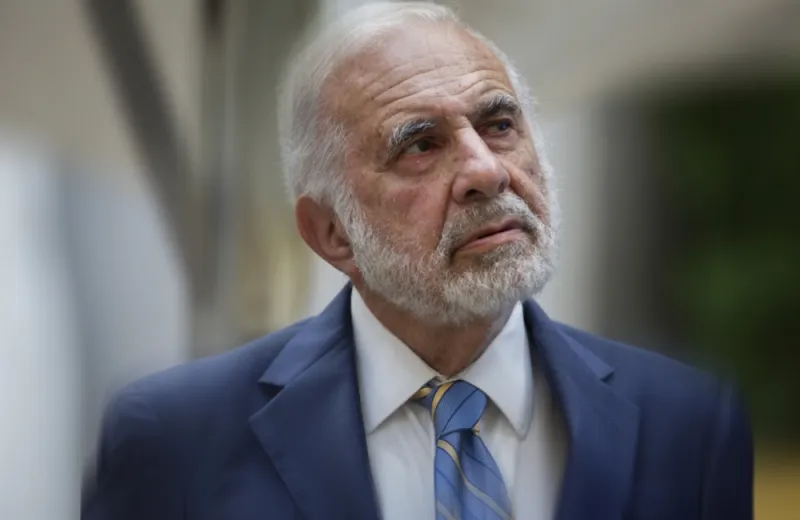

Legendary activist investor Carl Icahn has been accused of using a “ponzi-like” structure to mask the reality of years of terrible performance and overvaluation of its holdings. The charges came in a new report from Nate Anderson’s Hindenburg Research.

Short seller Hindenburg has already taken on some big names this year, including India’s wealthiest man, billionaire Gautam Adani — wiping $50 billion off his net worth — as well as Twitter founder and Block CEO Jack Dorsey. Icahn, whom Bloomberg recently estimated to be worth $24.8 billion, is just the latest to feel the heat.

The report quickly knocked Icahn Enterprises shares down about 20 percent on Tuesday, leaving the stock trading around $40 — its lowest level since late 2012. That was just before Icahn became the biggest investor in multilevel marketing firm Herbalife, betting against Pershing Square CEO Bill Ackman. Ackman had claimed Herbalife was a pyramid scheme, which is similar to a ponzi.

In its report, Hindenburg claims that Icahn is inflating the value of his firm’s private holdings on top of years of losses in his publicly traded investments. But worse than that, Hindenburg argues that retail investors are propping up a creaking empire.

“Icahn has been using money taken in from new investors to pay out dividends to old investors. Such ponzi-like economic structures are sustainable only to the extent that new money is willing to risk being the last one holding the bag,” Hindenburg said. The short seller claimed that Icahn’s net worth is “reliant on selling overpriced IEP units to retail investors while convincing them that they will be rewarded with a consistent, safe dividend in perpetuity, despite extensive evidence to the contrary.”

“While the focus has always been on [Icahn’s] grand public activist campaigns, quieter long-term investment losses, along with the substantial use of leverage, have whittled away his empire,” Hindenburg said.

Icahn shot back with a statement issued Tuesday afternoon, although he did not address the specific criticisms of the report.

“We believe the self-serving short seller report published by Hindenburg Research today was intended solely to generate profits on Hindenburg’s short position at the expense of IEP’s long-term unitholders,” Icahn said in the statement. “We stand by our public disclosures and we believe that IEP’s performance will speak for itself over the long term as it always has. Today, IEP operates from a position of strength with approximately $2 billion of cash and cash-equivalents on its balance sheet as of March 31, 2023 to execute on our strategy.”

Icahn and his son Brett own 85 percent of Icahn Enterprises, but Icahn has borrowed against some 60 percent of the units he owns, the Hindenburg report notes.

According to Hindenburg, Icahn Enterprises’ investment portfolio has lost more than half of its value since 2014, and the less liquid holdings it owns have wildly inflated valuation marks. The short seller estimates that Icahn Enterprises’ net-asset value at the end of 2022 is inflated by 22 percent, “due to a combination of overly aggressive marks on IEP’s less liquid/private investments and continued year to date underperformance.”

The losses on Icahn’s investment portfolio are fairly easy to gauge, using public disclosures of the firm’s stock holdings and quarterly investment performance. It lost $89 million in 2022, and Hindenburg’s analysis of Icahn’s 13F holdings as of the end of the year indicates a loss of $471 million so far in 2023, according to the report. One reason for the losses is that Icahn has been bearish for some time, although last year the money was lost on his long positions. The company disclosed a 47 percent notional short bet in December, which Hindenburg estimates could have added another $272 million in losses so far this year.

The portfolio hasn’t chalked up an annual gain since 2018, when it was up 7.9 percent.

Icahn also owns majority stakes in private businesses, and Hindenburg says the corporate raider has been wildly inflating those values. For example, Icahn Enterprises owns 90 percent of a publicly traded meat packaging business that it valued at $243 million at year-end. But that company had a market value of only $89 million at the time. In other words, the report stated, “IEP marked the value of its public company equity holdings 204 percent above the prevailing public market price.”

Hindenburg said that valuation looks “even more irregular given that IEP bought over a million shares of the company in December before immediately writing up the value of those shares by ~194 percent in the same month.”

The research firm concludes that Icahn Enterprise’s units are inflated by 75 percent and trade at a 218 percent premium to net-asset value.

Hindenburg says that Icahn Enterprises is able to attract such a huge premium because retail investors are attracted to the dividend yield, which is about 15.8 percent — the highest for any U.S. large cap company. These investors also are drawn by “the prospect of investing alongside Wall Street legend Carl Icahn,” the report says. Institutional investors have “virtually no ownership” in the company.

Although the company has been burning billions of dollars in cash for years, it has raised $1.7 billion since 2019 to pay the dividend, which it has increased three times since 2014, when Icahn Enterprises started losing money.

The offerings have been led by Jefferies, which has long been Icahn’s bank. Jefferies is also the only large investment bank with an analyst covering Icahn Enterprises and has consistently had a buy rating on Icahn Enterprises.

“In one of the worst cases of sell-side research malpractice we’ve seen, Jefferies’ research assumes in all cases, even in its bear case, that IEP’s dividend will be safe ‘into perpetuity,’ despite providing no support for that assumption,” Hindenburg says.

“In essence, Jefferies is luring in retail investors through its research arm under the guise of IEP’s ‘safe’ dividend, while also selling billions in IEP units through its investment banking arm to support the very same dividend,” it says.

Jefferies did not respond to a request for comment by presstime.