Fully incorporating complete and accurate ESG data into the investment process is an elusive but necessary goal for asset allocators and the asset managers they choose as partners. The solution may be to create a proprietary ESG assessment process that is managed using a highly configurable research management system (RMS). In a landscape plagued by a lack of standards and inconsistent data, such a process using an RMS could represent the best-case scenario for institutional investors who must meet or exceed stakeholder expectations around sustainable investment strategies and trustworthy reporting. That was the topic of conversation when II recently sat down with Danny Donado, Founder and CEO of Bipsync. Donado is a former hedge fund research analyst, and the company’s software is purpose-built for the investment industry

What are the primary challenges in automating the ESG research process?

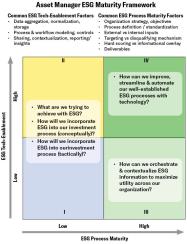

Danny Donado: The challenges depend on a firm’s overall level of maturity in terms of ESG, which can be broken down into two dimensions – ESG tech enablement and process maturity. Tech enablement is essentially the digital scaffolding – having a tech stack that makes it possible to aggregate, normalize, and store data; systems for process and workflow modeling that enable process controls; and systems that allow users to share, contextualize, and ultimately report holistically on the activity, work, and data that’s in the system.

And what do you mean by process maturity?

Donado: At the very base level it’s having established what your organization is trying to achieve – what are your objectives, and what is the strategy for meeting them? Are you about impact investing or is it more of a screening mechanism? Are you using external or internal inputs – in other words, ratings that you ingest and use for scoring, or are you coming up with your own formulation? It’s an exercise in defining processes and establishing standardization of deliverables. There are no right or wrong answers to the questions, however they have to be answered in some way for firms to successfully incorporate ESG into their investment process.

ESG investments are not excluded from an ever-shifting regulatory landscape that is also inconsistent from region to region. How much of a challenge is it to keep up with ESG-related regulatory demands and anticipated changes, and how much time can it consume?

Donado: In short, it can eat up a lot of time. There’s no universal regulatory body, nor agreed upon standards or prescriptive measures on how to incorporate ESG into your investment process. That’s up to each firm. What most regulations focus on is greater disclosure and reporting, which means that no matter which process a firm incorporates they must be able to provide significant detail. That sounds simple, but in practice it is not at all straight-forward. Other areas of regulation target standardization of taxonomy. For example, a company can receive a low score in one rating system and a high score in another. From an asset management perspective, it becomes a question of how to protect investors and help them make sense of the lack of consistency across the ESG landscape. In addition to staying current on requirements, there also must be a way to systematically implement them and ultimately enable asset managers to provide disclosures and reports around ESG-based investment strategies – the output, if you will. That is ultimately how oversight works.

As you mentioned, there are not agreed upon ESG standards – so how can investors determine which merit their attention and which don’t?

Donado: I don’t think you rely on one set of guidelines. What you’re looking for is frameworks from accredited institutions or industry groups that provide standards and best practices – for example, the Impact Management Project and the UN Sustainable Development for private equity firms. And then there are all the ESG benchmarks, ranging from MSCI to a global ESG benchmark for real assets. Taken together, they provide a mechanism by which you can attempt to stay on top of things, and by using multiple sources a manager can create a degree of cover. Once you have all that information, the digital scaffolding I mentioned allows you to aggregate and store normalized data so people can share and collaborate as part of the digital workflow.

It’s early days in the ESG journey for the buy side. What role does the RMS [research management software] play in ESG research for the buy side? And, ideally, how customizable should it be?

Donado: Incorporating ESG adds an extra layer to the research management and investment processes. It involves establishing a formal framework, scoring mechanisms, approval processes, and handoffs to different parties in the firm, all while tracking the work in its various stages. When you increase the complexity and formality in your research process it requires a more formal system of record, process management tools, and everything else needed to help coordinate and execute the investment process across the organization. For each nuance added and person involved the complexity increases. It’s very difficult to manage everything I’m describing without a modern RMS.

Regarding how customizable and flexible an RMS needs to be to incorporate ESG, something akin to a LEGO set is more appropriate than an off-the-shelf turnkey solution. You want building blocks than can accommodate different ways of doing things from a technical standpoint. Two of the biggest things are configurability in the user interface – because everyone’s workflow and dashboard looks different – and flexible data architecture, aka APIs [application programming interfaces] that allow the user to connect with other systems when incorporating external data into the RMS or sending data out.

What does the information flow look like on the Bipsync RMS? How is information injected into the investment decision-making process?

Donado: From a topline view, our RMS adds structure to your investment process, but how it does so is unique to each firm based on the Lego-type capability to integrate qualitative and quantitative research in one place. Essentially, the RMS centralizes everything about your investments and the contributing factors to the convictions and decisions behind them.

As an example, you can incorporate ESG data into issuer dashboards, i.e. whatever company you’re ultimately doing an ESG assessment on. The profile of a company incorporates piped-in external data the manager might subscribe to from a multitude of sources such as MSCI or CDP. The point is that you’re centralizing that data and our RMS can feed it into the system. Regardless of where you are in the asset management firm you now have at least some element of ESG in your dashboard for that company. You can also incorporate external information and research beyond what you subscribe to into a company’s profile – trusted stories that are published on the web, for example.

It’s also possible to take qualitative research that would typically live in someone’s handwritten notebook and add structure to it through ESG note types and configurable fields. If you use a digital tool and RMS you can capture the information in digital form and report all of that metadata so other people involved in the investment process can access it. For example, if you want to mandate quarterly corporate management access calls as part of your ESG process you can establish a template to indicate who was on each call. From there you can start to do ratings and add values. Users can add as much structure and as many fields that take whatever form they choose.

It sounds as if an asset manager can create a proprietary ESG grading or ranking system of their own using the Bipsync RMS.

Donado: A firm can establish its own ESG assessment process and create a scorecard for any company that includes different sections for environmental, social, and governance. Some scores might be manual inputs, while others might be extracted from external data sources. The customized process can include checklists and requirements and require that a scorecard be filled out in order for a company’s ESG assessment to be considered complete. If there are scenarios in which only a certain subset of groups within the firm should have permission to access data – for example, if only compliance should be able to interact with data during a certain time period – the proper controls can easily be put in place.

Investment pipelines are critical to asset managers. How can the RMS help streamline pipeline staging as it relates to the ESG research process?

Donado: Let’s say you want to create an assessment pipeline by which you scrutinize a particular company on ESG dimensions as defined by your firm. With our RMS you can create a four-stage pipeline consisting of backlog, initial diligence, full diligence, and completed assessment. Everything starts in the backlog stage, and that could be populated by a universe of names that’s powered by your securities master record, for example. In turn, those names have ESG ratings and external data associated with them that are being pulled in, and you can perhaps use those as an early screening mechanism. If a company reaches a certain threshold it advances to initial diligence.

The initial diligence stage requires the capturing of qualitative information from meeting and phones calls, along with additional external data. When this reaches a certain threshold after being added into the RMS, you move onto full diligence which makes use of process control requirements. For example, every assessment requires that a scorecard be completely filled out, or perhaps written approval by an oversight committee. When all the criteria are met, the name can advance to the completed assessment stage, in which you can notify colleagues that there’s a new assessment ready. At this point, reporting becomes a powerful tool because you have a completed data set. Some of our clients are adding automated time-bound rules where, for example, an assessmnt is valid for a certain period of time, after which it reverts to the backlog stage because it’s stale.

Shifting from the technology aspect of ESG, it’s no secret the U.S. lags Europe in terms of corporate commitment to it and adoption of related investment strategies. Are you optimistic that we might see some change in that regard?

Donado: The new administration strikes me as very ESG conscious and there’s ample evidence to back that up – re-entering the Paris Agreement, the pledge to achieve net zero greenhouse gases by 2050, the reopening of the $40 billion loan program for clean energy projects, the SEC announcing an enforcement task force that’s focused on climate and ESG issues. I think investors will continue to press companies on social issues, particularly worker safety and diversity concerns that have been highlighted by the pandemic. I think as part of the plan to build back better in the wake of the pandemic we’re going to see conversations shift from mitigating the negative impacts of climate change to a deeper conversation on adaption and climate resistance. Conversations about energy transition will become increasingly nuanced. There’s going to be more transparency, more regulation, more adherence around disclosure and reporting. As a general observation, it does seem to be trickling down. Change is inevitable. It’s just a matter of how long it takes.

Learn more about Research Management Software.