In BlackRock’s last contribution, we suggested that a vigorous debate appeared to be under way within the Federal Reserve’s monetary-policy-setting Federal Open Market Committee, and that investors would do well to scrutinize both August’s Jackson Hole symposium and this week’s FOMC meeting for signals of rate policy transition.

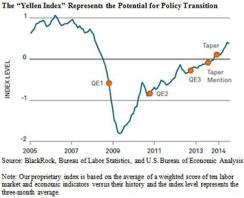

Now we will examine two pieces of evidence regarding the prospects for, and timing of, a transition away from the zero-interest-rate policy (ZIRP): Fed chair Janet Yellen’s Jackson Hole speech and the August nonfarm payroll data. We believe these indicators suggest that we are likely to see rate normalization sooner than many expect — in the first quarter of 2015 — and that the FOMC may even begin outlining its plan at its September 16–17 meeting. We will conclude with an examination of our own proprietary index of potential rate change, which we at BlackRock have informally named the “Yellen index.”

Overall, we were impressed by the balance Yellen displayed in her August 22 speech, which provided a nuanced overview of the labor market recovery since the 2008–’09 financial crisis and examined several factors that are complicating the assessment of genuine labor market slack. Those factors include, among other considerations, the low levels of labor force participation, elevated numbers of people working part time for economic reasons, changes in the flows of private sector labor and a shifting wage dynamic. In each instance, Yellen explored whether labor market indicators were being held back by cyclical factors resulting from the tepid recovery or by broader structural factors that in some cases were already at play well before the financial crisis and recession began. Also fascinating was that she highlighted the Fed’s own development of a factor model utilizing 19 labor market metrics, the labor market conditions index (LMCI). The LMCI is, in some ways, analogous to BlackRock’s own Yellen index, but vitally it underscores the broad range of measures Yellen looks at in making policy judgments, and it emphasizes her focus on the data.

Unfortunately, the August nonfarm payroll report, released September 5, provided a meaningful data disappointment that runs counter to what had been a consistent run of solid economic figures that we believe move the Fed closer to meeting its policy goals. The below-consensus August payroll print of 142,000 jobs, as well as downward revisions of 28,000 jobs for the prior two months, highlights the fact that the summer months are historically a weak period for hiring. Still, with prior three-month, six-month and 12-month average payroll gains of 207,000, 226,000 and 207,000, respectively, the run rate in job creation is on par with that of past periods of economic expansion.

Moreover, we think it is important to note that out of the past 18 August employment releases, 14 came in initially below consensus expectations, but 12 of the 14 were subsequently revised higher. Indeed, in August 2014, the total number of unemployed ticked down by 80,000 people, and all of the short-term unemployment measures improved month-over-month. So, despite the weak headline number, we think it’s likely to be revised higher next month. Further, although some cite an extremely low labor force participation rate as a cause for concern, we believe that trend is largely a function of structural and demographic factors and, consequentially, remains beyond the scope of meaningful monetary policy influence. In fact, our research suggests that nearly half of the 3.2 percent decline in the labor force participation rate between December 2007 and July 2014, now at 62.8 percent, is likely the result of retirements. Thus it would appear that demographic influences, not labor market weakness, are driving this participation trend.

BlackRock has developed a proprietary index (see chart) that aggregates a series of labor market and other metrics that we think reflects the relative weight Yellen and other members of the FOMC are likely to place on incoming data in making their decisions on when to transition from ZIRP. In fact, the measures and their weightings have been gleaned from the policymakers’ own statements. In contrast to the LMCI index, which depicts broad labor market conditions, the Yellen index is designed to foreshadow the potential for policy movement based on changes to underlying labor market and economic conditions. Furthermore, if we look to a traditional Taylor-rule analysis as a check on our index, we discover that the appropriate (rule-implied) policy rate in the U.S. is indeed meaningfully higher than present levels, suggesting that we are closer to the end of “emergency” policy accommodation than many have been willing to admit.

In our view, a growing body of evidence suggests that much of the cyclical heavy lifting done by monetary policy is behind us and likely to be of limited usefulness in the face of the increasing costs associated with excessively easy policy. Further acceleration in labor market recovery will likely require fiscal action, such as policies to improve the housing sector, which pre-2008 drove a great deal of employment growth. Raghuram Rajan, head of the Reserve Bank of India, described this global conundrum well in a recent interview with the Financial Times in which he said, “Central bankers have had enormous responsibilities thrust on them to compensate, essentially, for the failings of the political system. And my worry is, we don’t have sufficient tools to do that... [and may] create more risk in the system.” In the U.S. at least — Europe, Japan and emerging markets are another matter — we think a window of opportunity has opened to begin the process of rate normalization. We hope policymakers will oblige.

Rick Rieder is chief investment officer of fundamental fixed income and co-head of Americas fixed income for BlackRock.