If a hedge fund’s portfolio managers all attended the same Ivy League university and worked for the same investment bank, the fund could be missing out on significant alpha, according to academic research.

A recent study from researchers in the U.S., U.K., and Singapore found that hedge fund teams with different educational backgrounds, work experiences, and nationalities outperform homogenous teams by 3.59 to 6.23 percent annually, after adjusting for risk.

This outperformance was linked to diverse teams “exploiting a wider range of long-horizon investment opportunities and avoiding behavioral biases,” according to authors Yan Lu of the University of Central Florida, Narayan Naik of London Business School, and Melvyn Teo of Singapore Management University.

“Hedge funds are uniquely positioned to fully harness the value of diversity given the complex and relatively unconstrained strategies that they employ,” the authors wrote. “Yet, they are often managed by homogenous teams that comprise managers with common education backgrounds, work experiences, and nationalities.”

[II Deep Dive: Want 20% Higher Returns? Do This.]

For the study, the authors focused on measures of diversity that they believed would capture the training, experiences, and investment beliefs of portfolio managers. “Managers who attended the same university likely took the same courses under the same professors,” the authors wrote. “Similarly, managers who worked at the same investment bank likely attended the same training program for junior analysts and traders, and adopted the same workplace norms.”

To understand the impact of more diverse teams, they analyzed performance data from more than 13,000 hedge funds that operated between January 1994 and June 2016, including nearly 8,000 funds that are now shut down. They limited the study to hedge fund teams with at least three people to ensure they could be scored on the three diversity measures.

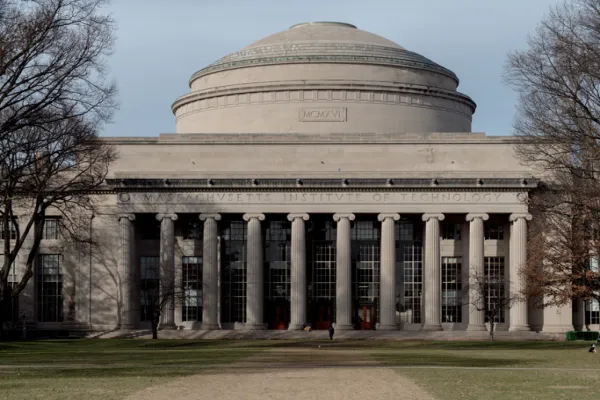

The top ten universities attended by hedge fund managers, according to the study, were Harvard University, the University of Pennsylvania, Columbia University, New York University, the University of Chicago, Yale University, Cornell University, the University of Virginia, the Massachusetts Institute of Technology, and Stanford University.

The most common former employers were Goldman Sachs, Morgan Stanley, Merrill Lynch, JPMorgan Chase & Co., UBS, Credit Suisse, Deutsche Bank, Lehman Brothers, Bear Stearns, and Citigroup.

Almost a third of the hedge fund managers in the sample were from the U.S. After that, the most-represented countries were Canada, France, Great Britain, Italy, Australia, China, India, the Czech Republic, and Denmark.

Researchers Lu, Naik, and Teo found that diversity in these three areas was linked not only to higher returns but also more prudent risk management, with diverse funds found to “eschew tail risk, exhibit lower operational risk, and report fewer suspicious returns.” They also determined that diverse teams were better at avoiding behavioral biases such as overconfidence and preference for lottery-like investments.

“Members of a diverse team, by serving as effective checks and balances for each other, help curb idiosyncratic and errant behavior,” they wrote.

Lastly, the authors found that by accessing a wide range of investment opportunities, diverse teams were less susceptible to the capacity constraints which cause funds to perform worse as they grow larger.

“These findings showcase the value of diversity for hedge funds,” the authors concluded.