Debbie Carlson for CME Group

AT A GLANCE

- A good monsoon season can drive physical gold demand, especially in India’s agricultural areas

- Gold demand globally has eased since the beginning of the year as central banks hiked interest rates with no sense of when they would finish

The connection between a weather event and gold purchases may not be immediately apparent, but about 60% of the country’s gold demand comes from rural areas. India is also the second-largest gold-consuming country.

Bountiful harvests mean Indian farmers can direct some extra income to invest in gold. In the past, India’s gold purchases in the late third to fourth quarter have impacted global gold prices.

Monsoon season can influence buyers’ decisions, with the weather event producing about 70% of India’s needed annual rainfall for crops, reservoirs and aquifers. Other macroeconomic factors are also affecting gold demand, say market observers. High interest rates and strong gold prices in rupee terms may offset some of the traditional demand seen toward year’s end.

A Historical Form of Savings

India’s monsoon season typically runs from about June through September. The India Meteorological Department (IMD) confirmed the entire country was officially in a monsoon as of July 2.Mike Tannura, founder of T-Storm weather, says the monsoon started late, but was very wet across the Northwest.

Joe Cavatoni, market strategist and head of Americas at the World Gold Council, says the organization’s Indian-based team suggests the local sentiment considers July’s rainfall was good for farmers. Rains receded across most of the country in August, only to bounce back in early September, according to the IMD.

Cavatoni says not only can a good monsoon season bring strong economic outcomes for rural areas; the end of monsoon season and harvest also heralds the beginning of the auspicious festival season. That leads to gold buying.

“Even though it is potentially jewelry purchases or foreign coin demand, (the purchases are) a form of savings, a long-standing, historical form of savings,” says Cavatoni.

Sachin Patel, Executive Director, Metals products for CME Group in Singapore, agrees the monsoon and festival season are unique and specific factors impacting Indian gold demand. He also points to India’s peak wedding season from October - December as another time when gold buying picks up.

“These big, auspicious events, whether they're religious or cultural festivals, or weddings, tend to be a driver of immediate physical demand and are a fairly unique dynamic compared to what would drive gold demand in other countries,” Patel says.

Patel says the prices paid for gold in India are usually seen in the local premium or discount for physical gold to International Gold prices.

Jewelry consumption is the biggest source of Indian gold demand, and in the first half of 2023, it was at 207 metric tons (MT), making up the bulk of the country’s total demand at 275 MTs over the same period. Will Rhind, CEO of GraniteShares, which issues the GraniteShares Gold Trust (BAR) exchange-traded fund, explains that gold jewelry is not just considered fashionable, but is an investment.

“Historically, a lot of Indian farmers buy gold or buy gold jewelry because they don't have access to bank accounts,” he says. “They use gold as a direct way to store wealth.”

High Gold Prices Pinching Consumers

Rhind suggests that factors beyond monsoons may have just as much of an impact on Indian demand. He says strong gold prices denominated in rupees have limited consumer purchases and a pickup in gold recycling to take advantage of those strong rupee-based gold prices has made Indian gold demand more muted than what gold-market watchers expected for 2023.“The price of gold is hovering around all-time highs. And clearly when that happens, it just makes it tougher from a consumer perspective for people to keep buying at the same pace as before,” Rhind says.

The World Gold Council’s second quarter gold demand trends report shows Indian gold jewelry consumption fell by 8% during the quarter, stymied by record high gold prices. That cut first half total gold demand by 12% year-over-year. The organization suggested that given prices were at a record high, jewelry demand could have been weaker, but a strong economic backdrop with GDP estimated to grow 6.3% in 2023/24 helped support demand, albeit at a lower level. It also noted “unofficial” gold flows surged in the second quarter, a trend often seen when prices are high.

The Indian government’s decision to ban 2,000-rupee notes during the second quarter may have also provided a short-term boost to gold demand, WGC’s report says.

Gold prices saw volatility earlier in the year because of worries over banks, such as the failure of Silicon Valley Bank, a U.S. regional bank catering to the technology sector, and the takeover of Credit Suisse by UBS, Patel says.

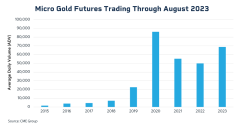

He notes volumes through August in the benchmark 100-ounce gold contract are up 4% versus a year ago, but the smaller gold products, such as the micro gold futures, which is one-tenth the size of the benchmark contract saw volumes increasing 32% through August. Likewise, the standard gold options contract is up 13% through August.

Inflation Challenges for India

The WGC demand trends report also acknowledges the importance of the monsoon. “The success – or otherwise – of the monsoon season will also have a considerable bearing on demand for the remainder of the year,” the report states.Rhind says Indian consumers may also be waiting to see if The Reserve Bank of India will cut interest rates. Much like the Federal Reserve and other western central banks, the RBI also raised interest rates to tame inflation. Inflation has tamped down on some Indian consumption as well, Cavatoni says.

Rhind says historically when gold hits new highs, consumers have to adjust to those prices. “It's a question of how quickly they adjust to those prices in order to keep demand up there,” he says.

Cavatoni says once a clearer picture of U.S. monetary policy direction emerges, that could affect investors’ interest in gold. Yellow metal demand eased as the Fed and other central banks hiked interest rates with no sense of when the central banks would finish.

“That could be moving the price, which might impact overall demand, or the appetite for consumption in India,” Cavatoni says. “So you might have a ripe environment from a monsoon perspective, or maybe even an inflationary environment, but ultimately, that price might be something that puts a bit of a hindrance on consumption.”