Investors keep adding private credit to their portfolios, but many still have questions on how to incorporate it into their portfolios.

Research from GIC, Singapore’s sovereign wealth fund, and consulting firm StepStone attempts to answer how allocators should think about structuring their allocations to private credit.

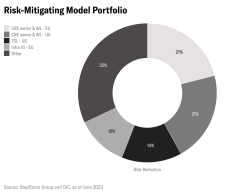

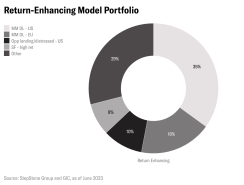

GIC and StepStone created two model portfolios that incorporate private credit. One is focused on reducing risk and adds investments in real estate and infrastructure debt; the other model is focused on higher returns and includes a large allocation to middle market direct loans.

The model portfolios were built using metrics specific to private credit, rather than conventional measures such as internal rates of return and total value paid-in. The models used net credit spread — the gross spread net of expected losses from defaults, fees, and costs.

“The use of net spread reflects a simple and elegant ‘hold to maturity’ projection of credit spread returns without assuming valuation changes as private debt investments are not traded frequently,” the paper said.

They also chose to use stress loss to measure credit risk. This metric is defined as the worst expected 12-month credit loss due to defaults exceeding the long-term expected loss rate.

Then they built the two portfolios.

Their analysis showed that for a portfolio focused on reducing risk, investors should allocate 21 percent of the private debt portfolio each to U.S. and European real estate debt funds. At the same time, 31 percent of the portfolio should be invested in infrastructure loans across risk tolerances and geographies. The outcome of this portfolio is a reduction in stress losses of 2.8 percent, while maintaining the same level of returns.

For portfolios focused on higher returns, the researchers suggest allocating 53 percent of the total private debt portfolio to middle market direct loans in the U.S. and Europe. They suggest that 10 percent of the portfolio should go to opportunistic lending, and then 8 percent to high-returning specialty finance funds.

According to the researchers, this portfolio can deliver higher returns by 3.39 percent, as compared to a public investment grade-high yield bond mix, while maintaining the same level of stress loss.

“As such, replacing the 10 percent public credit allocation with this private debt portfolio will improve total portfolio return by 34 bps [basis points] while maintaining the same level of risk,” the paper said.

To construct these model portfolios, investors will have to push to gain access to capacity-constrained funds, which could be an obstacle to immediate success. And there are, of course, factors beyond simple portfolio construction that private debt investors must also consider. For instance, tactical allocation and investment pacing will affect how well a private credit portfolio fares, according to the paper.

“Besides scaling up and maintaining the strategic credit allocation, investors can tilt their portfolios tactically to capture short-term dislocations and enhance returns,” the paper said. “Investors can monitor changes to market fundamentals, valuations, and technicalities, and hence develop near-term assessments of risk-reward across segments.”