Individuals preparing for retirement often ask their financial advisers, “How am I doing?”

If the client participates in a defined benefit pension plan, the answer is relatively easy and depends chiefly on the retirement benefit formula, which typically has a degree of built-in inflation protection via salary increases and possibly postretirement inflation adjustments. A view to these liabilities, moreover, is one reason why sponsors of defined benefit plans have turned to liability-driven investing — an approach that measures not only the absolute value of assets but also the relationship of assets to liabilities.

If a client relies on a defined contribution plan, however, assessing retirement readiness is a more difficult proposition. The answer will depend on a variety of unknowns, including future contribution levels and investment performance. There is no simple way to calculate the equivalent of a defined benefit plan’s funded status or the ratio of assets to liabilities.

Treasury Inflation-Protected Securities (TIPS), however, can be part of the answer for financial advisers. As inflation-linked instruments, TIPS can frame readiness in real, inflation-adjusted terms and provide insight into structuring retirement portfolios.

A retirement saver’s liability equals the income she needs for living expenses in retirement. Assuming that she would want to keep her living standard constant over time, her liability consists of a steady income stream that is adjusted for inflation and other increases in living expenses.

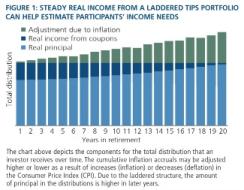

The value of this steady stream of real income can be estimated by a laddered portfolio of TIPS that, when constructed properly, provides consistent real income of coupon and principal payments, both adjusted for future inflation. Chart 1 conceptually illustrates this and the steady amount of real income it could potentially generate.

Source: Pimco

Of course, the value of this annuity like steady real income stream could also be approximated by the market price of a real annuity offered by insurance providers. Using TIPS is a more pure approach to real annuity pricing than commercial products, however. Unlike TIPS, policies sold by insurance companies are not backed by the full faith and credit of the U.S. government, and the policies include a margin for profit, risk and other variables. It is important to note that the TIPS marketplace provides prices for forward real yields that are required to calculate the cost of a steady income stream that starts when individuals enter retirement.

Consider a 55-year old with a salary of $85,000 and retirement savings of $450,000 who is wondering how she is progressing toward her goal of replacing approximately 40 percent of her present income, or $34,000, at age 65, excluding Social Security benefits. Based on the real annuity framework and June 30, 2013, TIPS pricing, her retirement savings would likely be able to generate $28,000 in real annual income at retirement. She would be 82 percent ($28,000 of the $34,000) of the way toward achieving her goal or slightly ahead of schedule, assuming she had completed 30 of 40 working years.

This concept, if extended to a range of portfolio allocations and expected outcomes, also could provide insights beyond those based on traditional return and volatility analysis. For example, we could measure performance and volatility based on the growth and change of future real purchasing power — the retirement investor’s ultimate objective.

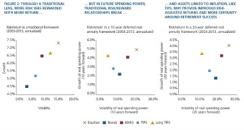

Rather than measure returns and volatility in nominal terms, Pimco’s framework measures the value of a deferred real annuity by assessing volatility as changes in the annuity’s value. Using TIPS ten years and 20 years forward to price the deferred real annuity, we applied this alternative framework to a series of asset classes and portfolios using the last ten years of data. Our analysis showed how each of the asset classes and portfolios would have affected the size of the real annuity we could purchase, while giving a sense of the volatility around this expectation (see chart 2).

Source: Pimco; Bloomberg (as of June 30)

The goal, of course, is to maximize the size of the real annuity we could purchase while minimizing its volatility. This is critical, as it increases the probability that the target for retirement would be achieved.

To be clear, we do not advocate one asset class over another. Instead, we propose a more appropriate risk-return framework to compare different investment options and asset allocations for retirement savers. We believe investments should be optimized for maximum efficiency — that is, maximum growth, measured in future purchasing power, for a given level of risk, also measured in future purchasing power.

We believe that individuals planning for retirement would benefit from considering a real annuity framework to help measure progress toward their retirement goals. Furthermore, we believe this framework has the flexibility to inform asset allocation considerations and offer options other than simply considering the traditional risk-return characteristics of various asset classes and portfolios. This framework may provide a vital tool for investors or sponsors to contemplate one retirement investment versus another. And it could give financial advisers a way to answer a defined contribution plan participant’s question about “How am I doing?”

Bransby Whitton, CFA, is a senior vice president and real return product manager at Pimco’s Newport Beach, California, headquarters. He previously spent five years in Singapore as a director and head of Pimco Asia Private Limited, overseeing all aspects of the client servicing and business development efforts in Southeast Asia.

Klaus Thuerbach, CFA, FRM, is a real return product manager at Pimco’s Newport Beach headquarters. Prior to joining Pimco in 2012, he was a relationship manager at Frankfurt–based Bankhaus Metzler.

See Pimco’s legal disclaimer.Get more on pensions.