In the past, the secondaries market was a limited way for LPs to get rid of illiquid positions, but it has since evolved to service a wider breadth of investor motivations.

Tremendous growth and positive outlook ahead

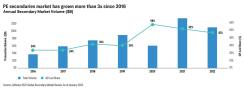

Over the past twenty years, the secondaries market has boomed, with volumes starting around $2 billion in 2002 to $132 billion at its peak in 2021.1 LPs have become more comfortable using secondaries to sell off legacy positions to consolidate funds, free up capital and rebalance asset allocations.

Additionally, as the private equity markets matured and multiplied, so too did the players in the secondaries markets. Since the early 2010s, GPs have begun looking to the secondaries markets to provide liquidity to their LPs while still maintaining ownership of profitable portfolio companies. This helped the secondaries market grow over three-fold since 2016 (see chart) alone. GP-led transactions now dominate the secondaries markets, which have helped to create a healthy balance of transactions in a market that plays an important role in offering alternatives to private equity investors.

Despite a slowdown in private market transactions last year, secondaries markets are expected to grow to an estimated $135 billion by average estimates and to upwards of $160 billion.2 The first half of 2023 has provided some clear areas of growth drivers for the secondaries markets. More and more LPs are looking to the secondary market for cash to solve the denominator effect and rebalance their investments in the face of macro headwinds and market uncertainty. On the demand side, there is already significant interest for secondaries buyers as market conditions are providing the opportunity to acquire high-quality assets at a discount.

Long-term, the prospects seem favorable for this booming market. Secondaries growth rates have been sitting comfortably at around the mid-teens over the past 7 years reasonably providing estimated volumes upwards of $500 billion by 2030 should they maintain current growth rates. Some estimates place secondaries growth volumes even approaching $1 trillion should private capital investments continue to grow, and GPs and LPs keep utilizing secondaries in their asset allocation, liquidity and risk mitigation approaches.

Buy-side secondaries investors will have the ball in their court this year

Secondaries allow sophisticated investors to trade amongst themselves in their specific well-known private markets, and 2023 will present a significant shift in the supply-demand dynamics of these markets. In the lead-up to 2022, deal volumes were mainly dominated by GP-led transactions, usually in the form of continuation funds and single asset deals, while discounts for LPs were in the single digits.

Looking ahead, a number of forces coming to head indicate that secondaries supply in 2023 is likely to substantially outpace demand. First, GP-led sales are most likely to rise given GPs seek to hold on to their high-quality companies longer and extend their funds. Second, the amount of money earmarked for acquisitions or buyouts is down about $30 billion. Dry powder in the space currently stands at around $100 billion, down from $130 billion in 2021.3 Sellers are now outnumbering buyers, which will drive greater discounts in the secondaries markets. LPs will also be likely to continue seeking liquidity in an effort to manage the overall public market downturns are having on private markets as well.

Additionally, LPs that made commitments during periods of easier money might find themselves in a bind as exits are low and they need to either quickly find funding for the commitments or get out of positions entirely.

This denominator effect from public markets will create a tremendous opportunity for the right buyer. In 2022, the average discount on secondaries sat at around 19 percent, or prices 81 percent of NAV.4 That represents the greatest average discount in almost a decade.

While this lopsided market will likely not benefit LPs and others looking to sell, the secondaries market of 2023 may heavily favor buyers. This secondaries market is perfectly primed for those private equity investors that need to deploy capital but cannot do so in larger markets because of sustained volatility and might not prefer the responsibility of running an add-on process. By all accounts, the perfect storm has emerged to poise secondaries as one of the ideal investments to help private equity get through a tough season.

If steep discounts emerge, they may also lend themselves well to fund appreciation – be it through actual appreciation of assets or the level of discount itself relative to the overall balance sheet.

Diversification is another benefit to the secondaries market. For asset allocators, secondaries provide access to mature companies from different managers, vintages, asset classes, industries and locations.

Secondaries also tend to target more mature stakes in funds and assets, and managers might invest capital more quickly than a primary fund investment. This gives investors quicker access to assets and thereby a quicker redistribution of capital.

Overall, with the anticipation of steep discounts and sustained macro volatility, secondaries might provide quality companies for a bargain to the right investor. Buyers will come out on top in the 2023 secondaries market and private equity will likely struggle in providing primary fundraising. Buyers exist for this market but given current market conditions might choose to be more selective. This booming market, although once pushed to the side for bigger deals, is now proving to be an asset worth considering even when the market eventually rebounds.

1 Source: PitchBook, Global Private Market Fundraising Report, as of February 22, 2023.

2 Source: Lazard, Private Capital Advisory Secondary Market Report 2022.

3 Source: Jefferies 2022 Global Secondary Market Review, as of January 2023.

4 Source: Jefferies 2022 Global Secondary Market Review, as of January 2023.

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance.

All investments involve risks, including the possible loss of principal.

Investments in alternative investment strategies are complex and speculative investments, entail significant risk and should not be considered a complete investment program. Depending on the product invested in, an investment in alternative investments may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. An investment strategy focused primarily on privately held companies presents certain challenges and involves incremental risks as opposed to investments in public companies, such as dealing with the lack of available information about these companies as well as their general lack of liquidity. Diversification does not guarantee a profit or protect against a loss.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton ("FT") has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.