India’s rapid economic growth over the last two decades has lifted millions out of poverty and contributed phenomenally to global human development. It is now the fifth largest economy in the world and will likely be the third largest in the next seven years, with its GDP more than doubling from the current US$3.3tn.

According to our analysis, India is forecast to add more than US$400bn to its GDP annually, a scale that only the US and China surpass1. India is poised to drive about a fifth of global growth in the coming decade.2

While growth has moderated slightly in recent months, the outlook remains strong, driven by many factors including India’s ‘demographic dividend’ (more than half of India’s population is under 30), an expanding middle class and rapid digitalisation.

Meanwhile, from an ESG perspective, the Indian government’s policy commitments around renewables, healthcare, financial inclusion and other sectors, give cause for optimism and present ample opportunities for companies to align with the UN Sustainable Development Goals.

However, India’s economic success has not yet resulted in an improved quality of life for everyone, and gender inequality and labour rights are ongoing areas of concern. Further economic expansion is needed to provide better education and improved healthcare, as well as access to banking services and the internet, to many more millions of people.

Companies face high exposure to climate change risks, both physical and transition, despite very low per capita energy consumption, and governance standards are sometimes lagging Securities and Exchange Board of India (SEBI) guidelines.

Against this backdrop, while the government of Prime Minister Narendra Modi is continuing to push ahead with reforms, it has set a delayed timeframe to achieve net zero of 2070.

ESG: risks and opportunity

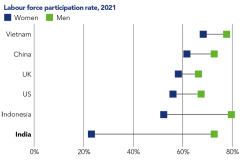

While issues vary by company, at a country level, we consider climate change, water scarcity, labour rights, gender equality and access to basic services to be the most material environmental, social, and governance (ESG) risks and opportunity areas.According to the World Bank and the UN’s International Labour Organization, overall female participation in the workplace is one of lowest in the world (less than 30% in 2021) and declining. India was ranked 140 out of 156 countries by the World Economic Forum (Gender Gap Report 2021) and is now one of the worst performers in South Asia, despite some improvements at senior and executive levels.3

Figure 1: India’s female participation rate lags behind

While some sectors are further advanced on this topic (such as apparel), it is relatively new for others (such as the auto and consumer products industries). Risks of human rights abuses and poor working conditions increase at lower tiers of the supply chain, particularly when sourcing agricultural raw materials and metals. The Global Slavery Index flags that an estimated 8 in 1,000 people in India can be classified as being in the condition of modern slavery, compared to 4 in China, 6.4 in Indonesia and 6.3 in Malaysia. According to the World Bank, 1.7% of children aged 7-14 are involved in child labour (2019).

Despite huge growth that has lifted millions out of poverty, further economic expansion is required to deepen access to essential products and services. Notably, despite fast and widespread digital uptake, internet use in India hovers below 50% according to World Bank data with a marked gender gap (57% of men and 33% of women). This leads to both opportunities and challenges.

More than a fifth of Indians (aged over 15) are unbanked with women particularly affected. Government schemes provide a supportive backdrop, such as an initiative to guarantee a bank account for all, and the Aadhar scheme, which provides unique identification numbers to every individual.

In terms of access to health care, life expectancy at birth has increased from 62 years in 2000 to 70 years by 2020, yet many still lack access to services. All Indian citizens can get free outpatient and inpatient care at government facilities yet underfunding of the state system leads many households to seek care from private providers and pay out-of-pocket.

Climate risks

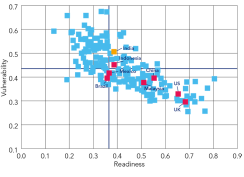

Despite very low per capita energy consumption, India is the world’s third-largest greenhouse gas emitter. India’s economy is closely tied to natural resources such as agriculture, water and forests and is therefore highly vulnerable to increases in temperature. Research shows that with a 2°C to 3.5°C rise in temperature, India’s farmers may lose 9% to 25% of their net revenues, which may decrease the country’s GDP by 1.8% to 3.4%. The Notre Dame GAIN Index ranks India as more vulnerable and less ready than some of its peers (for example China and Malaysia).

Figure 2: India is more vulnerable to rises in temperature than peers

However, despite policies to encourage the transition from coal to gas in various industries (such as the ceramics sector in Gujaret), the government continues to support the use of coal to ensure energy security and meet the fast-growing demand for power as India’s population rapidly increases. India has the second-largest coal pipeline globally and the draft National Electricity Plan4 projects another 26 GW of coal capacity will be installed by 2026-275. (Such priorities need to be seen in the context of a country where millions of people still do not have access to reliable electricity.)

To learn more about 2023 corporate governance trends across emerging markets, read our ESG Materiality newsletter here.

1 Global Emerging Markets Outlook (hermes-investment.com)

2 India takes off? | Financial Times (ft.com)

3 Labor force participation rate, female (% of female population ages 15+) (modeled ILO estimate) – India | Data (worldbank.org). Explained: Why Indian Women’s Workforce Participation Is Still Considerably Low (indiatimes.com).

4 DRAFT_NATIONAL_ELECTRICITY_PLAN_9_SEP_2022_2-1.pdf (cea.nic.in)

5 India | Climate Action Tracker

Disclaimer:

The value of investments and income from them may go down as well as up, and you may not get back the original amount invested.

Investments in emerging markets tend to be more volatile than those in mature markets and the value of an investment can move sharply down or up.

For professional investors only. The views and opinions contained herein are those of the author and may not necessarily represent views expressed or reflected in other communications. This does not constitute a solicitation or offer to any person to buy or sell any related securities or financial instruments.

Issued and approved by Hermes Investment Management Limited which is authorised and regulated by the Financial Conduct Authority. Registered address: Sixth Floor, 150 Cheapside, London EC2V 6ET.