Retirement has taken on a new meaning. Before the COVID-19 pandemic, stopping work entirely was already starting to look like a thing of the past. Post-COVID, stopping work entirely may be even harder for many workers in the U.S. and around the world. People worry about having enough money for retirement – and, indeed, are more stressed about money than anything else in their lives. Some American workers, now in the prime of their earning lives, were caught up in the transition from defined benefit pensions to defined contribution (DC) plans and had new retirement responsibilities thrust upon them. Others have never heard of an old-school pension, but according to new research they desire the certainty such plans provided.

In short, retirement is a moving target for workers today, as revealed in People & Money 2020, a survey of nearly 27,000 people in 18 countries, conducted by BlackRock. The good news is that the DC industry isn’t just sitting back and doing nothing. The challenge, now identified, is accepted, and the quest for solutions is well underway. The findings, takeaways, and applications of the sentiments and data derived from the research are the subject of this report.

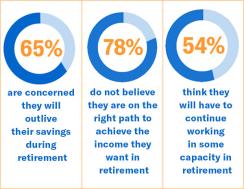

Big Numbers*: Participants in the People & Money 2020 survey say…

*All data in this report is from People & Money 2020 (BlackRock)

No matter the situation, everyone is concerned about outliving their savings in retirement.

- 37% globally have not started saving for retirement.

- 32% say that running out of money in retirement poses the greatest risk to their financial future.

- 55% are concerned about running out of money.

- 44% are concerned about maintaining their standard of living.

The data in People & Money 2020 is global, but the U.S. story differs somewhat from the rest of the world. Here are some highlights regarding Americans.

How would you sum up the findings in People & Money 2020?

Tiffany Perkins-Munn: People & Money is BlackRock’s flagship research, and it helps us understand the relationship people have with money. Our purpose as a company is to help more and more people experience financial well-being, so it’s important to regularly take a reading on their feelings about money because it’s always changing. People have a lot of issues with money, and that can translate into unwise decisions – or even feeling catatonic, in a way – when it comes to making financial decisions. As a result, people are ill-prepared for retirement and are forced to reframe what it means to be retired. To some, this means continuing to work as a normal part of retirement. In general, I don’t think people are currently in a good place mentally and emotionally when it comes to planning and readiness for retirement. The future looks more hopeful, however, because people are making significant strides toward being better prepared for retirement.

Did anything in that turned up in the research surprise you?

Perkins-Munn: I was surprised that money was considered more of a stressor than family. I thought that with GenXers having to raise and educate their own kids, and nearing the point where they might have to take care of their Boomer parents, family would be the top stressor. However, both family and money have major implications for retirement.

Matt Soifer: We work with both finance and HR professionals in the DC field. Right now, our partners on both sides of that coin are spending a lot of their time on well-being – especially in the middle of the COVID-19 pandemic. A natural extension of physical and mental well-being is investing time in financial well-being. That makes sense, because as Tiffany just noted, money is the top stressor. Research makes it clear that many people don’t know how to invest, are concerned about saving, and don’t know how to spend money – which is why they have no confidence that their money’s going to last them for the rest of their life. That’s something we need to wrap our heads around in the DC industry – we have to bridge accumulation and decumulation in a way that generates confidence.

What do you make of the idea that people feel they can’t retire in the traditional sense of not working anymore?

Perkins-Munn: It’s a good question. Is part of the reason that GenXers, for example, envision a version of retirement where they are going to continue working in some fashion is that they aren’t currently properly prepared? Or are they just starting to rethink and reimagine what retirement is? GenXers are now getting close to what is considered traditional retirement age, and many are just starting to think seriously about it. That goes back to what the research tells us about money being taboo – about three-quarters of people don’t talk to their family or friends about money, and nearly half don’t talk to their spouses about it. When something stresses us out, the easiest thing to do is ignore it, right? We have to incorporate those concerns and education about retirement into the process much earlier, and in a very tangible way, to help change how people feel about their futures.

Soifer: That is why plan re-enrollments are so important in the DC world – it’s your chance to reset the system. It’s more work for everybody to do it, but when an employer tells employees there will be a re-enrollment, most people are okay with it because they view their employer as a credible source of advice, and it puts them on a better path. GenXers are a good example. They got caught in the middle of the shift between traditional pensions and 401(k) plans. Boomers had pensions that they could supplement with the 401(k) plan, and Millennials have never known anything other than 401(k)s. To the extent that GenXers had a pension, it likely had a decreased benefit level compared to a Boomer’s, and in mid-career they switched into a 401(k) as their primary retirement savings vehicle. Today, a lot of them are defaulted into target date funds – which is good – but at the same time many plan sponsors are taking the right steps in terms of re-enrollment to help them get to a good place.

Why is it that those who are actively saving for retirement feel they won’t be able to retire more so than those who are not saving for retirement?

Soifer: Part of it is they know they’ll have a pot of money, but no idea what to do with it. They need more transparency around what it takes to have your money last a lifetime. Plan sponsors are working on this challenge, and legislators are, too. You can see this with some of the provisions in the SECURE Act that require disclosures around income. It’s not perfect, but it’s a step in the right direction, and provides a lot more transparency in terms of what to expect in retirement.

The idea of not being able to retire is also in step with fears of running out of money. So, what are people really telling us? That they want certainty, consistency of cash flow, and to maintain standard of living – characteristics that are 100% consistent with a defined benefit pension. That’s why we’ve been so adamant about trying to borrow know-how from the insurance world, notably trying to get annuities into DC plans, because it’s completely consistent with people’s risk preferences.

Four out of five people do not believe they’re on the right path to achieving the income they want in retirement. That’s…

Soifer: … a very high number, and its likely many people in the survey don’t have access to a DC plan or pension. Even considering those factors, this number is way too high – and it shows that access is a big problem.

A number that big also shows that we are reaching people at the wrong point in their lives in terms of education. If the first time you hear that you’re responsible for your own retirement planning and savings is when you start your first job out of high school or college, we’re too late. People probably need to hear this when they are in middle school, so it becomes part of their natural muscle memory. And the minute they’re getting that first job, they’re in a plan, money’s coming out, and that becomes the norm for them.

Perkins-Munn: That’s a great point about muscle memory. The survey shows that most people aren’t comfortable making financial decisions, and that leads to hoarding cash and underinvesting. In the study, we estimate that something like $45.9 trillion is currently being held in deposit accounts, cash savings, or foreign currency. The average proportion of investible assets in cash for those in the study was 48%, and 25% of people hold only cash. That touches on what Matt said earlier – people don’t know how to spend or invest their money. As a result, they’re holding onto it with no clear understanding of how they could earn a better return by not having it under their mattress.

Why do you think so many people find it difficult to make a regular contribution to their savings?

Perkins-Munn: There’s a misconception that wealth accumulation is only for wealthy people. That’s a myth that we have to break. You don’t have to wait until you reach a certain level of income or wealth to start thinking about investing. It should be happening simultaneous with all the other financial decisions you’re making in life. It’s also important that employers help employees understand that you don’t just put money in the stock market and watch it go up and up forever. The market will go down sometimes, and that’s something you have to get comfortable with. In the same way, you just have to get comfortable with that $50 being deducted from every paycheck because it is helping you grow your wealth over time. In our study, we asked current investors what they would recommend to non-investors to help get them started saving. They recommend coming up with unique and innovative ways to invest small amounts. The second thing they suggest is to invest incrementally – start small and increase your investment over time as you become more experienced and knowledgeable. The third suggestion is to use automatic transfers, such as having your credit cards automatically put any spare change into an investment account. Or in a DC plan, that could translate to setting contributions to auto-escalate, if that’s not already set at the company level. Ideas like that can really help employees dip their toes in the water and get comfortable with investing.

How would you suggest to a DC plan sponsor that they consume the findings in People & Money 2020, and leverage it for the benefit of their participants?

Soifer: A lot of people in the DC industry are investment professionals, and the natural tendency is to use the investment lineup as a starting point for everything else. If I were a plan sponsor and had a blank sheet of paper on Day One, I would start with plan design as the primary consideration in driving outcomes. Most plan sponsors don’t have that Day One scenario, so what I suggest is start with your existing plan and get to know the people who work in your organization – how they think, invest, and save. Our data is about the broad population, but if you know this about your own organization that will help you answer the important questions: What’s our overall objective for the plan? Should we auto-enroll people? Should we auto-escalate? What’s the risk profile of our employees? What are their savings preferences? What are their spending preferences? You can learn a lot about the way people think and their appetite for risk by really getting behind your demographics.

For a long time, we did the same thing everyone else does and started with the investments. But we’ve been doing a ton of work on this and now we always ask plan sponsors to show us the data so we can start with plan design. As a plan sponsor, the design-first approach makes you a better fiduciary. You don’t need all the bells and whistles right away, but the approach in general gives you a great roadmap on how to help get people to better outcomes.

Do you think DC is where it should be on the investment side?

Soifer: We, as an industry, have to up our investment game. If you handed somebody a blank sheet of paper and said, “Design an investment portfolio,” they wouldn’t draw up a portfolio of long-only stocks and bonds. We’ve acquired the know-how from pensions, endowments, and foundations to build more robust portfolios for DC – portfolios with higher risk adjusted returns. But what happens when you’re in a low return environment – like now, for example, with bonds yielding nothing, and equities at or near all-time highs? Those are the basic tools a DC plan has, so it would be nice to see some evolution in that regard. There’s a lot we can do between long-only stocks/bonds and private equity.

Beyond regulatory change, a lot of that depends on how participants and plan sponsors feel about spreading their wings, so to speak.

Soifer: Right, and you have to meet people where they are. HR departments are really strapped, but I love the concept they are pursuing of overall well-being. You can meet people where they are in their careers and life, and share insights and education that can help them get from where they are to where they want to be. This is not something that gets fixed in five years – it’s a generational change.

Perkins-Munn: Financial services firms in general are notoriously good at investment data and notoriously bad at understanding client data. Who are these clients? How should I be thinking about them differently? That’s one of the significant contributions of our survey, and a way that BlackRock can outperform when helping DC plan sponsors. With the data from our survey, we can really understand different money mindsets and what their wellbeing could look like from a holistic perspective. We were surprised to learn, for example, that 39% of the people in our sample are what we classified as “dynamic” – they’re happy in life and with their investments, they have retirement savings, they’re confident, and in good financial health. That’s a group of people we can we learn from.

Were there other groups that intrigued you as a data scientist?

Perkins-Munn: About 20% of the people we identified as “determined.” They’re heavily involved in their finances, they’re using digital tools, they’re thinking through and changing their investment strategies, and they are holding debt. They are eager to learn more about investing. These two groups – dynamic and determined – make for a hopeful and promising financial future with the right guidance. They can also influence other investors. At BlackRock, we are really leaning into the data to understand how we can be most effective in the DC space –peeling back the onion to understand who people are, what their needs are, and how we can serve them best.

BlackRock is more than just a provider of products. What should DC plan sponsors know about you as a partner for solving the challenges we’ve been discussing?

Soifer: We’re very focused on listening first, doing the work to gather and understand the data, and letting it inform us all – plan sponsors and our team at BlackRock – as fiduciaries to make decisions accordingly. Here’s an example of that in action: We used to sit around the table with investment committees and all agree that auto-escalation was a great thing – but nothing would happen. Nothing happened because we couldn’t offer the committee anything tangible to help with its ultimate decision. These days, we have the data and we can demonstrate the change auto-escalation will have on any cohort within the plan, or employees as a whole. We can show people the economic impact around their fiduciary decisions in five seconds, and that it is a game changer. We’re in a unique position to be able to synthesize data, enable investments, and understand education and communication with plan sponsors. We understand behavioral economics, and how that drives decisions and better outcomes.

Perkins-Munn: At BlackRock, we are really good at flexing an empathetic muscle. We care about the plan sponsor, we care about the employees. It’s in our DNA. Our purpose is to help more and more people experience financial well-being. So, we strive to determine how to use data most effectively, and we think through technology options to bring it all together and apply it through an empathetic lens. We want to deeply understand the needs of the employees and how we can be most helpful to the plan sponsor.

Learn more about what DC plan members need to retire, and how you can help them get there.

About the BlackRock People & Money Survey: One of the largest global surveys ever conducted on the topic of financial well-being, the survey interviewed 26,814 respondents, in 18 nations (with 4,004 respondents from the US.) In North America: the US and Canada; in Europe: Germany, Italy, Switzerland, France, Belgium, Netherlands, Denmark, Spain, Sweden and the UK; In Latin America: Brazil and Mexico; in Asia: China, Hong Kong, Japan, Singapore and Taiwan. Respondents were ages 25-74 and were either the primary or shared decision maker for savings and investments in the household. No income or asset qualifications were used in selecting the survey's participants. Executed with the support of Kelton Global, an independent research consultancy, the survey took place online from November 2019 to January 2020. The margin of error on this global sample is +/-.598 percent.

This material is provided for educational purposes only and should not be construed as research. The information presented is not a complete analysis of the global retirement landscape. The opinions expressed herein are subject to change at any time due to changes in the market, the economic or regulatory environment or for other reasons. The material does not constitute investment, legal, tax or other advice and is not to be relied on in making an investment or other decision.

Investing involves risk, including possible loss of principal. Asset allocation models and diversification do not promise any level of performance or guarantee against loss of principal.

The opinions expressed in third party articles or content do not necessarily reflect the views of BlackRock. BlackRock makes no representation as to the completeness or accuracy of any third-party statement.

No part of this material may be reproduced, stored in any retrieval system or transmitted in any form or by any means, electronic, mechanical, recording or otherwise, without the prior written consent of BlackRock. This publication is not intended for distribution to, or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

FOR INSTITUTIONAL AND FINANCIAL PROFESSIONAL USE ONLY

©2020 BlackRock, Inc. All Rights Reserved. BLACKROCK is a trademark of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.

MKTGH1020U-1375386