Delivering value to both investors and borrowers

We believe private credit, and direct lending in particular, will continue to deliver tangible value to both investors and borrowers. Today, investors have benefited from the higher returns, consistent cash flows and steady income distributions that private credit can provide while seeking to deliver lower volatility. At the same time, borrowers have appreciated the partnership that a private credit manager can provide with certainty of execution and no direct market risk for the borrower due to the committed capital and contractual commitments that underlie such financings. These factors increasingly make private credit borrowers’ lender of choice.

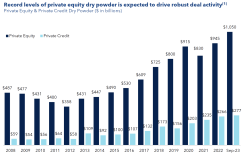

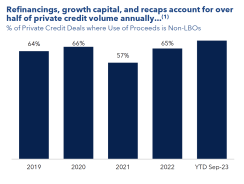

Banks continue to retrench from middle market lending with private capital providers filling the void. Record levels of investible capital amassed by private equity sponsors, as well as the growing volume of refinancings, growth capital and dividend recapitalizations, continue to drive demand for private credit. Private equity dry powder far exceeds the available debt capital needed to support projected buyout activity.

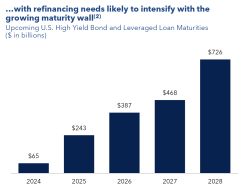

Finally, we have observed that borrowers have increasingly turned to private credit for refinancing solutions to help solve the upcoming maturity wall of loans and bonds that were underwritten in a zero-rate environment. This includes seasoned public issuers that have utilized the private credit markets to address their pending maturities.

2 Data represents the developed market USD High Yield Bond and USD U.S.-Syndicated Leveraged Loan maturities. BofA Global Research, HY Credit Chartbook. As of September 30, 2023.

Flexible capital to deliver sought-after solutions

We expect borrowers to increasingly look to private credit to provide flexible capital solutions across both senior and non-senior structures to meet their specific financing needs in today’s market.

For example, creative senior solutions and non-senior structures could be critical in helping companies transition and right-size their capital structures, which may have been put in place during a significantly lower interest rate environment. Flexibility to structure debt with cash or non-cash (payment-in-kind) returns allow borrowers to access incremental growth capital without increasing their cash interest burdens. This growth capital can be used to generate liquidity, retire cash-paying debt or make accretive acquisitions. Non-senior debt can also be a cost-efficient tool for sponsors to raise capital without repricing existing senior debt or triggering existing most-favored-nation (MFN) provisions.

Finally, we believe flexible capital solutions represent a compelling value proposition to borrowers and can subsequently provide investors with the opportunity to capture value and earn higher risk-adjusted returns

Implications for investors considering private credit

from mere asset gatherers and may result in a

greater dispersion of returns across

managers.

Against this backdrop, it’s clear that experience matters. Investors considering private credit today should consider a manager’s experience investing across multiple credit cycles (including through prior high interest rate environments and periods of economic weakness), strength of sourcing platform, consistent discipline in underwriting and portfolio management expertise.

We believe that with the right manager, the attractive yields and conservative structures today should create the conditions for a compelling vintage in private credit.

ABOUT CRESCENT CAPITAL

Crescent is a global credit investment manager with over $40 billion of assets under management as of September 30, 2023. For over 30 years, the firm has focused on below investment grade credit through strategies that invest in marketable and privately originated debt securities including senior bank loans, high yield bonds, as well as private senior, unitranche and junior debt securities. Crescent is headquartered in Los Angeles with offices in New York, Boston, Chicago and London with more than 210 employees globally. Crescent is a part of SLC Management, the institutional alternatives and traditional asset management business of Sun Life. For more information about Crescent, visit www.crescentcap.com.

LEGAL INFORMATION & DISCLOSURES

This document expresses the views of the author as of the date indicated and such views are subject to change without notice. Neither the author nor Crescent Capital Group LP (“Crescent) has any duty or obligation to update the information contained herein. Further, Crescent makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Crescent makes this document available for informational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Nor is the information intended to be nor should it be construed to be investment advice. Certain information contained herein concerning economic trends and performance may be based on or derived from information provided by independent third-party sources. The author and Crescent believe that the sources from which such information has been obtained are reliable; however, neither can guarantee the accuracy of such information nor have independently verified the accuracy or completeness of such information or the assumptions on which such information is based. This document, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Crescent.