. Some of that investment – for example in grid infrastructure – may happen as part of a natural upgrade cycle, that goal is more than double the 2:1 ratio that exists today.

As with any ratio, only two actions can change the equation: investing more in clean energy and reducing the use of existing fossil fuels in our economy.

Or in the words of UN Climate Finance Envoy and Brookfield Asset Management’s Head of Transition Investing Mark Carney, “we must go where the emissions are.”

In practice, this means investors must be willing to work with and partner with carbon-intensive businesses—like steel, cement and transportation companies—to transition to more sustainable business models and help reduce their emissions.

Not every business can reduce its emissions overnight, nor is it always desirable to do so – sometimes the economic or security cost is too great. And such a transition can only be achieved when those businesses have a clear and committed pathway toward reducing emissions in line with global climate goals.

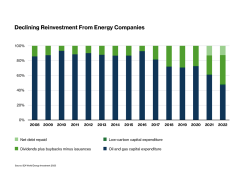

There have been some important steps forward in the oil and gas sector. International majors have increased clean energy investment to as much as a third of their overall capex.

The excess cash is being returned to shareholders in record amounts, leaving investors the task of reallocating that capital into transition-friendly investments.

In place of the traditional energy companies, investors can now turn to specialist fund managers with both a track record of successful investing in renewables and the capability of investing where the emissions are.

Mark Carney sums up the challenge: “We need an industrial revolution at the pace of the digital revolution, and that means transition investment must accelerate in every sector of the economy. Investment firms will increasingly take up the gap left by traditional energy companies, and that creates a wall of opportunity for smart money.”

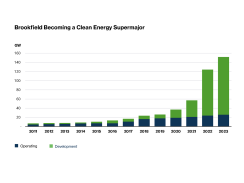

This includes firms such as Brookfield Asset Management—recently named the world’s largest impact fund manager and a leading private capital investor in the energy transition.

The firm is already a global leader in renewable energy deployment, building on over 30 years of specialist investing in the asset class. Since 2020, however, Brookfield has witnessed exponential growth in its Renewable Power and Transition investing strategy, cementing its role as one of the leading global players in the transition.

In the last two years, Brookfield has deployed or committed the entirety of its record-breaking $15 billion transition fund across three core pillars: clean energy infrastructure, including wind, solar and batteries; sustainable solutions, such as carbon capture, waste recycling and nuclear; and business transformation, which drives the transition of carbon-intensive industries.

Critically, this is private capital that will work alongside an existing corporate ecosystem to accelerate investment.

Where technologies are already mature, such as wind and solar, asset managers can invest in platforms that build efficiently at scale. Where technologies are proven but not yet at global scale, such as carbon capture and renewable natural gas, asset managers can invest in project development and commit much larger quantities of capital to construct facilities when they are ready.

For example, Brookfield’s investment in carbon recycling business LanzaTech includes a $500 million commitment for new facilities as they become ready for construction.

In another example, Brookfield committed C$300 million to construct a pipeline of projects alongside Entropy, a Canadian carbon capture and storage (CCS) technology business that can retrofit onto existing industrial facilities. Wherever you find existing heavy industry, the role of carbon capture will be critical to protecting jobs and economic strength while also meeting Net Zero goals.

As these examples show, there will be a strong role for private capital in driving transition investment, particularly when it comes to scaling new technologies. It is critical for progress in this area that more asset managers are stepping up.

This article and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, "Brookfield").