Debbie Carlson, for CME Group

At a Glance:

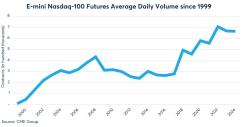

- Launched in 1999, E-mini Nasdaq-100 futures at CME Group have become a key tool for managing exposure to the Nasdaq-100 Index®, with $230 billion in notional value traded daily

- From the dot com era to AI, new economy stocks that make up the Nasdaq-100® have evolved from being a niche part of the overall stock market to a major force

Over the past quarter century, technology stocks have become a source of economic strength, and the Nasdaq-100 index is now one of the main gauges global investors and traders watch. With the growth in both the overall market value of the index’s constituents, and the rise in investors’ exposure to it, there has also been an increase in the need for effective risk management.

That’s where a mainstay of equity derivatives markets, E-mini Nasdaq-100 futures, comes in. The contract’s ascendancy reflects both the growth of technology and other new economy stocks, and investors’ need for a diversified choice in risk management.

The E-mini Nasdaq-100 future was the second E-mini futures contract CME Group launched, following in the footsteps of the E-mini S&P 500 debut. Since then, the E-mini Nasdaq-100 has become one of the exchange’s biggest contracts in terms of volume and liquidity. It trades more than $230 billion in notional value daily and has spawned other complementary products based on it, including E-mini Nasdaq-100 options contracts and Micro E-mini Nasdaq-100 futures and options.

Setting the Stage for Growth

The E-mini Nasdaq-100 launched on June 21, 1999 during the height of the first technology boom that propelled the cash Nasdaq-100 index to new highs at the time. The timing gave the upstart contract strong tailwinds.“If we think about how much it was trading in the initial days, it was a few thousand contracts, and we thought that was extremely successful,” said Paul Woolman, managing director and global head of equity products at CME Group. “If you compare it to how much it trades today, it’s over 600,000 contracts per day.”

“In those early days, clients wanted to get different kinds of exposure through additional benchmarks. Index choice matters and clients can now choose where they want to have exposure, where they want to hedge their risk. This flexibility is really important,” Woolman says.

Today’s E-mini Nasdaq-100 contracts also benefit from a surge of trading interest and a cash index that is holding at all-time highs. Equity Index options at CME Group reached a record 1.7 million average daily trading volume (ADV) in the first quarter of 2024 in part due to the strength in the technology sector, a trend that continued in the second quarter when ADV rose 28% over Q2 2023. E-mini Nasdaq-100 options ADV surpassed 82,000 contracts and set a single-day volume record of 135,855 contracts on Jan. 19.

Today’s Tech Risks

The recent strength of the technology sector, which lately has been powered by companies with significant exposure to artificial intelligence, has some investors thinking about the first tech boom and subsequent bust, but Mark Marex, Senior Director of Index Research and Development at Nasdaq Indexes, says the comparisons mostly do not hold. “It was a very unique time in the history of the index,” he says of the dot-com era.It’s difficult to find reliable data on index valuations from the late 1990s since Nasdaq maintains access to data that only goes back to about 2001, Marex says. However, news reports at the time showed some price-to-earnings ratios for the index as a whole reached as high as 200 or more.

“We've not come anywhere remotely close to that type of an environment,” he says. Even after the onset of the COVID-19 pandemic, which increased some technology stock valuations higher and pushed index valuations closer to 40, those lofty modern P/E ratios were significantly below the dot-com era valuations.

Technology and what Marex calls the “new economy” holdings that make up the Nasdaq-100, have evolved from being a niche part of the overall stock market to a major force. Marex says looking at the S&P 500 index, Nasdaq-100 companies represented about 10-15% of the index market cap throughout much of the 2000s. It has averaged closer to 50% in recent years. “The Nasdaq-100 is such a substantial part of the US equity market that you can almost think about it now as a core holding,” Marex says.

As markets rise in value, smaller futures contracts allow a wider range of market participants to use the product for investing, hedging or other purposes in a very liquid backdrop. Benchmarks, too, are changing as technology becomes even more embedded into the U.S. economy, so it changes how investors think about hedging and risk management.

Choices matter, whether it’s the type of benchmark or the size of a contract, says Tim McCourt, senior managing director, global head of equity and foreign exchange products for CME Group. As an example, he pointed to the material difference between how an investor manages risk between the S&P 500 and the Nasdaq-100. The launch of the Micro E-mini contracts across the four major equity index benchmarks five years ago also reflect those needs.

“Since launch, those contracts have done over 2.5 billion contracts of volume… the market wants more precision in their risk management, and they want easier access to trading vehicles,” McCourt said in a Nasdaq Trade Talks discussion.

U.S. Economy Index, Global Benchmark

CME Group’s licensing of the Nasdaq-100 index, and subsequent E-mini Nasdaq-100 contract, was one of the firms’ early partnerships. Combining the strength of the two entities has been the secret to the partnership’s success, McCourt says.He points to Nasdaq’s leadership in initial public offerings and ability to create a global benchmark, and CME’s ability to build liquidity and unlock capital efficiencies in derivatives markets as “something that's really powerful and has served the community for decades, and hopefully decades to come as well.”

Because the Nasdaq-100 is largely (but not exclusively) focused on the U.S. economy, U.S. investors may only think about it domestically, but it’s a global benchmark, and the E-mini Nasdaq-100 is a global trading vehicle, as well, McCourt says.

“We're continuing to see outsized growth outside of the U.S. From a trading hour perspective, almost 500,000 micros per day are from outside the U.S. From a trading hour perspective, we look at the participation. It's very diversified in terms of segments, as well as regions across the globe. And what we're seeing is, as people get familiar with the E-mini, the Micro E-mini, the Nasdaq options, they're now adopting all the other sort of varietal of products that we have similar to the other indices as well. All these things are great growth drivers for the Nasdaq-100,” McCourt says.