After a jittery January, U.S. equities investors are gritting their teeth. But even if stocks lose some steam after the rally last year, we at AllianceBernstein think company fundamentals and the interest rate environment should support a resilient market in 2015.

At first glance, U.S. equities look expensive. The S&P 500 index traded at a forward price-earnings ratio of 16.3 at the end of 2014 — 63 percent higher than at the market trough in 2009. U.S. stock valuations are much higher than those of their emerging- and developed-markets peers. And in only about 15 percent of all quarters since 1970 has the S&P 500 been pricier.

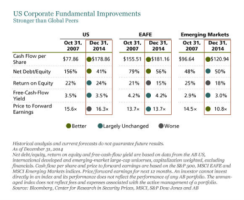

But has the market really risen too far? Valuations might be higher than usual, but the market is also much healthier than usual. Compare the present with the stock market’s peak in October 2007. U.S. companies are generating substantially more cash and have reduced debt dramatically, while profitability is similar (see chart 1; click to enlarge). Fundamentals for international companies aren’t nearly as good. So whereas U.S. stocks might be a bit costlier than normal, investors are getting much more for their money in historical and global investing terms.

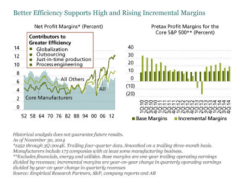

High profitability looks sustainable. Profit margins of nonfinancial S&P companies — and especially manufacturers — have risen sharply in recent years because of structural changes driven by globalization, outsourcing and process reengineering (see chart 2; click to enlarge). Outside of the energy sector, in which consensus expectations are rapidly catching up with the fall in oil prices, these factors aren’t going away anytime soon. And for some sectors of the market — especially consumer industries — lower energy prices will be a boost to earnings.

We also think that interest rates are likely to hover near zero, as low oil prices suppress inflation and are beneficial for earnings too. Financing expenses account for about 1.5 percent of U.S. company sales today, down from 1.7 percent in 2010 and almost a third lower than the 2002 peak. What’s more, many companies have locked in low rates on their extended maturities, which should help mute the future impact of rising rates on profit margins. Low inflation and solid economic expansion also make a great recipe for companies to sustain sales growth.

Above-average valuations like those we’re seeing now make sense when interest rates are low. Future cash flows are worth more and investors will be willing to pay more for them. Against this backdrop, we think relatively high U.S. equity valuations don’t seem quite so scary.

Of course, the U.S. market will face plenty of challenges and uncertainties. The principal risk is global economic growth. Many investors are worried that the declines in long-term interest rates, inflation expectations and commodity prices are the result of weak demand, rather than excess supply of commodities and capital. Although there is evidence of slower growth in Europe and in emerging markets, for the time being U.S. economic data have remained robust, and these risks don’t portend a major pullback in U.S. stock prices.

For investors, what really matters is how companies behave. In today’s environment, we believe companies will have to think twice about hoarding their cash. Companies with attractive free cash flow valuations are especially appealing, as an economic pickup could prompt a fresh wave of M&A activity and provide an impetus for more share buybacks.

Overall, we see a big opportunity today for stock pickers. When the U.S. market as a whole is relatively pricey, active managers can add value by targeting companies with relatively low valuations and strong fundamentals.

Joseph G. Paul is chief investment officer of U.S. value equities at AllianceBernstein in New York.

See AllianceBernstein’s disclaimer.

Get more on equities.