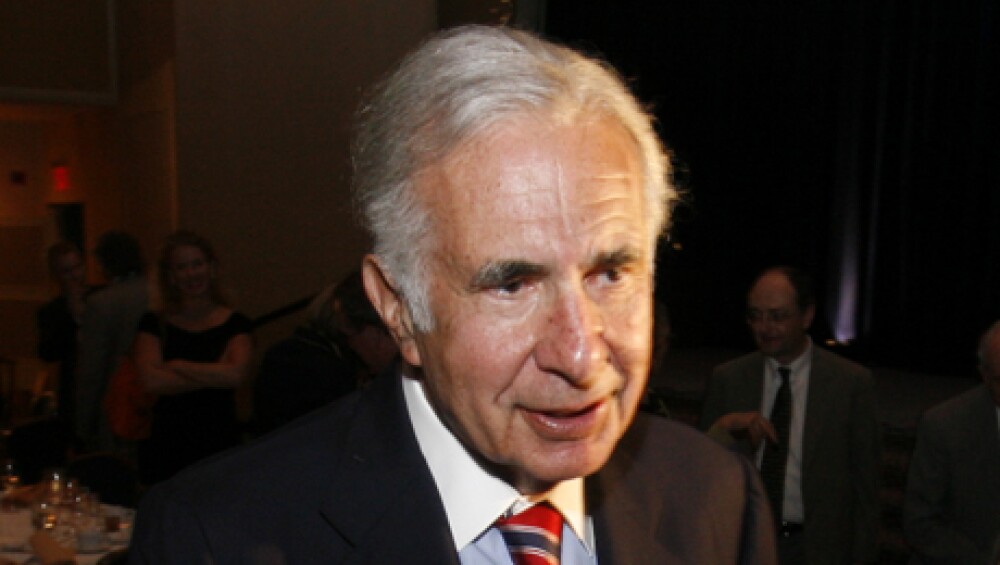

Carl Icahn’s sale of his shares in Motorola Solutions and the departure of his handpicked board member do not mean the telecom company will no longer feel the same intense heat to maximize shareholder value.

Sure, the septuagenarian cut his stake to 4.95 percent from 12 percent and is no longer the largest shareholder — after Motorola Solutions bought $1.2 billion of his shares as part of a large buyback. But another activist shareholder, Jeff Ubben of ValueAct Partners, is still firmly committed to the stock, which was his largest holding at year-end. And unlike Icahn, who is more short-term oriented, Ubben has a long history of working closely with management and staying for the long haul as long as he feels there is more value to mine.

Ubben will not comment. But he is known to communicate regularly with chief executive officer Greg Brown about getting the excess cash off the balance sheet and returned to shareholders. Investors say the company’s annual free cash flow — after capital expenditures, working capital and dividends — currently exceeds $1 billion. In a report published late last week, Credit Suisse Securities estimated Motorola Solutions total excess cash position at $3.5 billion.

Credit Suisse expects the company to return a total of $7.7 billion to investors between 2012 and 2015. Analyst Deepak Sitaraman believes about $6 billion of this sum will come from stock buybacks and $1.7 billion from dividends. This works out to roughly 50 percent of the company’s current market cap.

In fact, these kinds of outsized capital distributions combined with strong fundamentals inspired Sitaraman to raise his rating on the stock to Outperform from Neutral and dramatically lift his price target to $62 from $49.

Motorola Solutions is the old Motorola; it spun off its mobile devices division and named it Motorola Mobility in January 2011 after public prodding from Icahn. The one-time corporate raider had earlier threatened to launch a proxy fight.

Motorola Solutions — formerly the Enterprise Mobility Solutions and Network divisions of Motorola — is a data communications and telecommunications equipment provider, specializing in security devices. It sells to both companies and governments, including police and fire departments.

The government segment includes two-way radios and public-safety systems. The enterprise segment includes enterprise mobile computing and scanning devices.

Credit Suisse expects the government segment, which accounts for roughly two-thirds of the company’s total revenue, to grow about 4 percent to 4.5 percent over the next two years. Sitaraman notes, however, that growth in this group has been steady “with mid-to-high-teens operating margins and low capital requirements driving solid free cash flow.”

The huge excess cash flow and steady revenue growth also make Motorola Solutions an ideal takeover candidate for a private equity firm — unless management steadily rewards shareholders with buybacks and hefty dividends, keeping activists like Ubben off its back.