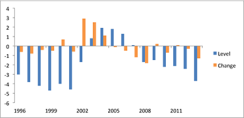

The list of problems besetting Brazil in the past few years — disappointing growth, persistently high inflation and street protests fueled by middle-class discontent — grew in 2013 as the country’s current-account balance deteriorated significantly. As recently as 2007, Brazil ran current-account surpluses. Modest deficits in the subsequent few years found ready long-term financing in the form of direct investment. The shortfall climbed to 3.7 percent of GDP in 2013 (see chart 1), however, and foreign direct investment (FDI) no longer covered the deficit. Brazil was subsequently grouped as one of the emerging-markets “fragile five,” along with India, Indonesia, South Africa and Turkey — countries with large external financing needs and thought to be particularly vulnerable to the changing global environment as U.S. bond yields have headed higher.

With currencies under pressure and with, in many cases, inflation uncomfortably high to begin with, central banks in all five of these economies raised interest rates during 2013. Whereas Turkey’s monetary tightening stood out for its abruptness, Brazil’s rate-hiking cycle has gone beyond the others in its duration and extent, with its central bank raising the policy interest rate 350 basis points during the past year. Growth ended the year weakly, and forecasts for 2014 call for ongoing sluggishness.

Although external risks do not appear to have been eliminated entirely, a look at what’s driving Brazil’s current account suggests it may stabilize or improve marginally during the course of 2014. If direct-investment flows continue, a sideways move in the current account might prove sustainable, although considerable uncertainty surrounds Brazilian FDI in a less commodity-favorable global environment. Brazil thus appears to represent an intermediate case. Its adjustment has not proceeded as far as that of India or Indonesia but looks more complete than that of South Africa or Turkey.

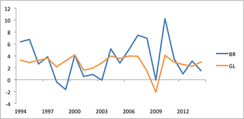

With the real’s depreciation beginning in 2011 — well before the more recent intensification of emerging-markets jitters — the effective exchange rate has fallen significantly. Unsurprisingly, the real (as in the actual, not the currency) effective exchange rate, or REER, has played a major role in shaping the merchandise trade balance in the past two decades (see chart 2). The trade balance worsened as the REER appreciated in the early stage of the real plan, a mid-’90s attempt to stabilize the currency in an inflationary climate. The 1999 devaluation and subsequent exchange rate weakness helped produce the large surpluses of the mid-’00s. Appreciation from 2004 onward again led to deterioration. The REER now has been falling for nearly three years. Its average for 2013 stood below the average of the previous four years, a metric that historically has shown a statistically significant relationship with the trade balance. At its present level, the same would be true in 2014, by a noticeably wider margin. The trade balance already appears to have leveled off in recent months. Based on the REER alone, it should improve during 2014.

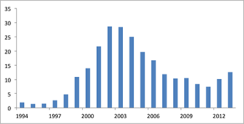

The trend in relative growth rates also looks favorable for the current-account balance. All other things being equal, faster growth in Brazilian demand versus that of the global economy should worsen the current account. Conversely, if the country’s demand should grow more slowly than that of the global economy, Brazil’s current account stands to improve. Along with the exchange rate, rapid economic growth in Brazil during the mid-’00s likely contributed to the steady slippage in the current account during those years (see chart 3). Although Brazilian growth disappointed in 2013, very soft conditions elsewhere meant that Brazilian domestic demand still grew faster than global gross domestic product. With the global economy picking up steam in 2014 and Brazilian demand squeezed by high interest rates, ongoing weakness in business investment and perhaps fiscal tightening, relative strength should flip. If global demand growth outpaces that of Brazil, that should contribute to improvement in the country’s current account.

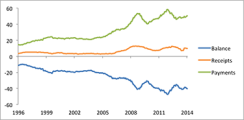

Two factors, however, are pushing in the other direction. First, terms of trade are falling as commodity prices stagnate. Terms of trade have already moved down from their 2011 peak but remain elevated by longer-term standards (see chart 4). They may normalize further, especially if stronger global growth begins putting upward pressure on the price of the manufactured goods that Brazil imports, and as iron ore price contracts reset. Spot prices for iron ore, a small part of the overall market, tumbled recently on fears about Chinese consumption. In contrast, grains prices, including that of soybeans, have risen recently — in part because of drought conditions in Brazil — so that the country will not necessarily see higher receipts from exports of these products. Second, profit repatriations abroad as a result of previous FDI inflows may rise. Following the surge in FDI in the late 1990s associated with the privatization program, Brazil has received a second wave of FDI inflows in the past three years — smaller as a share of GDP than the previous round but nonetheless significant (see chart 5). Profit repatriations began rising in 2004–’05, about four years after the privatization-related inflows (see chart 6). They may reset again higher in the next two years or so.

These two offsets, particularly the ongoing decline in terms of trade, make it unlikely that Brazil will experience rapid improvement in its current-account balance. Currency depreciation and weak growth, however, should weigh against further worsening and could generate mild narrowing this year. Given the rate of FDI experienced in the past three years, Brazil should not face much difficulty in financing a current-account deficit of 3 percent of GDP, even in a world of scarcer fixed-income capital inflows.

Two possible developments could hinder this scenario. First, troubles in Argentina could both push up Brazil’s REER — if the Argentinean peso collapses further — and worsen the relative-growth story, given the importance of Argentina as a destination for Brazilian exports. Second, FDI could slow, shrinking the current-account deficit that can be sustained without relying on portfolio inflows. Whereas a broad upturn in global corporate investment spending may help on this front, a significant portion of recent FDI into Brazil has come in commodities, where investment is now fading. Markets thus will be observing not only the “above the line” aspect of Brazil’s balance of payments — that is, its current account — but also its financing, particularly the evolution of long-term flows. Uncertainty on these fronts will likely keep Brazil at least on the fringe of the fragile five for some months to come.

Michael Hood is a market strategist for J.P. Morgan Asset Management.

See J. P. Morgan’s disclaimer.

Read more about emerging markets.