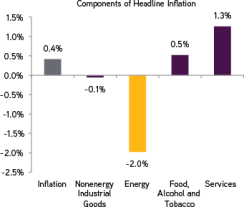

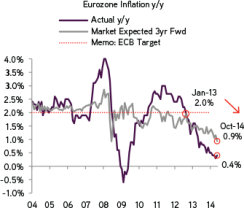

In our view at KKR, deflation is one of Europe’s greatest risks in 2015. Almost everywhere we went, European Central Bank (ECB) watchers, business leaders and investors were talking about the risk of European deflation. Is Europe the next Japan, and what does this mean for returns? To be sure, we believe some caution is warranted. If we use France as a proxy, we note that already one third of the input items in its consumer price index basket are now experiencing deflation. Moreover, with commodity prices falling, we believe there is the risk that overall euro zone headline inflation will touch zero at some point in 2015 (versus 0.4 percent in October) before rebounding (see chart 2).

The ECB Target for Inflation Is 2 Percent, but No Component is Even Close to That Level

Data as of October 31. Source: ECB, Haver Analytics

As Such, Inflation Expectations Are Now Falling to Dangerously Low Levels

Market-expected inflation is as per euro zone inflation swaps. Data as of October 31. Source: Eurostat, Bloomberg

For our nickel, we believe the euro zone area will avoid a sustained period of Japan-like deflation. First, wages in aggregate are still growing 1.2 percent, albeit coming mostly from protected areas of the economy, including unionized-labor and nontraded sectors. Second, property prices in Europe have fallen just 6 percent, versus 80 percent in Japan. Significantly, a side-by-side historical analysis actually suggests that in many instances housing in Europe is again approaching affordable levels, which has not been the case in Japan for a long time. Third, corporate leverage in Japan was 50 percent higher when deflation began than it is in the euro zone today.

Aidan Corcoran, my colleague based in Dublin, left Paris (see previous KKR post, “In Europe, the Focus Is on Positive Macro Momentum”) with the sense that the bar for sovereign quantitative easing may be higher than the market thinks. True, ECB president Mario Draghi said in mid-November that “the other unconventional measures might entail the purchase of a variety of assets, one of which is government bonds.” But our trip led us to believe that at a minimum, the macro backdrop will have to turn noticeably worse, including a further nosedive in inflation expectations, to push Europe’s central banker to battle Germany over the direct purchase of government bonds.

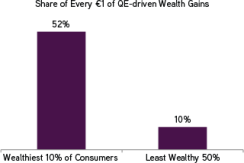

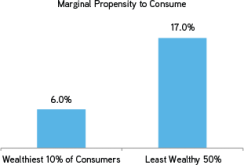

Moreover, we think that Europe has more of a socialist bent, and both Europe’s central bank and its politicians know that QE favors the wealthy. One can see the magnitude of the issue through some of the work Aidan brought to our attention.

The Top 10 Percent of Wealth Holders Have 52 Percent of the Total Wealth...

Data refer to net wealth including real assets. Data as of November 2014. Source: ECB Household Finance and Consumption Survey

...But Just a 6 Percent Marginal Propensity to Increase Consumption from Changes in Wealth

Data as of November 2014. Source: ECB working paper: “The Distribution of Wealth and the MPC”

Against this backdrop, our base view is that the ECB will be using its wallet creatively. In the near term, we think there are three levers on which Draghi will focus:

1. Expanding the range of assets on the ECB’s menu. This means looking at bank bonds, supranational bonds and government bonds, if necessary. The ECB could even reach for exchange-traded funds — or drop a hint — if there is a further inflation scare.

2. Targeting small and medium-size enterprises (SMEs) by refining terms of targeted longer-term refinancing operations (TLTROs) to further favor SME lending or by backstopping SME securitization via direct purchases, while continuing the push for capital relief on such securitizations.

3. Undermining the euro. The two levers mentioned above will also do this, but the ECB can add verbal assaults on the currency or become more aggressive on the timing or price of asset purchases to further reinforce the effect. Our research shows that 1.15 to 1.2 percent is achievable over the next 12 to 18 months, particularly if the Fed increases rates by summer 2015.

Ultimately, though, there is a growing possibility that the ECB will be forced into large-scale sovereign quantitative easing by the second quarter of 2015. Key to our thinking is that the stock of eligible private assets in the euro zone is just too limited, since banks do most of the credit transmission. To review: Nearly 80 percent of credit extension still comes via the traditional bank lending market. Indeed, as we show below, it is mathematically difficult for the ECB to hit its stated goal of adding €1 trillion ($1.22 trillion) in assets to its balance sheet without essentially becoming the market in many instances.

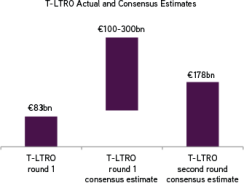

In Addition to Direct Asset Purchases, We Also Have the TLTRO, Which Disappointed in Round 1

Figures show outstanding amounts. Data as of November 19. Source: Bloomberg, KKR Global Macro and Asset Allocation analysis

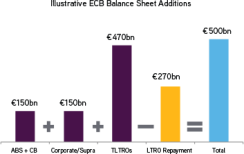

We Believe Reaching €500 Billion Is More Realistic Than the ECB Pledge of €1 Trillion

Data as of November 19. Source: Bloomberg, KKR Global Macro and Asset Allocation analysis

Moreover, as Aidan points out, the ECB must contend with not only a smaller-than-expected take-up of the TLTROs but also ongoing repayment of the prior LTRO. Indeed, TLTRO take-up was just €83 billion, versus the consensus estimate of €100 billion to €300 billion.

Henry McVey is the head of global macro and asset allocation at KKR in New York.

Get more on macro.