With a viral pandemic, quarantines, a global economic shutdown, and furloughs of non-federal workers, it certainly seems as if where we are going, there are no roads. With global central banks rapidly deploying balance sheet to ease a liquidity strained market, and a US Federal Reserve Bank (Fed) balance sheet likely to hit $10 trillion, we are seeing stimulus of a 1.21 gigawatt magnitude. Sadly however, I’m fairly certain not even the flux capacitor could bring us back to where we were in January.

Though we’ve seen global financial crises before, this one certainly feels different. First of all, is it really just a “financial” crisis? Let’s start there.

Entering this year, economically speaking, we were already late cycle, but not in the same way as in 2008. Following the last financial crisis, there was heavy regulation of the banking system, material consumer protectionism, and heavy regulation of mortgage lending and securitization. As such, the consumer felt much better positioned from a debt (or leverage) perspective. The limited re-leveraging of the consumer contrasted sharply with the expansion and quality deterioration in the corporate sector. However, for the consumer, wealth inequality has been increasing, and with it a profound difference between a prime consumer (one that owned a house and had seen more income stability), and the more leveraged or the non-prime consumer (with subprime auto loans, installment debt and student loans).

We see here in Figure 1, the evolution of the increases in mortgage and real estate delinquency rates, and their recovery to pre-crisis levels.

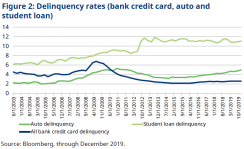

Next, we illustrate the contrast between the recovery seen in the prime or “bank card” credit card delinquency rates, which remain low versus the high and rising auto delinquency rates and the student loan delinquency rates, which are already above levels seen in 2008-2009. The difference between “prime” and “not prime” has been a factor in our investment allocations well before this recent dislocation.

So is this just a liquidity crisis, or is it a solvency, crisis?

There is now a massive exogenous shock to the economy. The speed with which economic activity has arrested is astounding. With the yield machine having fueled itself with the plutonium of debt (leveraged loans), we have very real concerns about the ability of more leveraged sectors, borrowers and corporations, to last through a period of decline. The growth of leverage has created a different subset of problems that, at worst, may need a different playbook. At best, it will have a much different impact on the market if the timing to resolution is longer, as the presence of leverage, increases sensitivity to change and reduces “staying power”. Built to last cash flows are critical in an environment of uncertainty. No one should want to be too dependent on a recovery path in an environment that is not likely to be well referenced to another period in history.

Indeed, the first symptoms we saw in March were those of a liquidity crisis, including “cash hoarding”. These “symptoms” were so significant they rendered markets, from Commercial Paper to Agency MBS, dysfunctional. Central banks have responded with massive injections of liquidity, interest rate cuts and QE, a so-called, “bazooka” or “double down and all-in”. As well, the government has responded with massive fiscal stimulus programs (CARES Act). But, implementations take time, and problems are likely well beyond simply “liquidity”. We have credit problems of a magnitude that will significantly impact employment and they will test the consumer. This is where leverage is relevant. A lower leverage consumer, or business, will have a longer time frame to abide and navigate a decline in cashflow. In a market where timing is very uncertain, this underscores the importance of looking for this reduced sensitivity.

If companies have more leveraged balance sheets, they have a shorter runway, and can no longer withstand months of economic slowdowns, let alone stoppages. Support for businesses from the fiscal package will be a government-driven effort in picking winners and losers, but ultimately winners and losers will come down to leverage.

’Furlough’ will likely be the most popular google search in the coming days and weeks. The impact of ‘temporary unemployment’ is at best, uncertain and at worst likely to have a longer lasting impact on the consumer psyche: confidence, spending, saving, all of these consumer aspects are quite important economically speaking. While most expect several quarters of an economic downturn, the certainty around that projection is low, and this could be a much longer downturn depending on the medium-term destruction of jobs. Like corporations, or pensions, cash hoarding is not uncommon, even for a consumer. If you are uncertain about your employment, you may not make a payment on your mortgage, or your car, “just in case”. Moreover, spending is likely to be curtailed and savings is likely to go up, this can have a more lasting impact on markets. Consumer sentiment is dropping, and likely to fall more than in 2008-2009.

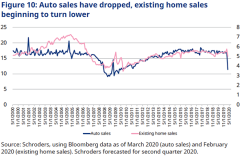

What has happened so far:

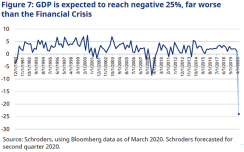

But the projections are eye popping:

Securitized credit: 2

This is why we say: ‘Where we are going, there are no roads’.

In looking, not back, but forward to the future, we would characterize the economic outlook as highly uncertain. That we have a serious recession on our hands, is not in doubt, But the depth and length of this recession is, in my view, very challenging to predict with accuracy. No one is a virus expert, nor is anyone likely to predict the impact of fear and quarantine on consumer behavior. So what do we do?

We combine the truth of Tyson (Mike) and the wisdom of Eisenhower (Dwight) into the ’atomic throw’ of analogies.

“Everyone has a plan until they get punched in the mouth” – Mike Tyson

“In preparing for battle I have always found that plans are useless, but planning is indispensable.” – Dwight D. Eisenhower

Planning is indispensable: Where we are going we don’t need roads, we just need to think in phases.

![]()

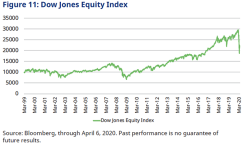

With any new crisis, the steps or phases can be highly variable in terms of length. While selling and overshooting took four to six months in 2008, it seems to have taken about three weeks this time around. Can that be true?

Navigating the steps in an uncertain environment

What is not uncertain is that we will have a recession and reconciliation of markets. It is, however, the depth, the timing and the pattern of this cycle that are highly uncertain variables. Given the uncertainty, we believe there are several critical aspects of investment strategy that should be a central focus.

- Flexibility is key. Opportunities will change as we progress through the phases of the cycle. The most attractive opportunities can be rare and impermanent. These are often asymmetric opportunities with limited downside and attractive upside and they can be promulgated by aligning with the largest balance sheets, such as the Fed, or through critical government programs such as the Term Asset-Backed Securities Loan Facility (TALF), or through forced selling, where leveraged hands cannot hold even their better-quality cash flows. Or even later in a cycle, when more information is known, and when defaults are priced in, there will be the distressed opportunities.

- The lens with which one looks for opportunity must be suitably wide. This is not the market for a single silo. Opportunities, even those driven by regulation, can often take different forms, or structure, for example securities or loans or funds.

- Conviction is an essential component for investors in a dynamic market. Without it, it can become difficult to move. Building conviction means finding cashflows that are more certain in the scope of the current information, and have a required tolerance to variability. Hope is not a strategy and in a market like today’s, the parameters related to the range of possible outcomes, or expectations, must be widened. Being right on your base case is unlikely, being tethered to that sort of analysis does not work in an uncertain environment.

Standing before a precipice is often a breath-taking and challenging moment, and surely we have all felt, in different ways, the swerve to the edge over the last few weeks. It is the “everything has changed, right now” moment and at these moments, that change feels quite permanent. Only time will tell how much will change, and how much will be ingrained as we move forward together, but in these moments the tendency is to be overly dark, or overly light.

Overly dark: we will never go to restaurants, movies, hotels or work in offices, ever again. Working at home with a spouse, three kids, and a dog, it’s a real treat.

Overly light: anytime the index is over 900 OAS, you always win. It sure looks cheap at $80. $80 is cheap if the value returns to par, not if it goes to $0

It is because of these swings in sentiment, or psychology, or opinion, that we have a market in the first place. Within it, opportunities can be created, even opportunities that allow for us to factor in, or price for, a wide range of possible variability.

Final thoughts

At its heart, leverage is a part of every crisis. This can be borrower leverage, corporate/operating leverage, asset leverage, or even financial leverage. It is important to understand where the leverage is within markets, and the course its reconciliation will take. Leverage can impact staying power, and with uncertainty, and today you likely want the luxury of time to allow for variability.

The intersection of fundamentals, structure and valuation help us navigate different degrees of uncertainty. With strong positives in fundamentals, structure AND valuation, cashflows can tolerate a greater amount of variation and become built to last. Built-to-last cash flows are like the boxer in the ring that can take a number of chin shots and remain standing.

This is what is necessary and desirable given the range of potential outcomes that are possible as we look to the future.

We believe there are securities that currently offer the type of “uncertainty” protection that is desirable, while still retaining upside to the eventual recovery. These are more likely to be found either where the government is assisting private capital, through leverage, to aid in the recovery, like TALF, but also in areas where there is like both a dislocation and fundamental or structural support, such as in mortgage securities, that have seen liquidity driven selling and forced selling. This is an asset, that is not just a “risk on trade”, but one that represents a risk-managed exposure to the extent markets need more than a spoon full of sugar to help the medicine go down.

So, while we are going where it feels there are no roads, we can still cut the trail. Understanding that uncertainty need not create paralysis, nor should it result in rash bet making, or blind faith in old “rules of thumb”. Maintaining an awareness for when uncertainty rises and falls is critical, and understanding that even through these phases opportunities with conviction can be identified though an examination of fundamentals, structure and valuation.

1 Reference “Securitized Credit: The best offense is a good defense” January 2019.

Schroder Investment Management North America Inc.

7 Bryant Park, New York, NY 10018-3706

For more information please visit our website at www.schroders.com/us/institutional.

@SchrodersUS

Important information: The views and opinions contained herein are those of the authors and do not necessarily represent Schroder Investment Management North America Inc.’s (SIMNA Inc.) house view. Issued April 2020. These views and opinions are subject to change. Companies/issuers/sectors mentioned are for illustrative purposes only and should not be viewed as a recommendation to buy/sell. This report is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for accounting, legal or tax advice, or investment recommendations. Information herein has been obtained from sources we believe to be reliable but SIMNA Inc. does not warrant its completeness or accuracy. No responsibility can be accepted for errors of facts obtained from third parties. Reliance should not be placed on the views and information in the document when making individual investment and / or strategic decisions. The opinions stated in this document include some forecasted views. We believe that we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee that any forecasts or opinions will be realized. No responsibility can be accepted for errors of fact obtained from third parties. While every effort has been made to produce a fair representation of performance, no representations or warranties are made as to the accuracy of the information or ratings presented, and no responsibility or liability can be accepted for damage caused by use of or reliance on the information contained within this report. Past performance is no guarantee of future results.

SIMNA Inc. is registered as an investment adviser with the US Securities and Exchange Commission and as a Portfolio Manager with the securities regulatory authorities in Alberta, British Columbia, Manitoba, Nova Scotia, Ontario, Quebec and Saskatchewan. It provides asset management products and services to clients in the United States and Canada.

Schroder Fund Advisors LLC (SFA) markets certain investment vehicles for which SIMNA Inc. is an investment adviser. SFA is a wholly-owned subsidiary of SIMNA Inc. and is registered as a limited purpose broker dealer with the Financial Industry Regulatory Authority and as an Exempt Market Dealer with the securities regulatory authorities in Alberta, British Columbia, Manitoba, New Brunswick, Nova Scotia, Ontario, Quebec, Saskatchewan, Newfoundland and Labrador. This document does not purport to provide investment advice and the information contained in this material is for informational purposes and not to engage in a trading activities. It does not purport to describe the business or affairs of any issuer and is not being provided for delivery to or review by any prospective purchaser so as to assist the prospective purchaser to make an decision in respect of securities being sold in a distribution. SIMNA Inc. and SFA are indirect, wholly-owned subsidiaries of Schroders plc, a UK public company with shares listed on the London Stock Exchange.

Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY 10018-3706, (212) 641-3800.

WP-SC-NOROADS