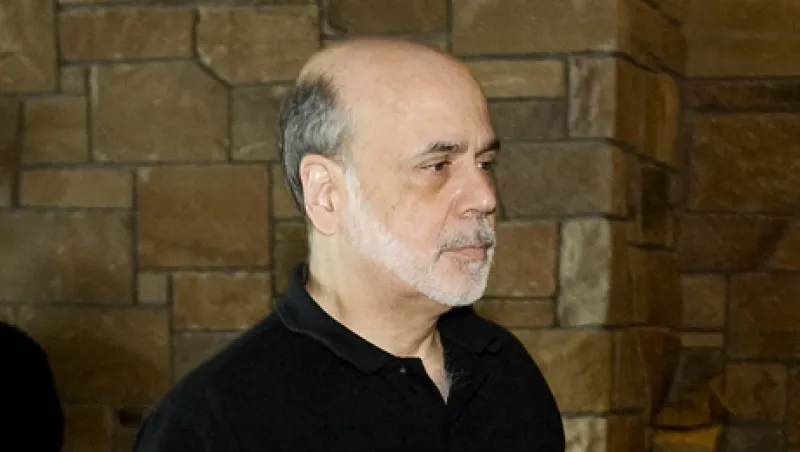

To Federal Reserve watchers, “Jackson Hole” — shorthand for the annual summit of central bankers hosted by the Kansas City Fed in Jackson Hole, Wyoming, in late August — is widely anticipated for the speaker who kicks off the proceedings, Federal Reserve chairman Ben Bernanke.

This year, Bernanke’s speech didn’t contain any market-moving surprises.

But another paper, delivered by Michael Woodford, a professor of political economy at Columbia University, caused a stir. In a 97-page study, Woodford maintained that with interest rates near zero, the time had come for the Fed to take a fresh approach in its efforts to stimulate the economy and reduce unemployment by targeting growth in nominal gross domestic product (GDP) as its key indicator of when it should reverse course and start raising interest rates. The Fed has already promised to keep rates low through 2014, but if it were to switch gears, it would instead promise to keep rates low indefinitely, until nominal GDP, or GDP adjusted for inflation, was showing clear signs of a recovery.

“The thing that the central bank should wish to signal is not a commitment to keep interest rates low for a fixed calendar period, but rather a commitment to maintain policy accommodation until the nominal GDP target path is reached,” Woodford said.

It’s not a new concept. Last October Goldman Sachs published a paper titled: “The Case for a Nominal GDP Level Target,” and right before Jackson Hole, Goldman said that moving to that target would be one of the ways in which the Fed could “open the door to ‘unconventional unconventional’ easing . . . until the economy has regained a bigger share of the lost output and/or employment.” (The Fed’s balance sheet/asset purchase policies are already considered unconventional.) But the fact that a paper of that heft from a monetary policy expert like Woodford was delivered in a forum like Jackson Hole may indicate that the concept is starting to gain ground.

It’s not without its problems, notes Roberto Perli, managing director and partner, policy research, at the International Strategy and Investment Group (ISI) of Washington, D.C.

Perli, who worked on monetary policy in different capacities for the Fed for eight years before joining ISI in 2010, says that targeting nominal GDP “is an attractive idea from an academic perspective,” but in practice, has a few issues. “For example,” he says, “targeting a nominal GDP level would essentially mean creating inflation if real output growth remained stubbornly low as it is today. In that case, can policymakers be sure that inflation expectations would remain as stable as they remain in academic models?”

There’s another set of obvious questions, he says. “What exactly is an appropriate nominal GDP target — 4 percent, 5 percent, 6 percent? How would the Fed pick one? How much inflation would a central bank be willing to tolerate to achieve that? Nobody knows,” he says, but he notes that inflation “is already close to the Fed’s 2 percent target,” the level it sees as being “compatible with the dual mandate of maximum employment and price stability.”

Perli believes the Fed could move in that direction “without actually going there,” by promising “not to tighten policy even after the economy has begun its recovery.” He believes the Fed has already done that “in a sort of timid fashion.” In the minutes of the last Federal Open Market Committee (FOMC) meeting, the Fed said its guidance about it not raising rates until late 2014 “could be extended,” and that, combined with other language in the minutes to the effect that “a highly accommodative stance” was “likely to be maintained even as the recovery progressed,” suggests that the Fed “is likely to move somewhat in the direction suggested by Woodford at Jackson Hole, but in a cautious way that would leave many outs should inflation become a concern,” Perli says.

Dimitri Papadimitriou, the president of the Levy Economics Institute of Bard College in Annandale-on-Hudson, New York, is also wondering how the Fed would put a strategy of targeting nominal GDP into practice. “How do you do this?” he asks. “There is no reliable transmission channel from monetary policy to GDP. The evidence is clear about that,” he says.

Still, Papadimitriou says, “Woodford’s long paper is interesting, and he is right about the ineffectiveness of monetary policy at zero-bound interest rates.”

Tearing apart the Fed’s current policies is a big part of Woodford’s 97 pages, but it looks to be a sure thing that the Fed is going to go for more quantitative easing, either at its next FOMC meeting in September, and if not then, by its last meeting of the year, in December.

“Nothing in chairman Bernanke’s published remarks at Jackson Hole altered our view that the FOMC is poised to announce a new balance-sheet program on September 13,” says Lou Crandall, the chief economist at Wrightson ICAP in Jersey City, New Jersey, adding that “we don’t think this is a particularly close call,” though there’s still a chance that stronger-than-expected economic indicators “could delay the announcement,” he said.

“The FOMC policy statement on August 1 indicated that the decision on further easing was being fast-tracked, and the minutes of that meeting two weeks later warned that additional action would be called for unless incoming information pointed to ‘a substantial and sustainable strengthening’ in economic activity,” he said, in his post-Jackson Hole report.

But Crandall also believes “the Fed’s next bond-buying program will be its last.” Noting that the Fed has itself acknowledged the “risk of diminishing returns” from each additional round of buying long-dated bonds to bring down interest rates, known as LSAP, or Large-Scale Asset Purchases, Crandall says: “There will be no ‘QE4,’” or fourth round of quantitative easing. “A skeptical public will increasingly ask whether the Fed is throwing good money after bad,” he said.

He does believe, though, that “the Fed may embrace the idea of switching to an open-ended format for its asset purchases,” and “is likely to alter the format of its forward policy guidance to lessen the reliance on specific calendar references.”

In his speech at Jackson Hole, towards the end of his remarks, Bernanke said: “The stagnation of the labor market in particular is a grave concern not only because of the enormous suffering and waste of human talent it entails, but also because persistently high levels of unemployment will wreak structural damage on our economy that could last for many years.”

Given Bernanke’s “grave concern” about unemployment, all of the economists seem to be sure Bernanke will press forward with more easing, even if some members of the FOMC are opposed.

“He will, I think, proceed with another bond-purchasing program, if there is no improvement in GDP growth and decrease in unemployment,” says Papadimitriou, noting that monetary policy won’t solve the unemployment problem. “It is only fiscal policy that is potent to improve economic conditions,” he says. But Bernanke, “being a student of the Great Depression,” doesn’t want to be blamed for not doing everything he could possibly do to lower unemployment, he says.