To add to our thinking on shocks, we are now also conducting semi-annual surveys of institutional investors to extend the dialogue and complement our “What if …?” conversations. Here, we dig into the findings of our latest survey, which considers shocks and their effects on asset allocation – with special focus on equity allocation.

We asked Franklin Templeton’s Tom Fisher, Head of U.S. Institutional, and Pierre Caramazza, Head of Financial Institutions, to interpret the highlights of the survey findings, and where they lead us for future surveys, including insights on “alternatives differentiate” and “rose-colored glasses on shocks.”

If you would like to be involved in the next survey and join the conversation, email us at solutions@franklintempleton.com.

Tom Fisher: It’s fair to say there were more than a few revealing surprises in the responses to the survey, including a perhaps over-optimistic view of how major shocks would affect respondents’ portfolios. Also, that we have a blind spot when it comes to alternatives. We need to dig deeper into that in our next survey.

Pierre Caramazza: It was curious to me how consistent the responses were from investment decision makers in North America.* The group was a mix of chief investment officers (CIOs), investment officers, portfolio managers, directors of research, and research analysts – from asset owners and managers. Whether by asset size or investor type, we generally had very tight bands, with little variance, among responses. So, let’s focus on the averages and dig into the findings.

Fisher: Let’s not cover everything in painful detail, but rather cover what we found to be most curious.…

Caramazza: Good idea. I want to jump to the question about how respondents plan to alter their equity holdings over the next six months.

Look at the “decrease” percentages. All are 11% or less. Now, this data was collected in May 2019, but still the bullish nature of these results surprises me. Maybe the Fed played a role. Anyway, it will be interesting to track this over time.

Fisher: To me, this data suggests we should be seeing global equity search activity – and we haven’t. I am going to be watching and asking about that. Also, we know our multi-asset team has been a bit more bearish during that time.

This “risk-on” mode also fits with the question about how respondents expect shocks to impact their portfolios.

Look at how small the “large and negatives” percentages are. And if you combine the two negative categories, only “regulation” and “inflation” are real fears.

Caramazza: You would have to call this looking through “rose-colored glasses.” Respondents are basically saying their portfolios are well-positioned for shocks. Or perhaps it is a behavioral phenomenon? Are institutional investors saying, “I can only think of positive shocks?”

Fisher: To start the survey, we collected the portfolio allocations to equity, fixed income, and alternatives. It surprised us how tight the bands were around the mean – really within plus/minus 10% on either side of the mean. We saw this no matter how we sliced and diced the data, and in some cases closer to plus/minus 5% of the mean.

This held true for the allocation within equities, too, which is particularly surprising considering the wide selection of people participating in the survey, and their different outcome needs. It causes us to zero in on alternatives at 27%. That must be where the difference comes. Some may be thinking real estate, while others have unconstrained strategies, and perhaps others may have their liability hedge. We’ll see if we can tease that out in the next survey.

Caramazza: The equity drilldown is also intriguing. I think we expected to see more home-country bias. Additionally, the percentage of emerging market allocation is high compared to capitalization-weighted expectations. I’d like to take a closer look at both topics in the next survey.

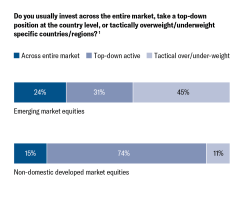

I thought one of the most interesting was the question that explored how respondents invest in emerging and international markets.

The overwhelming percentages for top-down and tactical weighting suggest some level of active management – whether in the selection of the countries to index, or in the selection of managers to invest across countries.

Fisher: This tilt toward active is not what we hear about in the press, nor necessarily see in industry-wide flows. But, perhaps it is what we should be expecting from the readers of institutional investment publications. We do believe in the mantra “invest country by country.”

Caramazza: Among the potential major global shocks to their portfolios, investors are most concerned about inflation. Inflation has largely been dismissed for several years now, but this would suggest creeping anxiety that it might occur.

Fisher: Where are the TIPS searches? I’m joking, but concern about inflation is such a curious finding. In the field, it is just not a subject that seems to be top-of-mind with large institutional investors and gatekeepers. And, yet, we know from past experience that investors will claim to be shocked – shocked, I say! – when inflation suddenly appears.

Caramazza: Is it more revealing that institutional investors seem less nervous and more optimistic about the potential global shocks that dominate news headlines around the world –slowing economic growth, multiple geopolitical tensions, and immigration and workforce issues?

Fisher: For the most part, some degree of non-reactionary mindset is to be expected of institutional investment professionals who generally strategize and act long-term. However, investors’ calm before a potential storm seems at odds with their expressed preference – and I’m now looking at the responses that indicate a significant number of respondents would react in an ad hoc way to most global shock scenarios. In other words, they might only be literally shocked into action.

Caramazza: It made me wonder if institutional investors are more focused on fundamentals than they are on headlines.

Fisher: That’s the good news. That said, those of us who have been around the block once or twice know that bull markets eventually end, and growth will slow. It often happens over time, but it can also happen quickly – like we saw during the global financial crisis.

Caramazza: And that really wasn’t so long ago, and is another reason I was surprised more managers were taking ad hoc approaches to shocks to growth rather than mapping out a predefined plan.

Fisher: It came to the top of my mind when we saw how many institutional investors were planning on increasing equity exposure, had almost no negative feelings about global growth, and would take an ad hoc approach to a shock to global growth.

Caramazza: This is where we need to dig deeper into alternatives. Could be they are hedged or diversified with assets not strongly tied to growth.

Fisher: Alternatives must be critical to understanding their differences – the good news is that there seems to be plenty going on with equities and adding risk there.

Caramazza: So, our three big takeaways are: First, that equities seem to be an active place for adding risk. Second, that respondents all seem to have relatively similar allocations; so, to understand their differences, we should ask more questions about how they define alternatives.

Fisher: And third, what people may be indicating about shocks – growth positive and inflation negative – does not necessarily fit with what we think we see in practice.

Franklin Templeton and Institutional Investor will be partnering to periodically survey institutional asset owners to extend the dialogue about “What if….?” Participate in the next survey by emailing us today at solutions@franklintempleton.com.

* This conversation and the data cited in it are based on a May 2019 survey conducted by Institutional Investor’s Custom Research Lab and Franklin Templeton. The cohort of respondents was 150 investment decision makers – CIOs, investment officers, portfolio managers, directors of research, and research analysts – at institutions in the U.S. and Canada. More than half the respondents represent an institution with at least $5 billion in AUM. However, when responses were broken down by level of AUM, there were no outlier groups – essentially responses were consistent regardless of AUM.

About this research

In May 2019, Institutional Investor’s Custom Research Lab and Franklin Templeton surveyed 150 investment decision makers—CIOs, investment officers, portfolio managers, directors of research, and research analysts—at institutions in North America. More than half the respondents represent an institution with at least US$5 billion in assets under management (AUM). However, when responses were broken down by level of AUM, there were no outlier groups—essentially, responses were consistent regardless of AUM.

More in the series "What if there are shocks to ... "

Franklin Templeton

|

Franklin Templeton

|

FT demographics

|

Franklin Templeton

|

Franklin Templeton

|

FT-global growth

|

interest rates

|

FT

|

Disclaimers:

This material is provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice. This material is general in nature and is not directed to any category of investors and should not be regarded as individualized, a recommendation, investment advice or a suggestion to engage in or refrain from any investment-related course of action. All information is current as of the date of this material and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm or the firm as a whole. Franklin Templeton does not accept any responsibility to update any opinions or other information contained in this document. This material may include estimates, outlooks, projections and other “forward-looking statements.” Due to a variety of factors, actual events may differ significantly from those presented.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

For US Residents Only

This site is intended only for U.S. Institutional Investors and Consultants. Using it means you agree to our Anti-Corruption Policy.

If you would like information on Franklin Templeton’s retail mutual funds, please visit www.franklintempleton.com.

Franklin Templeton Distributors, Inc.

1 Source: The Institutional Investor’s Custom Research Lab and Franklin Templeton Survey was conducted in May 2019. See “About this research” for more details. All data and charts referenced herein were derived from the aforementioned survey conducted