Where Private Equity Will Find New Deals

A significant shift in private equity strategy will be necessary to justify new deals as macro headwinds threaten to change the tide of banner years for deal transactions and valuations.

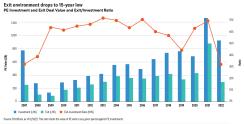

Private markets enjoyed unprecedented growth just 18 months ago. The entire M&A market recorded a historic high of $5.2 trillion total dollars invested in 2021.1 Easy monetary policy and a roaring stock market inflated valuations that facilitated astronomic deal flow. A series of rate hikes and persistent inflation in 2022 though were followed by a gradual decrease in deal flow, and an eventual sharp drop-off compared to 2021 highs. The end of 2022 saw an exit-to-investment ratios less than .4x – the lowest figure since the global financial crisis.2

Quality over quantity

Amidst repricing, higher quality companies will be more likely to weather the storm. Liquidity fundraising will likely take the brunt of the tightening and see down rounds, but higher quality companies with solid balance sheets will not be as likely to see valuations reduced.The shifting economic landscape has applied a reset to private equity markets but has also ushered in a different type of investment opportunity.

Despite macro volatility and private equity deal volume down, the take-private market soared in 2022, recording 91 public-to-private transactions worth $245 billion.3 Technology, media and telecommunications companies accounted for some of the largest transactions – 8 out of the top 10 take-private deals involved tech and media companies.

Private equity was able to profit off a historic sell-off year for the tech sector, which helped to buoy sharp deal declines. Take-private activity is expected to increase in 2023 as a bear equity market continues to threaten valuations of all asset classes. Public companies who may very well be properly valued might decide the pressure of meeting quarterly earnings or paying out a dividend is not worth the trouble in this interest rate environment.

This presents private equity GPs and LPs with a significant opportunity for creative dealmaking in a year that would otherwise not present itself with as many traditional transactions. As volatility remains, firms might not secure the debt financing to secure larger deals, but multiples for public tech companies remain low and well-valued mid-size companies that could use a lifeline will be ripe for the private taking.

Additionally, the slump in tech does not mean there is waning interest in transactions overall. Other markets, specifically healthcare, are still attracting investors and getting deals done. Although deal volume fell last year between 20-30%, the private equity healthcare experiences its second strongest year on record.

Further, this is a significant opportunity for private equity firms to rethink their talent pool. Massive tech layoffs have spilled high-quality, skilled engineers, developers, coders etc. into the available labor market, and private equity companies who have decided to take transactional pause this year might instead decide to strengthen their employee base or that of their portfolio companies in preparation for the next bull market.

The year of the add-on

Exits remain low in 2023, but mergers and acquisitions will still happen – just perhaps not in the way most expected. In addition to the take-private opportunities, private equity companies will likely see a number of add-on opportunities for their platform investments and portfolio companies.Private equity investors are holding off on larger big-ticket buyouts with high interest rates and expensive debt, but add-ons garnered robust interest last year. In 2022, add-ons comprised 77 percent of U.S private equity deals, representing a 3 percentage-point increase from 2021.4

These smaller-sized acquisitions are a smart way for private equity companies to meet their capital deployment mandates, and offer much0needed reprieve in a historic year of interest rate hikes and skittish investors.

The recent banking crisis and SVB fallout might make some investors pull away from certain add-on opportunities. Add-ons are beneficial for adding revenue in a cost-effective way, and this is often achieved through lower middle market acquisitions for portfolio companies purchased at a good price. If credit is too expensive, or banking fears cause investors to prefer to avoid the risk altogether, the potential problems of the add-on might outweigh the potential benefit.

Private equity investors still interested in add-on deals might look to the middle market for companies with solid balance sheets and good valuations to circumvent this. The end price might pull higher, but there are still companies available that may bring enough value and revenue to ride out the current rate wave until debt becomes more affordable to sustain larger deals.

In ideal economic times, organic growth through traditional investments and fundraising is preferred for the private equity market. During market downturns though, it’s difficult to make the case against the add-on, be it as it may not ideal. Overpaying for a platform deal, especially in this kind of interest rate environment, is simply worse.

Private equity transactions have slowed, but private equity markets remain robust after considerable growth. Over the past 10 years, AUM increased from $2 trillion in 2013 to $4.4 trillion just last year.5 Investors will need to get creative to get the deal done, but the shifting landscape and interest in private equity is sustainable enough to ensure dealmakers will sustain transactions – if they know where to look.

1 Refinitiv, as of December 31, 2022.

2 Based on reported PitchBook data, as of December 31, 2022.

3 Based on reported PitchBook data, as of December 31, 2022.

4 “PE turns to add-ons with large LBOs out of reach,” PitchBook, as of May 16, 2023.

5 “Three ways CFOs are adapting to emerging private equity trends,” 2023 EY Global Private Equity Survey.

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance.

All investments involve risks, including possible loss of principal.

Private equity investments involve a high degree of risk and is suitable only for investors who can afford to risk the loss of all or substantially all of such investment. Private equity investments may hold illiquid investments and its performance may be volatile. There can be no assurance that any investment will be adequately compensated for risks taken. A loss of an investor’s entire investment is possible. The timing of profit realization, if any, is highly uncertain. Investing in the natural resources sector involves special risks, including increased susceptibility to adverse economic and regulatory developments affecting the sector—prices of such securities can be volatile, particularly over the short term. Real estate securities involve special risks, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments affecting the sector. Investments in infrastructure-related securities involve special risks, such as high interest costs, high leverage and increased susceptibility to adverse economic or regulatory developments affecting the sector. Alternative investments include private equity, commodities, hedge funds and property. They may be difficult to sell in a timely manner or at a reasonable price. It may be difficult to obtain reliable information about their value. The value of derivatives contracts is dependent upon the performance of an underlying asset. A small movement in the value of the underlying can cause a large movement in the value of the derivatives, which may result in gains or losses that are greater than the original amount invested. Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton ("FT") has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.