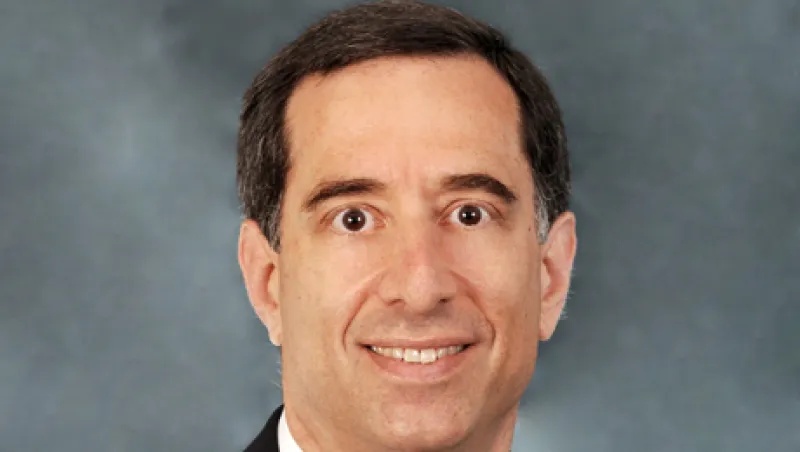

Third Avenue Nabs Banker David Resnick

In a sign of the times in banking, the former head of Rothschild’s restructuring and debt and equity advisory businesses joins Marty Whitman’s money management firm as president.

Julie Segal

September 28, 2012