Elizabeth Hui, CME Group

At a Glance:

- Jet fuel production in the U.S. increased from pre-pandemic levels to 1.9 million barrels per day at the beginning of August, an increase of 8% compared to 2023

- Over the summer, crude oil refiners ramped up activity to keep up with increased demand while closely monitoring the hurricane season through November 30

Jet fuel production in the U.S. also soared from pre-pandemic levels to 1.9 million barrels per day at the beginning of August, an increase of 8% compared to the year prior. The Transportation Security Administration (TSA) checkpoint passenger travel numbers from January through July 2024 showed an increase of 6.2% compared to the same period in 2023, signaling a swift recovery in the civil aviation sector.

Gasoline demand topped initial projections this year. The AAA projected 70.9 million individuals will have traveled 50 or more miles from home over the summer, an increase of 5% compared to 2023. Meanwhile, Labor Day domestic travel bookings were up 9% over 2023, according to AAA.

In efforts to meet the higher demand for air travel, industry trade organization Airlines for America projected that U.S. carriers would provide an additional 26,000 scheduled flights per day, up nearly 1,400 a day from the summer of 2023. In July, North American carriers saw a 4.9% year-on-year increase in demand over the same period in 2023, according to the International Air Transport Association (IATA).

Despite the hurricane season getting off to an early start, gasoline prices in the Gulf Coast remained steady after Beryl, a Category 1 storm, reached landfall in Texas on July 8.

Lower Gasoline Prices Held Over Summer

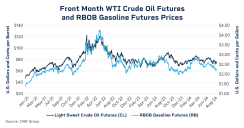

The price of gasoline is predominantly underpinned by crude oil as it is the primary driver accounting for approximately 60% of the cost. The remaining 40% of the price is determined by refinery operations and distribution costs, and state and federal taxes. Front-month RBOB Gasoline futures prices averaged $2.31 per gallon in August 2024, $0.51 cents per gallon lower than they were during the same period a year prior. Gasoline prices in 2024 are expected to remain relatively flat with slower but consistent economic growth according to the EIA.

Over the summer, refiners ramped up activity to keep up with increased demand while closely monitoring the hurricane season from June 1 to November 30, which could affect supply and contribute to price volatility in the future.

U.S. crude oil refiners expect to operate at approximately 90% of their combined processing capacity in the third quarter of this year. The largest U.S. refiner, Marathon Petroleum, said in August,it ran its refineries at 97% of their combined 3 million barrel-per-day capacity during the second quarter, compared to 82% in the first quarter, after their largest planned maintenance quarter in history. Marathon is positioned to run refineries at 90%, and Valero at 92% of combined capacity in the third quarter.

In line with seasonal norms, gasoline inventories rose in the winter of 2023 in anticipation of the summer peak driving demand. Inventories took a steeper dive during the peak driving season this summer, decreasing by 3.7 million barrels to 223.8 million barrels at the end of July, 3% below the five-year average.

As gasoline transitions into the fall period, it could also be a key factor in campaigns during the upcoming U.S. election cycle. Given the upcoming uncertainty, demand for risk management in both jet fuel and gasoline markets is likely to remain strong.