Since 2016, a Japanese publication for institutional investors, AL-IN, has periodically surveyed Japanese corporate pension funds to determine what products best serve them as they confront structural and market changes. The 2018 edition of the survey found pension funds preparing for a domestic economic downturn. Income gains were already slack and pension funds sought bond-related and low-liquidity assets to cover the shortfall. Since then, investment and financial markets have been defined by the U.S. Federal Reserve’s shift in monetary policy from tightening to easing and the worldwide economic freeze due to COVID-19. “Survey of Pension Product Supply and Demand 2020” asked how Japanese corporate pension funds have adjusted their product mix in response. Data was collected from 136 respondents.

Assumed interest rates and risk levels

Over the last several years, most Japanese pensions made gains on the back of a relatively strong market, until COVID-19 delivered an unprecedented and sudden blow to stock markets worldwide. Pension funds were not unscathed by the coronavirus crisis, but damage was mitigated by earlier reductions in portfolio stock ratios.

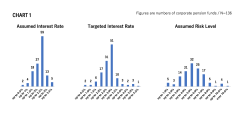

Overall, survey respondents indicate a volume zone of assumed interest rates of 2.1% – 2.5% and a volume zone of target interest rates of 0.5% above the assumed rate. The average assumed rate is 2.23% and the average target rate is 2.64%.

As shown above, the level of assumed risk in investment portfolios is distributed in a mountain-like pattern, with a peak in the 4% range. Compared to the previous survey, the number of risk-taking respondents with a risk tolerance at about 10% decreased, and the majority of respondents fall within the center of the mountain. The number of respondents with an assumed risk in the 5% range peaked at 27 in the last survey, while this year's figure decreased slightly to 25.

The survey then looked at policy asset mixes (PAM) and asset class adoptions within each asset class in pension portfolios. Asset classes include domestic bonds, foreign bonds, global bonds, currency-hedged foreign bonds, domestic equities, foreign equities, global equities, alternatives, general life insurance accounts, multi-assets, short-term funds, and others.

The number of pension funds with global bonds in PAM increased by 10.7 points to 25%, while global equities increased by 8.5 points to 21.1%, compared to the previous survey. As more funds embraced global bonds, the proportions of both domestic and foreign bond holdings decreased, with the decline in domestic bonds being distinct at -11.8 points. Similarly, the share of foreign stocks decreased significantly by -7.8 points as the allocation to global stocks increased. Increasingly, pensions recognize that portfolios relying solely on the four traditional assets can no longer deliver.

Multi-asset strategies now account for 27.3% of PAM and 34.4% of portfolios, suggesting such strategies have acquired a certain status among domestic pension funds. While the 2018 survey indicated pensions were accumulating short-term funds, the 2020 survey showed them shedding those funds by about 10% in both PAM and investment portfolios.

Some pension funds further categorize “other” asset classes according to their risk-return levels into safe assets and income seeking assets, rather than into specific asset classes. Pensions with this type of classification are more prominent than in the previous survey, suggesting that more and more pension funds are moving away from traditional portfolios.

Ratio averages for each asset in the PAM and investment portfolios give a general idea of allocation trends, and there was no significant change from the previous survey. Average domestic bond ratios are 30.9% in the PAM and show a slight increase to 26.8% in the actual portfolio. Average equity ratios are unchanged with domestic, foreign, and global equity ratios in the low 10% range. The equity ratio has been reduced as much as it can be, which had a significant impact on last year's investment performance. (More on this later.)

Survey respondents also selected pension fund management issues they want to see addressed.

“Considering asset allocation in light of the low interest rate environment” and “Considering alternatives to bond assets” were chosen by more than 50% of respondents in 2018. In the June 2020 survey, 57% of respondents chose “Considering asset allocation in light of the low interest rate environment,” representing a slight increase. While pensions continue to weigh alternatives to bond assets, a fair number have already divested from bonds in favor of alternative assets, which is reflected in the nearly 10-point decrease in “Considering alternatives to bonds,” down to 43.0% in the 2020 survey from 52.9% in 2018.

Addition of ESG

ESG investment was added to the questionnaire based on the growing appreciation and demand for sustainable investments. Respondents clearly recognize the importance of prioritizing ESG, as it received the second highest percentage of votes, 44.5% or 58 responses. Pensions cite adoption of ESG passive funds as one specific measure to promote ESG investment.

“Downside risk management” dropped (44.5% in 2018, 16.4% in 2020) as a priority compared to “Considering alternatives to bonds.” Between the 2018 survey and the recent pandemic shock, the market underwent several mini-crashes, during which pension funds took steps to insulate themselves from damage.

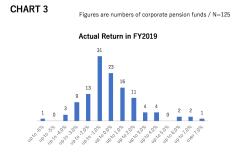

As shown above, actual returns in fiscal 2019 were negative for 78 or more than 60% of corporate pensions. Thirty-one pensions reported returns in the -1% range, and 23 pensions suffered losses between -1% to 0%, accounting for nearly 70% of total negative results. Many pensions saw their investment performance dip into negative territory, but the extent of the declines was less than market clamor would suggest, likely due to prior reductions in equity ratios and promotion of downside risk measures. Stock markets plummeted in the wake of the pandemic shock, but the low share of stocks pension portfolios lessened the impact on pension funds.

Learn more about Japan’s funds research.

Investment products

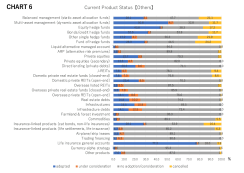

In Part 2, we look at the market for products. The survey included 57 investment products offered to domestic pension funds based on investor demand and supply by asset management companies. The products were placed into three categories: bond/credit, equity, and others. Respondents were asked whether they have adopted, are considering adopting, or are planning to increase/decrease allocations for each product.

The survey revealed: 1) increased diversification in the fixed income/credit category; 2) more respondents adopting or considering adopting assets from a wide range of asset classes, including ESG investments and low-liquidity debt products.

▪ Bond & Credit Products

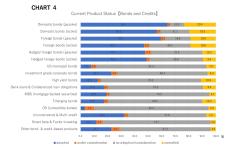

In the 2018 survey, domestic and foreign bonds (both actively and passively managed) accounted for a high proportion of the total. However, the June 2020 survey indicates their dominance is waning, as shown above. No bond product has seen a significant increase in adoption or consideration, which suggests that funds are flowing to other assets and confirms the decline in the number of pension funds considering bond alternatives.

In this year’s survey, the number of bond and credit products considered for adoption has decreased. In 2018, relatively new products were considered, unconstrained and multi-credit, and smart beta and factor investment funds were the most popular among bonds and credit-based assets at 11.8%. The percentages for those products slumped in the 2020 survey to 3.1% and 4.7%, respectively, but not because of a significant increase in adoption.

Among bond and credit assets, convertible bonds (CB) enjoy increasing demand, with 7% of pension funds considering them for adoption. Excluding other bond and credit-based products, the percentage of non-CB products under consideration is less than 5% across the board. Following the pandemic shock, the world is heading toward even lower interest rates. Such an environment makes it difficult for pensions to adopt or consider bonds and credit products.

While there is no significant jump in the number of products investors plan to use compared to the previous survey, the number of products considered for reduction has decreased overall as well.

Among bond and credit assets, passive domestic bond products continue to show a significant downward trend, but the trend has become more gradual (33.0% to 26.1% to 15.6%). This suggests a significant percentage of pensions have reduced their holdings in these products.

On the other hand, hedged foreign bond funds (both actively and passively managed) are most under consideration for an increase (passive10.9%, active 10.2%). It is interesting to note that fewer respondents are planning to reduce the funds than in the previous survey (passive 6.7% to 2.3%, active 11.8% to 3.9%). This may be due in part to the downward trend in hedging costs as the gap between domestic and foreign interest rates has narrowed.

▪ Equity-based Products

Increase in actively managed global equities and ESG

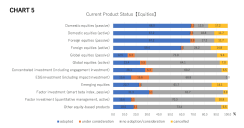

As with bond and credit products, the adoption of equity products – whether domestic, foreign, passive or active – declined by 5 to 10 percentage points each. Against this backdrop, there was some increase in the adoption of actively managed global equities, which rose to 23.4% from 21.8% in the previous survey. This may be due to more pension funds leaving the traditional framework and switching to global equities on PAM.

Particularly noteworthy is the growth in ESG investments (including impact investments). The adoption rate for ESG product was only 7.6% in the previous survey, but it more than doubled to 15.6% in the 2020 survey. This is evidence that ESG investment is gradually penetrating domestic pension funds and continues to be the most popular equity-based product considered for adoption, albeit at 15.6%, down slightly from 17.6% in the previous survey. Many pensions listed the promotion of ESG investment as an issue, and that acknowledgment is probably reflected in their product adoption and consideration.

As for planned increases in investment amounts, active products outperform passive products among domestic, foreign, and global investments. In particular, actively managed investment in foreign stocks is the second most popular choice after ESG investment.

Interestingly, the same is true for planned reductions. Actively managed investment in domestic stocks is the only category with a double-digit decrease expected among equity-based products.

The most prominent target for increases is ESG investment, with 23.4% of respondents planning to up their investment.

▪ “Other” products

Among bond alternatives, the increasing focus on the use of private assets to obtain yields stands out in the latest survey. Many assets have seen greater adoption, indicating continuous strong need for “other” products.

Direct lending, which provides investors with many traits they’re familiar with in bond and credit products, has seen a significant (to 20.3% from 14.3% in the previous survey) increase in adoption over the past two years. Among real estate-related products, domestic private REITs remain as popular as ever, but adoption has increased for most other products as well. Overseas real estate, in particular, continues the trend that caught attention in 2017-2018.

The adoption rate of open-ended overseas real estate funds grew from 5% in 2017 to 10.9% in 2018, to 14.1% in this year’s survey, and the rate of funds under consideration went from 6% to 9.2% to 8.6%. The adoption rate of closed-ended funds fluctuated from 2.0% to 1.7% to 5.5%, and the rate of those under consideration went from 6.0% to 5.0% to 7.8%. Open-end real estate funds have been the most popular, but closed-ends are getting attention as well.

Infrastructure, a typical low-liquidity asset, has seen a similar increase in the adoption rate. Although there was no significant change between 2017 and 2018 (12.0% to 12.7% adopted, 13.0% to 9.2% under consideration), in the latest survey 19.5% of respondents reported adopting infrastructure-related assets and 10.9% reported such assets under consideration. This shows that adoption has increased, and demand remains strong.

The figures for planned increases indicate upward movement in demand for low-liquidity assets. In particular, private equity is gaining in popularity, ranking high along with secondaries. Many respondents said they plan to increase their exposure to direct lending and debt products such as real estate debt and infrastructure debt.

Insurance-linked products (e.g., CAT bonds and other non-life insurance products), confronting a series of major natural disasters around the world, are the only other products with more than 10% of respondents planning a reduction. There are few plans to increase these products, and the situation is challenging.

The number of pensions planning to increase their exposure to equity hedge funds fell in the current survey (12.6% to 4.7%), while many investors indicated their intention to increase in the previous survey. Further, few investors plan to increase holdings in other hedge fund-related products.

On the other hand, many investors still plan to increase multi-asset products (12.6% to 13.3%). Among “other products,” multi-asset strategies and low-liquidity assets will likely continue to be popular.

Lastly, survey respondents were asked what they considered important when considering a product.

As in previous surveys, the factors deemed most important include “return risk in line with the expected interest rate,” “resilience to downside risk,” “stability of performance,” and “stable income.”

The survey also asked about ESG factors, and the results show that the percentages for “important" and “unimportant” were close to one another. Few respondents said ESG factors are not very important to them, despite their adoption needs.

Overall, the demand for low-liquidity assets remains high, and the market is dominated by products from asset management companies who respond to the need. The ESG market, which has been in the spotlight in recent years, seems to be gaining further momentum. Additionally, having experienced a number of market fluctuations since the 2008 financial crisis, including mini-crashes, Japanese pension funds seem to be building a resilient portfolio capable of withstanding shocks such as the that generated by the COVID-19 pandemic.

Gain more insights into Japanese markets