AQR Capital Management co-founder Cliff Asness says hedge funds are “petering out,” but the persistent benchmarking of their performance against the Standard & Poor’s 500 index is distorting the picture.

Hedge fund performance looks like an “epic disaster” when analysts make fallacious comparisons to S&P 500 gains since the 2008 financial crisis, Asness said in a May 31 blog on the AQR’s website. “Comparing hedge funds to 100 percent equities is flat-out silly,” he wrote, because, as the name “freaking” suggests, they make investments that are at least partly hedged.

While railing against the tendency of pundits to criticize hedge funds based on “incorrect analysis,” Asness said he’s not trying to “rescue” the industry from criticism over disappointing returns over the past nine years. Since the early 2000s, hedge funds have evolved to look more like active mutual funds doing traditional stock picking — but with higher fees, according to his blog.

“It’s not just their returns that have gotten more pedestrian, but the actual strategies they employ have as well,” Asness wrote. “This is different from, and more concerning than, say, still relatively unique strategies just having a poor period.”

[II Deep Dive: For Hedge Funds, Smaller Is Better, Study Finds]

Hedge funds should be different from equities, and have historically delivered equity exposure — or “beta” — of just under 50 percent, according to his blog.

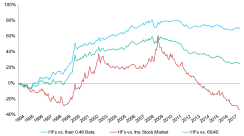

With this in mind, the AQR co-founder looked at how long-short equity hedge funds have stacked up against the stock market and a traditional portfolio consisting of 60 percent equities and 40 percent bonds. He compared these results to their performance relative to a 46 percent exposure to stocks — the proper way of judging the industry, he argued — and found that hedge funds “handily outperformed their exposure to the market” over a more than 20 year period.

Still, Asness acknowledged that the industry’s performance is a “big disappointment,” with hedge funds failing to add enough value to cover fees during the bull market. “Treading water” net of massive fees is hardly a marketing line that will attract investors to a fund, he wrote.

“This is far less extreme than the commonly reported epic disaster of hedge funds destroying many billions of dollars of their clients’ money,” he wrote. “But it’s still not very good.”