Junior capital has the potential to enhance yield for fixed income investors, who should welcome the help. U.S. 10-year Treasuries have not seen the top side of 4.0% since the end of the global financial crisis and are currently priced to yield less than 2.0%.

“While the Fed has indicated that it may begin tapering its quantitative easing program later this year, it is our expectation that long-term U.S. Treasury yields will remain low by historical standards,” says David McManama, a Principal on the Private Equity and Junior Capital team at Churchill Asset Management, which he joined via Nuveen in 2014. “Private subordinated capital – or junior capital – can help investors in their search for yield.”

A distinct opportunity

High yield (HY) bonds are a fairly common “go-to” in yield-starved environments. However, junior capital offers a distinct opportunity for fixed income investors who are comfortable with illiquid securities and a medium-term investment horizon.Junior capital can take on multiple variations such as subordinated notes (fixed rate) and second lien term loans (floating rate), but they all share a few underlying characteristics:

- Subordination or junior in right of payment to a senior secured term loan as part of a capital structure used by a private equity firm in a leveraged buyout.

- Return is commonly all or mostly cash pay with a small paid-in-kind element.

- Average all-in pricing is between 10.0% and 12.0%.1

This performance can be chalked up to a number of characteristics of junior capital, including:

- It often occupies the part of the market for borrowers under $50 million of EBITDA and is priced with more risk. However, we believe that risk can be mitigated with superior access to information, as we discuss in the next section.

- Investors are compensated for illiquidity with higher yield but must be committed to a longer-term investment strategy (typically three to five years of duration).

- It’s issued in a private, imperfect marketplace with transactions between one buyer and one seller. While providers of junior capital financing must contend with the threat of competitive pressure from other lenders, pricing is determined more by negotiation than the dynamic pricing of public markets.

- Equity enhancement: In some cases, junior capital investors receive strips of common equity alongside their debt investments, which, if chosen carefully, can boost returns.

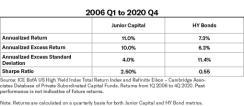

Returns on junior capital are even more interesting when adjusted for risk. Relative risk can be examined using return volatility as a proxy. In the table below, Sharpe ratio is used to measure risk-adjusted return – essentially, the ratio of return over a period of time to volatility. A higher ratio implies a greater risk-adjusted return. Calculations for March 31, 2006, to December 31, 2020, reveal a junior capital Sharpe ratio of 2.50 vs. a HY Sharpe ratio of 0.55.

“The implication of the [above] data is that junior capital offers higher relative returns per unit of risk,” says McManama. “Junior capital’s exposure to credit spread volatility factors is very different from that of high yield bonds. As an illiquid asset, junior capital is rarely traded. Its value is not subject to daily fluctuations of interest rates or of the supply-and-demand pressures of a public market. It is a buy-and-hold security, the value of which is determined almost entirely by the underlying credit quality of the borrower.”

An information advantage

Junior capital lenders also enjoy access to an unusually high quality of information. A properly staffed and resourced junior capital lending team can gain an edge through the scope of the information they can access.“Unlike publicly traded securities, which are required by regulation to make their financial information uniformly available to the public, junior capital lenders can benefit from direct access to borrowers in a private marketplace,” says McManama. “Our experience suggests that this information advantage can perhaps be the critical edge that private lending teams can use to excel.”

Rather than relying solely on pre-prepared marketing documents, lenders complete a deep dive into borrower data, financials, key business model drivers, and customer trends based on proprietary diligence requests. They also receive one-on-one calls with management addressing diligence criteria, including detailed financial projections. Often, the lender is working alongside the private equity sponsor and can leverage the full scope of its buy-side diligence. This access to information typically allows for more informed decision-making.

“Junior capital lenders remain in the data flow throughout the duration of the investment, with frequent calls with management or even board observation rights – and almost always receive financial covenants on their investments, typically in the form of a leverage covenant,” says McManama. “These guardrails on company performance provide lenders with leverage against borrowers if financials turn soft.”

It’s worth noting that the junior capital market is large, has many participants, and is quite stable. However, there are some potential pitfalls for undiscerning lenders. Constructing a portfolio is an active process that requires product and market expertise and tenured relationships with borrowers. A quality manager should have a track record that is extensive, durable, and accessible. However, with the right manager, junior capital can play a vital role in the search for yield.

“Historically, junior capital has offered a premium to reflect its risk exposures, rewarding investors able and willing to exploit the asset class’ structural market and information advantages,” says McManama. “A well-constructed portfolio should have the ability to generate significant annual returns with minimal losses.”

Learn more about junior capital.

1 Source: Churchill portfolio, 2013 to present

2 Source: ICE BofA U.S. High Yield Index Total Return Index and Refinitiv Eikon – Cambridge Associates Database of Private Subordinated Capital Funds as of December 31, 2020

3 Source: ICE BofA U.S. High Yield Index Total Return Index and Refinitiv Eikon – Cambridge Associates Database of Private Subordinated Capital Funds as of December 31, 2020

The views and opinions expressed are for informational and educational purposes only as of the date of production / writing and may change without notice at any time based on numerous factors, such as market or other conditions, legal and regulatory developments, additional risks and uncertainties and may not come to pass. This material may contain “forward-looking” information that is not purely historical in nature.

Nuveen provides investment advisory solutions through its investment specialists.

Churchill Asset Management is a registered investment advisor and an affiliate of Nuveen, LLC.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Financial professionals should independently evaluate the risks associated with products or services and exercise independent judgment with respect to their clients.

A word on risk

Junior capital investments are subject to certain risks. Investments in below investment grade or high yield securities are subject to liquidity risk and heightened credit risk. Please consider all risks carefully prior to investing in any particular strategy. These investments are subject to credit risk and potentially limited liquidity, as well as interest rate risk, currency risk, prepayment and extension risk, and inflation risk. Market forecasts are subject to uncertainty and may change based on varying market condition, political, and economic developments.

The information and opinions contained in this material are derived from proprietary and non-proprietary source deemed by Nuveen to be reliable, and not necessarily all inclusive and are not guaranteed as to accuracy. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.

GWP-1701479PR-O0721X

© 2021 Nuveen, LLC. All rights reserved.