Few people need to be reminded that the economic outlook has become cloudier in recent months. The crisis in the euro area, coming on the heels of the earthquake in Japan, as well as signs of a slowdown in China, have started to seep into real economic activity. Times like these typically bring bad news for equity investors. Earnings surprises may often turn out to be nasty rather than nice. In this setting, how can investors position their equity portfolios?

There are, of course, several ways. But for those who want to maintain exposure to the promise of equity returns, one way we prefer is to emphasize companies that benefit from secular growth trends that are independent of the economic cycle. Companies that develop innovative new or replacement products or that can cash in on burgeoning new markets or trends would all qualify.

Obvious examples include technology firms that create new products as well as new markets for those products. A couple relatively recent consumer favorites include smartphones and tablet computers.

Less obvious, perhaps, are older technologies, like payment cards, which have been around for at least 60 years. Despite their apparent maturity, payment cards continue to benefit from the long-term shift away from cash and checks, particularly in developing countries, where penetration rates are low. We expect global credit card companies to continue to prosper as this process runs its course.

Another example is life insurance, a very old industry in the West. Many years of experience in developed markets suggest that people tend to buy more life insurance as they get richer, and there is no question that many people are getting richer in the developing world today, particularly in Asia. We believe that insurance groups with significant exposure to Asia are well placed to benefit from the life insurance market continuing to grow more rapidly in than in the rest of the world.

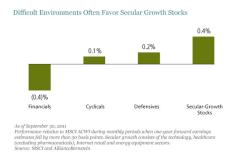

Our research also suggests that secular growth stocks hold up better than other broad categories in periods of weak economic and earnings growth (Display).

It’s hardly surprising that financial and cyclical stocks fare less well during these periods. More interesting, perhaps, is that secular growth stocks have historically outperformed defensive stocks, the classic fallback option in hard times. While secular growth stocks did not outperform defensives amid the sharp spike in risk aversion in recent months, we expect that they will return to form.

So for investors not yet ready to give up on equities, we believe that secular growth stocks should play a key role in their strategy as they face the uncertain markets ahead.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Chris Toub is Director of Equities for AllianceBernstein