The U.K.’s Financial Conduct Authority released a scathing report earlier this month on the state of the country’s asset management industry, concluding that the £6.9 trillion ($8.6 trillion) business has failed its investors. The interim regulatory review — the first such report, with the final due to be published in the second quarter of 2017 — criticizes how effectively the U.K.’s asset management industry has served retail and institutional investors. Here are five of the biggest findings:

1: Asset Managers Reap Outsize Profits

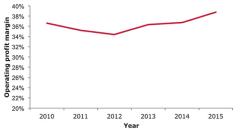

The FCA took an in-depth look at charges, costs, and profitability at U.K. asset managers. Based on data from 16 firms, it calculates an average profit margin of 36 percent over the past six years. Retail clients had a higher edge in profit margins, in part because of either less competition in the retail market or winning institutional business at a lower margin, the report finds. Larger firms’ revenues rose with assets under management, encouraging managers to become asset gatherers at the potential cost of performance, the FCA says.

“They do so at a slower rate with larger firms typically making larger profits,” the report notes. The FCA also compared asset management’s profitability with that of other industries and found it second only to real estate, with a 16 percent average profit margin for the FTSE All Share.

Average operating profit margin

2: Investment Consultants Are Conflicted and Face Investigation

The report heavily scrutinized U.K. investment consulting firms, finding that the three largest firms — Aon Hewitt, Mercer, and Willis Towers Watson — had a combined market share of about 60 percent in 2015 but notes that small- and medium-size firms are gaining ground. One concern is the gift culture in the investment consultancy sector, which the FCA says could influence manager ratings. This includes asset managers purchasing services (investment conferences, data, and investment consulting) from consultants. The FCA says it will examine these situations more fully in the future.

In light of such findings, the FCA proposes developing what it calls a market investigation reference to the U.K.’s Competition & Markets Authority (another regulatory body) on the institutional investment consultancy market; it recommends further regulation.

For Andy Agathangelou, founding chair of theTransparency Task Force, an industry group dedicated to increasing transparency in the pensions industry, this is a potential game changer for U.K. investment consultants. “The way the institutional market uses investment consultants will change substantially,” he says. “The FCA would not make a referral to the CMA unless it thought that there is a serious market failure.”

3: Feedback Wanted on Confidentiality and “Most Favored Nation” Clauses

The FCA reports a lack of transparency on segregated mandate costs, particularly for transaction fees, annual management charges, defined contribution products, hedge funds, private equity, and fiduciary management. Because only headline charges are publicly disclosed in the institutional market, it is difficult for asset owners to benchmark costs, the FCA says.

4: Active Managers Don’t Outperform or Compete on Price

Tracking error against OCF for clean equity

share classes over 2013-15

Not only do active managers fail to outperform relevant benchmarks after costs, the report notes, but about £109 billion in active funds are considerably more expensive than passive funds. For institutional investors, outperformance after fees has not been significantly different from zero, based on 2003–15 data provided by industry tracker eVestment.

The report contends that both retail and institutional investors place too much emphasis on past performance. Although there has been limited price competition among active managers, asset management charges have not changed significantly over time, the FCA says: “Clustering of prices appears to be a feature of the asset management industry.”

At present, passive investing has a market share of about 20 percent in the U.K. Active managers stand to lose market share if the U.K. follows the U.S. and moves toward a 50-50 split between active and passive investing, Agathangelou says. Pension funds and consultants will come under greater pressure to justify the use of active managers, he predicts.

5: Institutional Investors Can and Should Obtain Lower Fees

Reducing manager fees is always a popular idea among asset owners, and the FCA report supports this, citing recent changes in the U.K. local authority pension fund sector as a good example of how pension funds can achieve significant cost savings by pooling their assets.

“Since the end of 2005, the total number of pension funds in the Netherlands has dropped from 800 to 365, and this trend does not show any sign of slowing,” the report states.

On fee negotiations, the report says, investors have to be persistent: “When trying to negotiate on prices, asset managers will initially refuse to negotiate, but will do so when pushed.”

What the FCA’s Dressing-Down Means for Asset Management

Though asset managers’ initial reaction to the FCA report has been measured — echoing Standard Life Investments’ comment that it “supports the aims of the Market Study and is committed to improving transparency, value and outcomes for clients and customers” — it is likely a different story behind the scenes, with firms prepping a round of lobbying to impress upon government ministers that asset management is a vital part of the U.K.’s service economy, that attacks on it will discourage saving and investment, and so on. Meanwhile, there has been deafening silence from the investment consulting firms, which must be considering their response to a very strong challenge to their business model and reputation.

In any case, the FCA has made clear that it thinks the U.K. asset management industry has a long way to go in terms of how well it serves its clients — and how much it charges for the work it does. Agathangelou points out that despite a large number of firms operating in the market, the industry has enjoyed sustained high profits over a number of years. “This does seem to indicate the FCA have concluded that market forces are not functioning effectively,” he says.

Matt Craig is the European Content Director for the Investor Intelligence Network, Institutional Investor’s private community for asset owners.