The past two years have been defined by the pandemic, and the hope for 2022 is that society gets to move on. The lesson from the past two years is that nothing is assured. Surging new cases of the Omicron variant despite high vaccination rates acted as a reminder that vaccination gives protection not immunity. In that context, the outlook is clouded by the virus and its impact.

That said, asset markets have proved remarkably resilient. “The ability of markets to bounce back in the face of the pandemic is due largely to incredible action by both monetary policy – again, and again, and again – and fiscal policy to initially stave off a prolonged recession, and then to underpin the recovery,” says Brett Lewthwaite, CIO and Global Head of Fixed Income at Macquarie Asset Management.

Turning to 2022 the positive influences for the economic recovery and asset markets have changed in what can be describe as a tale of two tapers. Fiscal stimulus has turned into fiscal drag while the monetary pump of liquidity is gradually being reduced. This suggests that the framework for considering the investment climate for the new year will be quite different, and embraces the current debate surrounding the outlook for inflation.

Supply disruption is the key hurdle

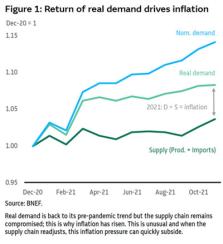

“At our most recent Strategic Forum, we recognized that as countries evolve from the influence of the pandemic, paths are uneven and that for most countries recovery remains incomplete,” says Lewthwaite. “The macro outlook is clouded by the unique disruption that has taken place with supply chains, which adjust very slowly, while demand has shifted quickly from shock to growth because of the impact of rapid deployment of both fiscal and monetary policies.”Analysis conducted by Macquarie points to this unique supply disruption being at the core of what has taken place and therefore will be the core to how things evolve. The term “transitory” has been widely used in the past year but often misunderstood.

“In our opinion transitory means easily reversable, a situation often seen in commodity markets; the path of lumber prices during 2021 is a good example,” says Graham McDevitt, Global Fixed Income Strategist, at Macquarie Asset Management. “Thus, the key question for 2022 is whether supply chains will realign. However, the pandemic needs to either pass or be contained for supply chains to improve sustainably.”

As 2021 drew to a close there were tentative signs emerging that supply pressures were beginning to ease. But the surge in the Omicron variant is a reminder that supply chains will remain compromised until the pandemic passes. Once the pandemic passes, global production and growth should receive a boost in 2022 while the pressures on inflation should begin to ease.

The labor market evolution is expected to be important to the inflation trajectory, where recent reports of higher wages have ignited fears of a repeat of the environment of the 1970s.

“Our analysis shows that the current environment is very different. Today, the world is working together to overcome the influence of the pandemic, while the oil shock in the 1970s was a deliberate act that was sustained until a geopolitical solution was eventually reached,” says McDevitt.

In addition, labor markets are now more flexible (less unionized) and the business environment is more competitive (driven by technological advancements). This suggests that the sustained upside pressure on inflation and wages experienced in the 1970s is unlikely to be repeated in the current environment. That said, the path of labor participation and labor productivity will also be important for the inflation environment going forward.

Tale of two tapers

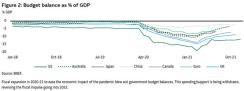

Fiscal policy broke the shackles of debt and deficit concern as governments were forced to offset the impact of imposed lockdowns. U.S. President Joe Biden embarked on an ambitious plan to follow this support with actual direct investment into the ailing infrastructure, as well as the social and climate objectives of the Democratic party. Markets embraced the “hope,” but deeper analysis by Macquarie revealed a different story.

“Such spending would be good news for trend growth, but it was unlikely to be large enough to push back on the worsening structural headwinds that had underpinned the current uninspiring and low inflation environment,” Lewthwaite says. “Importantly, we identified that politics was very likely to restrain Biden’s ambition, and that indeed came to pass. Interestingly, markets were quick to embrace fiscal stimulus, but we believe that the reality that this has already turned into fiscal drag is underappreciated by markets. Thus, in many countries, fiscal policy will work as a brake on growth and inflation in 2022 compared to 2020-21.”

Monetary policy has already turned for many countries, with rate hikes across many emerging market countries and a handful of developed countries, with the Bank of England recently joining that group. The Fed has signaled that it will soon begin tapering its bond purchases, and that rate hikes should be expected. Market expectations have embraced this change such that it seems unlikely that central banks can over-deliver on policy relative to the current discounted expectations.

“Importantly, for the outlook, while there has been a lot of debate over the effectiveness of monetary easing at the zero bound, the 2016-18 experience confirms that rate hikes work and, therefore, if the Fed does deliver on its forecasts we should expect a gradual dampening of demand to follow,” says McDevitt.

Back to the future

Turning to the outlook for fixed income markets, the investment climate in recent years has been defined by the insatiable chase for yield by investors. During the pandemic, sovereign bond yields posted new historic lows and credit spreads became historically tight. The power of this environment has been clear to see – that despite the massive shock and uncertainty, with soaring inflation, global bond yields remain at low levels and credit spreads have barely budged.“The tale of two tapers through 2022 may test this demand for yield,” says McDevitt. “However, for asset managers, the key question will be whether this proves to be once again a cyclical adjustment that ultimately provides a buying opportunity, or a structural shift. Structural headwinds such as debt, dependency, digitalization and deglobalization have actually worsened during the pandemic. Our approach through the past year has been to maintain low levels of duration and gradually reduce risk. This balanced approach provides flexibility for our funds to use expected periodic volatility to add selectively to risk and duration as we navigate 2022.”

Download a deeper dive that includes outlooks for the equity and real asset markets.

More from Macquarie Asset Management:

Why Tailwinds Will Continue in Real AssetsOpportunities in Global Equity Markets

The Path to Investment Opportunity