A complex market environment comprised of diverging interest rates, fluctuating commodity prices and unpredictable growth rates in both developed and emerging markets has pushed official institutions to become more agile and flexible.

Two years ago, organizations were considering new strategies in the wake of increased regulation and a challenging investment environment. In a 2014 State Street survey, we found that despite concerns about the challenges associated with new markets and asset types, 80 percent of official institutions expected to increase their exposure to new markets and, when institutions have the appropriate mandate, to alternative assets.

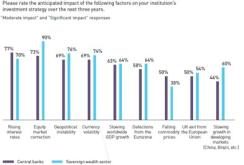

Now central banks, sovereign wealth funds and government pension funds are attempting to secure the returns they need in a climate in which they anticipate an impact from a number of factors (see chart).

A select group we call NIMBLE institutions — distinguished by six measures of organizational agility — is gaining a clear performance advantage in the face of an uncertain market. According to our new official institutions research, conducted by Oxford Economics, “Transforming to Meet the Needs of a New World,” they are pursuing a more dynamic investment approach, diversifying their portfolios by adding exposure to regions like Asia-Pacific and by looking at new strategies, such as environmental, social and governance (ESG) investing, to generate higher returns.

Faced with fundamental challenges to their investment strategies, NIMBLE organizations are more likely to identify themselves as being able to do the following:

Network, collaborate and create ad hoc teams for flexible working.

Investigate and react quickly to investment opportunities. Diversification is among the priorities of NIMBLE institutions to take advantage of opportunities in new markets or investment strategies, such as ESG, to help bolster returns.

Mix internal and external talent to meet business needs. NIMBLE organizations understand they need the right skillsets within their own four walls. But they also know that not all can be accomplished without capable outside managers to support and help develop their business.

Build adaptable business processes that respond to business priorities. Flexible processes that support all other measures of becoming a NIMBLE institution are imperative to easily take advantage of new opportunities or to correct course.

Learn continuously through a culture that promotes development. Nearly all NIMBLE institutions say they foster a culture of curiosity, entrepreneurial spirit and growth to respond successfully to a rapidly evolving industry and heightened market volatility.

Execute effective technology upgrades to support operations. The need for technological agility should be high among a company’s priorities.

A NIMBLE culture is affected less by an institution’s type, size or location and more by results stemming from conscious management action and investment decisions in three areas: risk management, technology and talent.

Risk management. Institutions that were found to be NIMBLE are the ones upgrading their approach to risk. In fact, about 75 percent of the institutions in our research say they have changed their approach to managing investment risk in the past three years — 20 percent more than other official institutions. They are continuing to improve their risk portfolio: 79 percent report expanding scenario modeling; 74 percent are increasing portfolio diversification, using derivatives and engaging in risk factor analysis; and 58 percent are engaging in currency-hedging strategies to better manage investment risk.

Technology. Priorities for NIMBLE institutions include investing in advanced information management techniques to better manage data and the associated risks. Over the coming year, strengthening cybersecurity and data warehousing are at the top of NIMBLE institutions’ to-do lists. Other institutions, in contrast, rank higher in prioritizing hiring or training more advanced technology capabilities in house and integrating performance and risk analytics.

Talent. Building new capabilities is critical in a time of increased volatility, which requires advanced skills and knowledge. NIMBLE institutions are more likely to prioritize upgrading talent in key areas of their organizations, with data management and analytics, investment and governance as the priority areas. In contrast, they are far less likely to prioritize risk and compliance, perhaps because they have already made the necessary investments in this regard.

With uncertain economic times come both threats and opportunities. Pro-active decision making is integral to overcoming such hurdles. The institutions that do so will be the ones poised for long-term success.

Jessica Donohue is chief innovation officer and head of advisory and information solutions for State Street Global Exchange in Boston.