Grantham Mayo Van Otterloo & Co., the $88 billion asset manager co-founded by famed value investor Jeremy Grantham, has been struggling as its bearish calls have hurt fund performance and sent investors packing. But don’t expect any big changes or modifications to its investment process under new leader Scott Hayward, former head of Quantitative Management Associates, a company insider says.

GMO said yesterday that Hayward will become CEO next month, replacing Peg McGetrick, who has been serving as interim CEO since last July and will remain a director of the firm. Hayward spent 13 years at QMA, including 11 as CEO. The firm manages about $116 billion in assets.

The Hayward hire comes at a time of turmoil for GMO, which was established in 1977. The firm’s assets have plummeted from a peak of $124 billion in 2014, and it laid off 10 percent of its workforce, including analysts and portfolio managers, in June.

Still, the new CEO hire should not be construed as the first step in a plan to make drastic changes. A GMO executive who declined to be named said that the firm has the advantage of being privately held and not subject to short-term profitability expectations of outside shareholders. He added that GMO has the stamina to persist through this period and will stick to its beliefs.

“We’ve been here before,” the executive said. “In terms of financials, we succeed in taking the long view. We want to deliver value for our clients. That is quite a different business model than you find in public firms.”

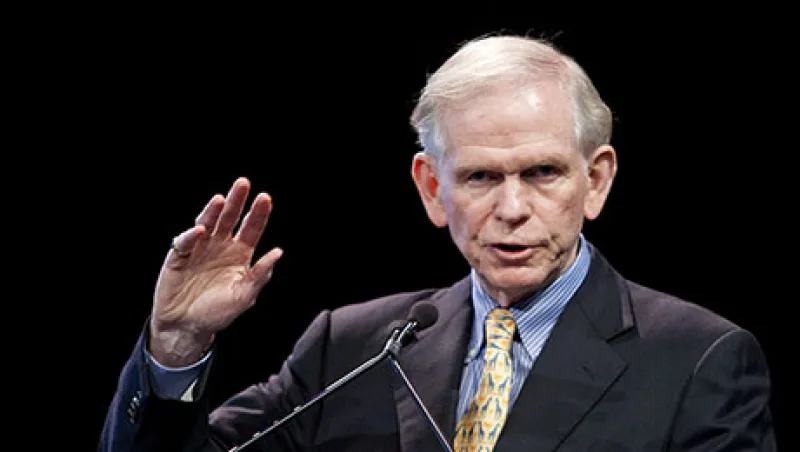

Grantham is a well-respected value manager whose reputation was burnished by his bearish calls before the 2008 financial crisis and before the collapse of the technology stock bubble in 2000. But the firm’s contrarian views, which famously have taken years to pay off, cost it in 2016, when the Dow Jones industrial average finished the year up 13.4 percent. The firm’s Benchmark Free Allocation Fund Class III, a diversified strategy, returned just 3.4 percent last year.

In June, Morningstar downgraded that fund to Bronze from Silver because of “organizational stress at the firm.” Morningstar noted that the pending departure of Sam Wilderman — a 20-year GMO veteran, a member of the asset-allocation committee, and a co-manager of the Benchmark Free fund — would be a “loss for investors.” Wilderman left GMO in December. His departure followed that of then-CEO Brad Hilsabeck and global equity chief David Cowan in June.