Bob Iaccino, for CME Group

AT A GLANCE

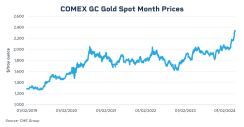

- The global nature of gold markets means factors like geopolitical stability, economic growth and currency value all impact the price of gold

- Gold can function as both an inflation hedge and an appreciating asset during periods of low real interest rates

Gold has long been viewed as a steadfast protector of wealth, often becoming attractive for investors during turbulent economic times. However, its price dynamics reveal a more nuanced story than simply acting as an inflation hedge.

Understanding how gold's price responds to inflation requires an appreciation of its multifaceted role as an asset and how broader economic policies, particularly those of the Federal Reserve concerning interest rates, influence its value.

Gold's Reaction to Economic Forces

At its core, gold is an asset that, like real estate or stocks, responds to the fundamental forces of supply and demand. The term inflation tends to be interpreted negatively in the context of higher prices paid by consumers. Inflation, however, is not just present in consumer prices.

What really happens when inflation rises is the purchasing power of a currency falls, which means the value of certain assets rises. This leads investors to seek assets that either maintain value or appreciate. Gold has historically been one of these assets because it is scarce, durable and has intrinsic value. Its price rise amid inflation is not solely due to its role as a safe haven.

Inflation and Real Interest Rates

Inflation impacts various asset classes differently, but the critical factor for gold is real interest rates – the nominal rates adjusted for inflation. When the Federal Reserve chooses not to hike interest rates in response to rising inflation, real interest rates tend to fall. Lower real interest rates reduce the opportunity cost of holding gold, which does not offer any yield.

Consequently, gold becomes more attractive to investors, not just as an inflation hedge but as an appreciating asset in an environment where traditional income-generating investments yield less in real terms. This phenomenon mirrors the behavior of other assets like real estate and stocks during periods of low real interest rates.

How Different Assets Respond to Inflation

Real estate may benefit from inflation as the value of properties and their rental income can increase while the cost of borrowing to finance property purchases in some cases remains relatively low. Similarly, stocks can appreciate as companies pass on the higher costs to consumers, potentially increasing earnings and making equity investments more attractive.

However, gold's response to inflation and interest rate policies is subject to its own set of unique factors. Unlike real estate, gold does not generate income through rent or dividends like stocks, making its investment case rely more heavily on capital appreciation. After the recent release of U.S. inflation data, intraday volatility in CME Group Gold futures reached a two year high.

Global Influences and Investor Sentiment

Investor sentiment, geopolitical stability, currency values and other macroeconomic factors that influence demand can drive this appreciation of gold. Furthermore, the global nature of gold markets means that while the Federal Reserve's policies are influential, they are not the sole determinants of gold prices. Central bank policies worldwide, global economic growth rates and even technological advances in gold mining and recycling can significantly shape gold's supply and demand dynamics.

Understanding Gold's Complex Nature

As with any investment, the key to leveraging gold effectively lies in understanding the broader economic context, including Federal Reserve policies and their implications for real interest rates and inflation.

The relationship between gold prices, inflation and interest rates highlights gold's dual nature as both a traditional hedge against currency devaluation and an asset class responsive to macroeconomic policies and investor behavior. Its appeal during periods of low real interest rates, akin to real estate and stocks, reflects its status as a valuable component of a diversified investment portfolio.