Investors with whom we at AllianceBernstein chat often say, “I want equities but not the meltdowns.” On that note, let’s talk about a concept that has gained currency lately: upside-to-downside capture. This concept demonstrates how downside protection can actually drive outperformance.

With traditional safe-haven assets paying skimpy, if not negative, yields, many investors realize that they may have to move up the risk curve to meet their long-term needs, including adding exposure to the higher upside potential of equities.

That’s a troubling proposition for a large and growing swath of investors. Whether an individual saving for retirement, a pension plan facing funding gaps or an insurance company dealing with stiffer capital requirements and asset-liability-matching challenges, investors increasingly need their capital to go the distance — and with as little stomach-churning as possible.

Upside/downside capture offers an answer to this investor quandary. It works on the same math that explains the superiority of the smoother pattern of returns in driving better long-term portfolio outcomes and the paradoxical tendency of less volatile investments to outperform the market over long horizons.

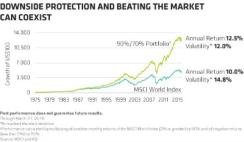

An investment that loses less in market downturns has less ground to regain when the market recovers — and is better positioned to compound off that higher base in subsequent rallies. Upside and downside capture is another way to measure this phenomenon. As with those other gain-by-not-losing cases, its workings can seem counterintuitive. Imagine a hypothetical global stock portfolio with a 90-to-70 percent upside-to-downside capture ratio — meaning that it captured 90 percent of every market rally and fell only 70 percent as much as the market during every sell-off. What would the long-term returns of such a portfolio look like?

You’d be forgiven for thinking that it underperformed. But, as the chart illustrates, this smoother-ride portfolio amassed a capital balance of nearly $13,000 over the period examined—or more than 2.5 times the size of the MSCI World Index’s. And it did so with significantly lower volatility.

In our view, achieving a 90-to-70 percent upside-to-downside capture ratio comes as close to investing Nirvana as one can find: getting downside protection and still beating the market over the long term.

Herein lies the rub: This performance potential doesn’t come for free. To get the full benefits of this approach, investors must accept that this strategy’s performance will, by definition, veer significantly from that of the market. Indeed, the tracking error of the hypothetical upside-to-downside capture portfolio was an annualized 3.1 percent over the period covered in the chart. That’s easy to overlook when the portfolio is outperforming in a crumbling market. The true test comes when it’s trailing during a roaring market rally. Investors must keep their eye on the long-term prize.

Here’s another reality: Striking the optimum 90-to-70 percent upside-to-downside capture ratio takes skill. That’s why we believe that closely and frequently examining the business models and fundamental traits of high-quality, less-volatile companies — that is, those with high and sustainable cash flows and healthy balance sheets — while remaining vigilant on valuation is the way to build a winning portfolio.

Kent Hargis is portfolio manager of strategic core equities, Chris Marx is portfolio manager of equities, and Sammy Suzuki is portfolio manager of strategic core equities; all at AllianceBernstein in New York.

See AB’s disclaimer.

Get more on equities.