Elizabeth Hui and Paul Wightman, CME Group

At a Glance:

- Higher blending mandates for gasoline are contributing to the rising demand for ethanol

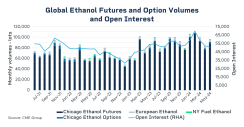

- Trading volume in the Chicago and European Ethanol futures has continued to rise over the past year

The resurgence in demand has also put pressure on corn, fats, greases, soybean oil, waste oil and other feedstock supply chains that are accustomed to producing a wide array of biofuel products.

The International Energy Agency (IEA) notes that biofuels can play an important role in decarbonizing transport in sectors such as aviation, shipping and trucking where electrification proves most difficult. Demand for biofuels is expected to increase by 38 billion liters from 2023 to 2028 and total biofuel demand could reach 200 billion liters or 70.6 million tons.

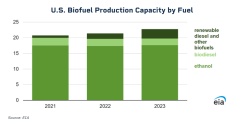

Ethanol remains one of the largest of the biofuel products. In 2023, fuel ethanol accounted for 78% of total U.S. biofuel production, a level which has been broadly consistent since 2021. Renewable diesel and ethanol are expected to account for two-thirds of the forecasted growth, according to data from the Energy Information Administration (EIA).

Global trading volumes in ethanol have increased rapidly with more countries adopting higher blending mandates into products like gasoline. Newer technologies such as the alcohol-to-jet blending for products like sustainable aviation fuel have also helped to boost demand for ethanol. In the European Union, the higher blending mandates are part of a wider package of measures to cut carbon emissions following the latest iteration of the Renewable Energy Directive (RED III), which aims to boost the share of renewable energy in the bloc’s overall energy consumption from 32% to 42.5%.

Boost to Ethanol Trading

Rising demand has shown a positive effect on Ethanol futures volumes at CME Group with the Chicago and European contracts seeing steep gains. The largest ethanol market remains in Chicago where volumes have increased 40% in the 12-month period up to and including April 2024 compared to the prior 12-month period. However, European Ethanol volumes traded on the key Rotterdam hub have also increased by around 15% over the same period.

Global consumption of ethanol is determined by several factors, including policy and ethanol’s value as a transportation fuel. Since 2009, the European market has been steadily increasing the blending mandate for gasoline with more countries selling larger volumes of the 10% ethanol content in gasoline, a doubling of the prior 5% level which existed for many years. E10 gasoline is available in more than 15 European countries and this number is expected to grow in the coming years.

In the U.S., ethanol, primarily made from corn, is the most prominent alternative transportation fuel. The largest of these markets is E10, gasoline which contains 10% ethanol fuel, though progress has been made to increase the blend level to E15.

E85 is a high blend of 51% to 83% ethanol that can only be consumed in flexible-fuel vehicles (FFVs); however, it can use every blend level from E0 to E85. According to the Greenhouse gasses, Regulated Emissions, and Energy use in Technologies (GREET) model, which assesses a range of life cycle energy, emissions, and environmental impact challenges, ethanol reduces life cycle greenhouse gas emissions (GHG) on average by 40% compared to petroleum based gasoline.

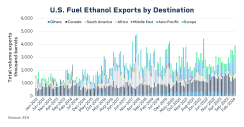

U.S. Ethanol Exports Expand Rapidly

As consumption of fuel ethanol has grown, so too has the role of U.S. ethanol in the global market with the expansion of exports rising on a month over month basis. Canada, Europe and Asia are the largest export destinations from the U.S. In the case of Europe, exports of fuel ethanol in the past 12 months up to and including March 2024 have increased from an average of 450,000 barrels per month to just over 650,000 barrels per month.

Trading volumes in Ethanol futures at CME Group have steadily been rising, reflecting the growing uncertainty in the market both in Europe and the U.S. The continued concern in the outlook around supply and demand could prompt more market participants to turn to the financial markets to manage risk. The introduction of agricultural practices such as the usage of corn-based ethanol in products like Sustainable Aviation Fuel could drive further demand. This trend toward greater risk management continues as both companies and countries seek to reduce the carbon intensity of the feedstocks that they choose for the transportation sector.